Unveiling Bitcoin Halving: a Simple Guide 🚀

Imagine you have a magic coin, one that magically cuts its own supply in half every few years. This isn’t just any tale; it’s the story of Bitcoin halving. Every four years, the reward that Bitcoin miners receive for adding new transactions to the blockchain gets sliced in half. 🚀 But why does this happen? It’s all by design to keep Bitcoin scarce, like a digital form of gold, ensuring it doesn’t lose its value due to oversupply.

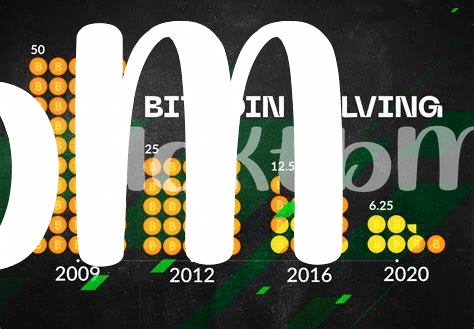

| Event | Date | Before Halving Reward | After Halving Reward |

|---|---|---|---|

| 1st Halving | 2012 | 50 BTC | 25 BTC |

| 2nd Halving | 2016 | 25 BTC | 12.5 BTC |

| 3rd Halving | 2020 | 12.5 BTC | 6.25 BTC |

Delving a bit deeper, think of Bitcoin’s blockchain as a ledger where all transactions are recorded. Miners use powerful computers to solve complex math puzzles, securing the network and validating transactions. In return, they earn Bitcoin. Halving reduces the reward, making new Bitcoins more scarce. This scarcity has a funny way of making people value things more, often pushing the price up. But it’s not just about making money scarce; it’s a built-in check to prevent inflation, ensuring that Bitcoin remains a valuable asset over time. Sounds futuristic, right? Yet, it’s happening right now, reshaping how we think about money. 💸🔍

How Halving Influences Bitcoin’s Value 💸

Imagine a world where every four years, a magic event happens, making it harder to find buried treasure. In the Bitcoin universe, this event is called “halving.” It’s like a digital spell that cuts the reward for mining Bitcoin in half. Because miners get fewer Bitcoins for their efforts, it creates a kind of scarcity. And in the world of shopping and trading, when something becomes scarce, its value can jump up. This is a key way that halving can tap dance on Bitcoin’s value, potentially leading it to climb up the market ladder.

Now, think back to the times this magical event has happened before. Each time, the market reacted like a crowd watching a spectacular fireworks show—some gasped, some cheered, and some were just puzzled. While some people try to use crystal balls (expert predictions) to guess what’ll happen next, it’s like predicting the weather in a land of dragons and unicorns. But, understanding these patterns gives us a treasure map for the future. And if you’re setting sail in the Bitcoin ocean, having a solid map and a sturdy ship is crucial. For those diving deeper into strategies, checking out https://wikicrypto.news/bitcoin-investment-strategies-for-beginners-in-2023 could be your next wise step.

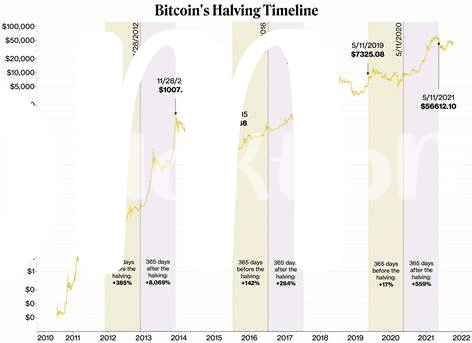

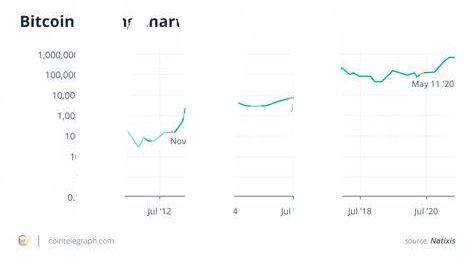

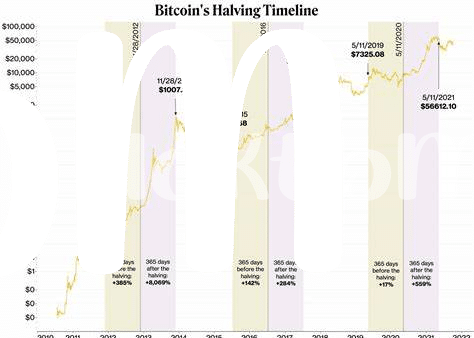

Past Halving Events and Market Reactions 📉📈

Imagine a roller coaster ride; that’s how the Bitcoin world reacted whenever there was a halving event. Like clockwork, every four years, the reward for mining Bitcoin gets cut in half, and each time, the market responds in a fascinating way. Initially, there’s often a bit of uncertainty—people holding their breath, wondering how it will play out. But historically, after a period of adjustment, the value of Bitcoin tends to shoot up 🚀, catching both seasoned investors and newcomers by surprise. Experts pour over charts trying to forecast future movements, while the average Joe might just see it as a lucky break. It’s like the market takes a moment to understand the scarcity created by halving, and then reacts with enthusiasm, driving prices up. Such events have carved out memorable chapters in Bitcoin’s history, teaching us that while patterns can guide us, the crypto world remains wonderfully unpredictable 📉📈.

Expert Predictions Vs. Reality: a Closer Look 🔮

When we listen to experts’ forecasts about Bitcoin and its future, it’s a bit like trying to read a crystal ball that’s sometimes cloudy. The truth is, predicting the crypto market can be tough, and while experts often provide educated guesses, reality can take unexpected turns. For instance, before a halving event, many predict a significant price surge based on past trends. But it’s important not to take these predictions as gospel. The market is influenced by a lot more than just halving events, from global economic changes to regulatory news. That’s why it’s smart to look at a broader picture, considering various strategies to protect your investment. For those interested in delving deeper into this topic, understanding bitcoin wallet types investment strategies can offer valuable insights, especially when reflecting on the 2017 Bitcoin surge. History shows us the importance of balancing optimism with caution, reminding us that while expert predictions provide guidance, the market’s reality can often write its own story.

Understanding Market Trends: Beyond Bitcoin Halving 🔍

Bitcoin halving is a big event, but it’s not the only thing that moves the price of Bitcoin. Think of the market like a big ocean. Bitcoin halving might be a wave, but there are also tides, currents, and storms – these are different factors like government rules, new technology, and how people feel about investing (their confidence). For instance, if a country says, “We’re cool with Bitcoin,” more people might want to buy it, pushing the price up. Or, if there’s a new way to make Bitcoin transactions faster and cheaper, that could also make more people interested. It’s a bit like trying to predict the weather by looking at just one cloud – you need to see the whole sky. By understanding these trends, you’re better prepared for whatever comes next in the world of Bitcoin. Here’s a simple breakdown of factors affecting Bitcoin’s price:

| Factor | Impact on Bitcoin Price |

|---|---|

| Government Regulations | Can increase or decrease demand |

| Technological Advances | Makes Bitcoin more accessible and appealing |

| Investor Sentiment | Changes can lead to rapid price fluctuations |

While halving is key, paying attention to these elements helps give a fuller picture of Bitcoin’s ever-changing landscape.

Preparing for Future Halvings: Strategies and Tips 🛠️

As Bitcoin halvings come around every four years, acting like leap years for the cryptocurrency world, it’s essential to gear up with the right strategies and tips. Imagine you’re getting ready for a long journey. Just as you’d pack essentials, understanding and preparing for halvings is crucial for anyone dabbling in Bitcoin. The key lies in staying informed and agile. By keeping a close eye on bitcoin historical price trends investment strategies, you can glean insights into how previous halvings have influenced market strategies and prices. It’s akin to learning from the past to predict future trends. Diversification is also a golden rule; don’t put all your digital eggs in one basket. Engage with various cryptocurrencies and investment methods to spread potential risks and rewards. Moreover, setting up a safety net, like stop-loss orders, can help protect your investments from sudden market downturns. Importantly, while strategies and tips are handy, embracing a mindset that is open to learning and adaptation is priceless. Stay curious, keep digging for information, and connect with other enthusiasts and experts. This proactive approach will not only prepare you for future halvings but also turn you into a savvy participant in the dynamic world of cryptocurrency. 📚💡🚀