🌎 Exploring the Basics of Portfolio Diversification

Imagine your investment portfolio as a garden. Just like how a variety of plants can make your garden more resilient to bad weather, diversifying your investments can help protect your money from market ups and downs. Diversification is like spreading your eggs across different baskets so if one falls, you won’t lose everything. It’s all about balance. By mixing different types of investments, you reduce the risk of one bad performer wiping out your entire savings. Think of stocks, bonds, and even gold as different crops. Each reacts differently to market changes. When stocks do poorly, bonds might do better, balancing the impact on your garden. This strategy helps your investment garden grow steadily over time, despite the weather’s unpredictability.

| Type of Investment | Characteristics |

|---|---|

| Stocks | High potential returns but more volatile |

| Bonds | Stable income but lower returns |

| Gold | Hedge against inflation but does not produce income |

🔍 Why Bitcoin Deserves a Spot in Your Portfolio

Imagine a world where your savings could work harder for you, beyond the traditional stocks and bonds. This is where Bitcoin comes in, a digital currency that’s been catching the eyes of investors globally. Seen by many as a bold move, incorporating Bitcoin into your investment basket can potentially add a layer of robustness against market swings. It’s a bit like adding a dash of spice to a well-loved recipe; just enough can transform the whole dish. Bitcoin’s unique qualities, including its limited supply and its growing acceptance, hint at its ability to hold value over time, making it an intriguing option for those looking to diversify. By sprinkling a bit of Bitcoin into your portfolio, you’re not just following the latest trend, but making a calculated decision to mix up your investments, possibly paving the way to a more stable financial future. For deeper insights, consider exploring https://wikicrypto.news/blockchain-revolutionizing-security-beyond-cryptocurrency, offering strategies for embracing Bitcoin’s volatility while eyeing long-term gains.

💡 Balancing Risk with Bitcoin’s Potential Rewards

Just like balancing on a tightrope needs focus and a small umbrella for stability, adding Bitcoin to your investment mix needs a careful balance too. It’s all about managing the ups and downs. Imagine Bitcoin as that adventurous friend who might suggest skydiving on a whim – it’s thrilling and could make for an unforgettable experience, but it’s not without its risks. By inviting Bitcoin into your portfolio party, you’re introducing a spark of unpredictability that, believe it or not, can actually help keep your financial feet steady on the ground. It’s a bit like adding some spice to a recipe – just the right amount can transform a dish, but too much can overpower everything else.

Now, handling this spice involves some smart moves. Don’t put all your eggs in one basket, as the old saying goes, and this couldn’t be truer here. Diversifying means spreading your investment seeds across different gardens, not just the Bitcoin plot, no matter how lush it looks today. Monitoring its performance, akin to checking the weather before you sail, ensures you can adjust your sails – or investments – accordingly. Remember, the goal is not to eliminate risk (because that’s impossible), but to manage it in such a way that maximizes your potential rewards while aiming for a smoother ride.

🚀 Bitcoin’s Role in Market Stability and Growth

When we think about the ebb and flow of the market, Bitcoin is like a boat that can help navigate through rough waters, providing a fresh perspective on stability and growth. It’s a bit like adding a sprinkling of salt to a dish; just the right amount can enhance the flavors, similarly, a well-considered amount of Bitcoin can add a new layer of balance to your investment portfolio. Its distinctive nature lies in its limited supply and independence from traditional market pressures, making it a potential hedge during times of inflation or currency devaluation. This digital currency has shown remarkable resilience and growth over the years, drawing attention from individual investors to large corporations. It’s a journey of discovery, venturing into the digital frontier where the rules of the game are being rewritten. By embracing this digital asset, investors open the door to opportunities that not only aim for portfolio growth but also contribute towards establishing a more diversified and resilient investment strategy. And for those looking to navigate the complexities of adding Bitcoin to their portfolio, insights on bitcoin security practices investment strategies can be invaluable. It’s about moving forward with your eyes wide open, ready to adjust sails as the market winds change.

🛠 Practical Tips for Integrating Bitcoin Effectively

Jumping into the world of Bitcoin can be both exciting and a tad overwhelming, but fear not! Think of it as adding a pinch of spice to your meal – it’s all about finding the right balance. Before diving in, start small. Imagine dipping your toes in the water rather than taking a plunge. This approach helps you understand how Bitcoin fits within your broader financial portfolio without causing too much of a stir. Now, remember the golden rule of never investing more than you can afford to lose. It’s like deciding not to bet the farm on a single horse race.

A neat trick is to set up automatic purchases. This is akin to setting a slow drip feed for a plant, ensuring it gets just the right amount of water over time. You can buy small amounts of Bitcoin regularly, which can help smooth out the highs and lows of the market. And now, for something super practical, let’s sketch out how you might visualize your journey:

| Step | Action | Reason |

|---|---|---|

| 1 | Start with a small investment | Minimizes initial risk and helps with learning |

| 2 | Set up automatic purchases | Spreads investment over time, avoiding market timing pitfalls |

| 3 | Review and adjust regularly | Keeps your investment aligned with your financial goals |

It’s also smart to keep an eye on your investments. Just like you might periodically check on plants to see if they need watering or moving to a sunnier spot, regularly review your Bitcoin investment. This helps you make sure it continues to meet your financial growth goals without veering off the path. Remember, the world of digital currency is always on the move, so staying informed and adaptable is key to navigating it successfully.

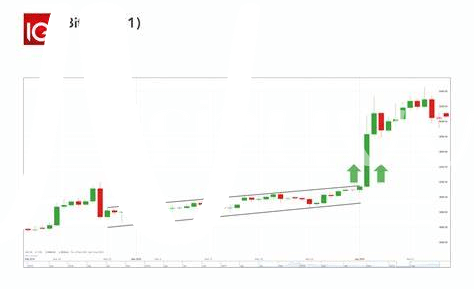

🧐 Monitoring and Adjusting Your Bitcoin Investment

Just like checking the health of your garden and making adjustments based on what you see, keeping an eye on your Bitcoin investment is crucial. Imagine this: as the crypto world spins, prices can go up and down faster than a rollercoaster. So, staying alert and being ready to tweak your investment strategy is like being the captain of a ship in changing seas. Think about it as having a map and a compass in the form of bitcoin transaction fees investment strategies, guiding you through the storms. It’s not just about knowing when to hold tight or when to sell; it’s about understanding the signs. By regularly checking on how Bitcoin is doing, comparing it to your initial goals, and keeping an eye on the broader market, you’re not just passively sitting by. You’re actively ensuring your investment can weather any storm and, ideally, grow over time. With the right tools and a watchful eye, you ensure your journey into Bitcoin isn’t left to chance but is a calculated adventure into the future of finance.