Understanding Bitcoin’s Fee Landscape 🌍

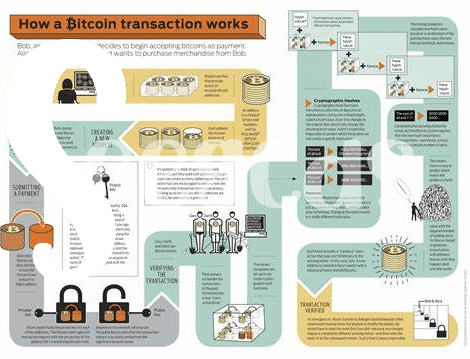

Bitcoin’s world is like a bustling market, where every transaction comes with a little price tag – that’s the fee. Think of it as the cost of getting your transaction picked and sealed into the blockchain ledger. This fee isn’t fixed; it dances to the tune of demand and supply within the network. When more people are sending Bitcoins, the network gets busy, and just like a crowded shop, the price to get your transaction processed quickly goes up.

To get a bird’s-eye view of this landscape, let’s dive into some numbers. Below is a simple table showcasing average transaction fees at different times, giving us a peek into how these fees can change.

| Date | Average Transaction Fee (in USD) |

|---|---|

| January 1 | 0.50 |

| March 1 | 1.20 |

| May 1 | 3.00 |

| July 1 | 0.80 |

| September 1 | 1.50 |

| November 1 | 0.70 |

Understanding these patterns helps you grasp the bigger picture: fees are responsive to the network’s heartbeat. By keeping an eye on this, investors can plan their moves more wisely, avoiding peak times for lower fees, or striking when the network is bustling for urgent transactions.

Analyzing Historical Fee Trends for Insights 📊

Peeking into the past of Bitcoin’s fees offers a map for treasure hunters. Imagine you’re embarking on an adventure, where instead of digging in the dirt, you’re sifting through data to find golden insights. This journey through historical trends is much like being a detective, hunting for clues on how fees have danced to the rhythm of market highs and lows. It’s not just a stroll down memory lane; it’s a strategy session. Recognizing patterns helps investors steer clear of rough waters and catch the tailwind at the right moment. For those eager to dive deeper into the intertwining worlds of blockchain and its broader impacts, including charity, a closer look at https://wikicrypto.news/exploring-the-impact-of-bitcoin-donations-on-global-charities offers invaluable insights. This investigative approach to fee history isn’t merely academic, it’s a flashlight in the dark, guiding investors towards more enlightened decisions.

The Role of Network Activity in Fees 📡

Imagine a bustling marketplace, where everyone’s trying to buy or sell their goods at the same time; this scene isn’t too different from what happens on the Bitcoin network. When lots of people are sending Bitcoin transactions simultaneously, it creates a high demand for the limited space available in each block of the blockchain. Think of it like a crowded train – there’s only so much room, and everyone wants a spot. This demand can make transaction fees go up because just like in an auction, people are willing to pay more to get their transaction included faster by the miners, the folks who process and add these transactions to the blockchain. So, when the network is busy, sending Bitcoin can become more expensive. Conversely, when it’s quieter, with fewer transactions vying for space, fees can drop, making it cheaper to send your Bitcoin. Understanding this ebb and flow is key to optimizing when you send transactions to avoid paying more than you need to. 🚂💼📊

Predictive Tools and Models for Fee Forecasting 🔮

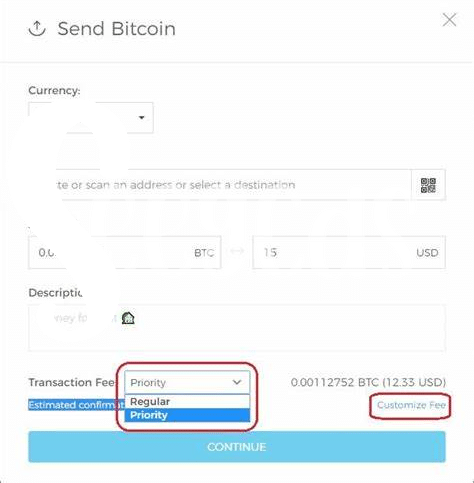

When it comes to staying ahead in the game of Bitcoin investment, knowing how to forecast fees can be a game-changer. Think of it like checking the weather before planning a day out. Instead of stepping out unprepared and getting caught in a rainstorm, having a reliable weather app helps you decide if you need an umbrella or sunglasses. Similarly, various smart tools and analytical models exist to help investors anticipate the ups and downs in transaction fees. These range from simple apps that give a snapshot of current conditions to complex algorithms that analyze trends, taking into account numerous factors like network traffic and historical data. By leveraging these insights, investors can make more informed decisions on when to move their Bitcoin around to save on fees. It’s not just about saving a few dollars here and there; it’s about optimizing your investment strategy to maximize your profits. After all, in the dynamic world of bitcoin blockchain technology investment strategies, staying informed and being able to anticipate changes can make all the difference. Whether you’re a seasoned pro or just starting, taking advantage of these forecasting tools can help you navigate the waters more confidently and strategically.

Crafting Your Bitcoin Investment Strategy Smartly 💡

When it comes to Bitcoin, diving into investments without a plan is like heading into a storm without an umbrella—it’s risky and might leave you drenched. To pave your path towards success, think of your investment strategy as building a house, where understanding fees is laying the foundation. It’s all about balance. Just like you wouldn’t overspend on the foundation and have nothing left for the walls and roof, allocating your investment based on fees and market trends can help you build a sturdy portfolio. This approach ensures you’re not caught off guard by unexpected fees that can eat into your profits. It’s like being in the driver’s seat; you control where your money goes.

As you refine your strategy, keep an eye on market shifts and adjust your sails accordingly. Here’s a simple table to guide your thoughts:

| Aspect | Consideration |

|---|---|

| Market Trends | 🔍 |

| Fee Analysis | 💼 |

| Investment Allocation | 🏦 |

By using insights from fee forecasting, you’re not just throwing darts in the dark; you’re making informed decisions that align with your financial goals. Invest smartly by keeping abreast of fee trends and leveraging predictive models. This way, your Bitcoin journey is not just about surviving the ups and downs but thriving through them. Remember, a wise investment today is the fortune of tomorrow.

Mistakes to Avoid in Fee Forecasting 🚫

When diving into the world of Bitcoin, enthusiasm often leads to overlooking the intricacies of fee forecasting. This oversight can cost dearly in the long run. One common blunder is the underestimation of network congestion’s impact on transaction costs. Imagine planning a road trip without considering traffic; just as unexpected jams can spoil your schedule, unplanned network activity can surge transaction fees, eating into your investment returns. Another pitfall is putting all eggs in one basket by relying solely on a single predictive tool. The crypto landscape is as unpredictable as the weather, making it essential to use a blend of forecasting tools and models. This diversified approach provides a more reliable compass for navigating the turbulent seas of Bitcoin investment.

To stay ahead in the game, it’s crucial to remain informed and adapt strategies accordingly. A smart move is to explore how Bitcoin is making waves beyond just investment returns. Initiatives like bitcoin philanthropic initiatives and the blockchain shed light on the broader potential of Bitcoin, illustrating its capacity to drive positive change. This perspective not only enriches your investment journey but also aligns it with the evolving narrative of Bitcoin’s role in society. Steering clear of the outlined missteps and broadening your horizon beyond mere profit can unlock doors to a fulfilling Bitcoin investment experience. 🚫🔮💡