🚀 the Start: How and Why Bitcoin Took Off

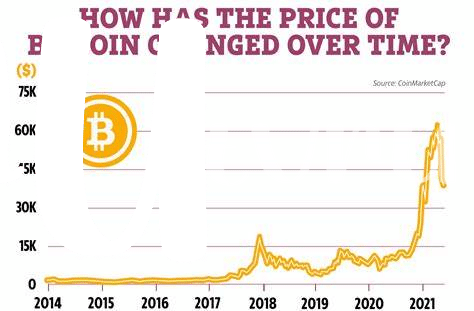

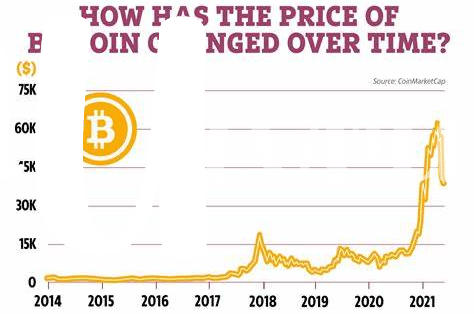

Imagine a digital treasure that caught the world’s eye around 2009 – that’s Bitcoin. Initially, it was like a secret among tech enthusiasts, a sort of digital gold that existed in the virtual realm. The magic began when people realized that this ‘gold’ could be mined from the comfort of their homes, using just their computers. It wasn’t long before this novelty turned into an opportunity for the visionary, leading to its monumental rise in 2017. This surge wasn’t just because people started to believe in its value, but also because it promised a future where money could be sent across the globe without hefty fees or the need for a middleman – a truly revolutionary idea. Its ascent was fueled by tales of early adopters turning into overnight millionaires, further capturing the public’s imagination. Suddenly, everyone wanted a piece of the Bitcoin pie, driving its price to the stratosphere.

| Year | Key Event | Bitcoin’s Price Impact |

|---|---|---|

| 2009 | Bitcoin’s Creation | Practically Worthless |

| 2017 | Price Surge | Hit Nearly $20,000 |

This journey from obscurity to a mainstream sensation showcased the power of innovation and the potential for digital currencies to transform our financial landscape.

💸 Big Bucks: Stories of Sudden Bitcoin Millionaires

Imagine waking up one day to find your digital wallet, which you almost forgot about, now holds a small fortune. This became a reality for many during Bitcoin’s sudden surge in 2017. Back then, stories began circulating of everyday individuals who, on a whim, invested a little in what seemed like digital “magic beans” and ended up becoming millionaires overnight. These narratives weren’t just urban legends but real-life Cinderella stories for the digital age. People who had dabbled in Bitcoin out of curiosity or as a small gamble saw their investments skyrocket as the value of Bitcoin climbed to heights nobody had predicted. But not every story had a fairy-tale ending, leading many to caution about the unpredictable nature of investing in digital currencies. For an in-depth guide on navigating these volatile investment waters and aiming for the best timing to maximize your profits, particularly in the thrilling world of Bitcoin, visit https://wikicrypto.news/maximizing-profits-timing-the-bitcoin-market. These tales serve as a reminder of the transformative power of technology and the unpredictable waves of the financial markets.

📉 the Rollercoaster: Navigating Bitcoin’s Price Swings

Riding the Bitcoin wave was like strapping into the world’s craziest rollercoaster—ups that made you dizzy and downs that could make your stomach drop. Imagine stepping onto a ride, not knowing if you’d end up screaming with joy or holding on for dear life. That’s how investors felt during those wild days. Some folks saw their digital wallets balloon overnight, feeling on top of the world, while others experienced the shock of seeing their investments shrink just as fast. The thrill was in the unpredictability, and talk about it filled every corner of the internet, from social media buzz to news headlines, making everyone wonder, “What’s next?”

🔍 As people navigated through these swings, they learned valuable lessons about the digital currency world. It wasn’t just about the potential to make fast money but also understanding the risks involved. 🚀💸 Patience became a virtue, and timing felt like everything, yet no one could really predict what would happen next. This journey taught investors the importance of care and caution, turning quick wins into long-term strategies. Looking closely, one could see a community emerge, ready to share insights and advice, making the wild ride a bit less daunting for everyone jumping on the Bitcoin bandwagon.

⚠️ a Cautionary Tale: the Risks Behind the Hype

Just like a rollercoaster, the journey of Bitcoin has had its ups and downs. Amid all the excitement and stories of people turning into millionaires overnight, there’s a flip side that often gets overlooked. It’s vital to remember that where there’s potential for great rewards, there’s also risk. The hype can sometimes lead us to make hasty decisions, diving in without truly understanding what we’re getting into. It’s not just about the possibility of prices plummeting; there are also concerns about security risks and the need for a solid understanding of how digital currencies work. Moreover, investing in digital currencies without a clear strategy might not always pan out as expected. For those looking to broaden their horizons, exploring bitcoin in emerging markets investment strategies might offer fresh perspectives. Learning from past mistakes is crucial. By doing so, we can make more informed decisions, ensuring that history does not repeat itself, and perhaps, ride the next big wave with a bit more wisdom and a lot less risk.

📚 Learning from History: Avoiding Past Mistakes

If we turn back the pages to the 2017 Bitcoin surge, a clear pattern emerges that can serve as a guide for future adventures in the cryptocurrency world. It was a time when excitement soared as high as Bitcoin’s price, teaching us that while the digital currency landscape is ripe with opportunities, it’s also fraught with pitfalls. One key lesson is the importance of not letting the fear of missing out (FOMO) cloud our judgment. Many jumped in headfirst without understanding the basics, like how Bitcoin works or the factors affecting its value. This led to some facing significant losses when the market took a downturn. Another crucial takeaway is to approach investments with a strategy—setting clear goals and sticking to them, rather than being swayed by the daily ups and downs. Diversification is another smart move; putting all your eggs in one basket, especially in something as volatile as Bitcoin, can be risky. By learning from these past mistakes, we can navigate the crypto waters with a bit more wisdom and hopefully, more success.

| Lesson | Summary | Impact |

|---|---|---|

| Understanding Before Investing | Grasping the basics of Bitcoin and the factors affecting its value. | Minimizes risks of significant losses. |

| Investment Strategy | Setting clear goals and boundaries to navigate the volatility. | Creates a buffer against market swings. |

| Diversification | Spreading investments across different assets. | Reduces the impact of a bad performance in any single investment. |

🔮 Looking Forward: Predicting Bitcoin’s Next Moves

As we dance into the future with our digital wallets, trying to catch the next wave of Bitcoin’s journey is like trying to bottle lightning. It’s fast, unpredictable, and full of energy. With each passing day, more folks are jumping into the world of cryptocurrency, dreaming of finding their pot of gold. But, as we’ve seen, the path is anything but straightforward. To navigate these choppy waters, understanding bitcoin scalability solutions investment strategies can be your compass. It’s about making smart, informed decisions and not just following the herd.

In the quest for the next big spike, it’s essential to keep both eyes open to the lessons of the past. Remember, for every story of overnight millions, there’s another of unexpected dips. The journey ahead is filled with opportunities and pitfalls. By learning from those who’ve navigated this path before, you can plot a course that balances both ambition and caution. It’s an adventure, no doubt, but with the right mix of wisdom and daring, who knows what peaks we might reach next?