🚀 a Brief History of Bitcoin Wallets

Imagine stepping into a time machine and zipping back to 2009, a time when Bitcoin itself was just a newborn in the financial landscape. The early Bitcoin wallets were quite rudimentary, imagine a digital version of a leather wallet, but for your online coins. They were software programs you could run on your computer, keeping your digital cash safe, or so was the plan. These wallets were the keys to the Bitcoin kingdom, allowing people to send and receive Bitcoin, sparking the beginnings of a financial revolution.

Fast forward a few years, and the landscape started to shift dramatically. Developers and innovators, inspired by the possibilities, began crafting wallets with more features, better security, and easier access. It was like watching a child grow up, with each version more sophisticated and capable than the last. Here is a brief table showcasing this evolution:

| Year | Key Development |

|---|---|

| 2009 | Launch of Bitcoin and simple digital wallets |

| 2011-2012 | Introduction of wallets with improved security features |

| 2014 onwards | Shift towards mobile and multi-currency wallets |

This journey from basic software to complex, feature-rich platforms marks a pivotal chapter in the saga of Bitcoin, illustrating not just innovation but a radical shift in how we think about and manage our digital wealth.

📱 Transition from Desktop to Mobile Wallets

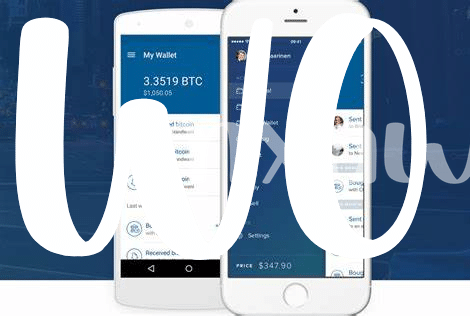

Once upon a time, accessing your bitcoins meant being anchored to your desktop, wading through technical setups that felt more like rocket science. Fast forward, and the scene has dramatically changed. Mobile wallets have surged onto the scene, transforming our smartphones into treasure chests that can send, receive, and store bitcoins with just a tap or swipe. This transition is much like moving from bulky maps to sleek GPS navigation on your phone – it’s all about making life easier.

The leap to mobile hasn’t just been about convenience. It’s also opened a new chapter in how we interact with the digital currency space, especially for those always on the go. Imagine being able to manage your digital riches while sitting in a café or during a commute. This evolution isn’t stopping here, either. As mobile wallets become smarter and more integrated into our daily lives, the boundaries of what they can do are expanding. For a closer look at how these changes are shaping the way we think about and interact with cryptocurrencies, consider the insights on https://wikicrypto.news/smart-contracts-simplified-unlocking-blockchains-potential, drawing us into a future where our financial management is literally at our fingertips, blending seamlessly with our lifestyles.

🔒 the Evolution of Security Features

Back in the day, keeping your digital coins safe was as simple as making sure you didn’t forget your password. But as more people began to use Bitcoin, the bad guys got smarter, too. Initially, wallet security was pretty basic, with simple codes to protect your stash. However, as hacking tricks evolved, so did the need to beef up security. The transformation was gradual but significant, leading to the introduction of advanced features like two-factor authentication, which added an extra layer of safety by requiring a second form of verification beyond just a password.

These days, some wallets even use biometric security, like fingerprint or facial recognition, making unauthorized access nearly impossible.🚀 It’s kind of like adding a high-tech lock to an already secure vault. Plus, with the rise of hardware wallets – small devices that can store your Bitcoin offline – your coins are safe from online threats.🔑🛡️ This shift toward more sophisticated security measures reflects not just advances in technology, but also a growing recognition of how important it is to keep our digital treasures locked up tight.

💼 from Simple Storage to Multi-functional Platforms

Gone are the days when managing digital cash meant storing it in a virtual wallet that did little else. Picture this, a tool once designed purely for holding your digital coins has transformed into a Swiss Army knife—a one-stop-shop for a variety of financial services. We’ve witnessed these platforms evolve to support not just the storage, but also the exchange, investment, and even the earning of interest on your digital assets. 🚀💼 It’s this progression toward multi-functionality that has made managing Bitcoin and other cryptocurrencies an intricately woven part of daily financial dealings. For those looking to dive deeper into this futuristic way of maximizing their digital assets, exploring bitcoin interest accounts in 2024 could offer insights into how to get more from your stash of digital coins. This shift has not just been about adding new bells and whistles; it’s fundamentally changed how we perceive and interact with our digital wealth. 🌐🔮

🌐 the Impact of Global Adoption Trends

As Bitcoin has danced its way onto the global stage, we’ve seen a fascinating shift in how people everywhere are interacting with their digital gold. Think of it as a worldwide party where everyone’s invited – from the bustling streets of New York to the serene landscapes of New Zealand. This universal embrace has pushed Bitcoin wallets to evolve, transforming from mere storage spaces to vital tools for daily financial operations. They’ve become as diverse as the users themselves, adapting to various cultures and economic needs.

This trend of global adoption doesn’t just mean more users; it’s reshaping the very fabric of financial transactions. Imagine sending money to a friend halfway across the world without hefty fees or waiting days for the transaction to clear. That’s the promise these next-generation Bitcoin wallets hold. They’re not just about keeping your digital currency safe; they’re about making your money truly global and fluid, like water. Here’s a glimpse into how these wallets are spreading their wings:

| 🌍 Region | 💡 Innovation | 🚀 Impact |

| Asia | Mobile-first approach | Increased accessibility for millions |

| Europe | Emphasis on privacy features | Greater security and trust among users |

| Americas | Integration with traditional banking | Seamless transition between fiat and crypto |

🔮 Predictions for Wallets in 2024 and Beyond

Looking into the crystal ball for Bitcoin wallets in 2024 and beyond, we’re embarking on an exciting journey into the future where these wallets evolve way beyond simple coin storage. Imagine wallets transforming into ultra-smart financial hubs, managing not just Bitcoin but a wide array of digital assets, with seamless swapping, spending, and even earning capabilities. They could become deeply integrated with everyday life, intelligently suggesting ways to optimize your assets based on your personal spending habits and financial goals. With the rapid advancement of technology, these wallets are expected to offer even tighter security features, possibly incorporating biometric data verification like fingerprints or even retinal scans to ensure that you and only you can access your digital treasure trove. Moreover, as Bitcoin continues to weave its way into the fabric of global finance, we might see wallets that automatically adjust to regulatory changes, keeping you in compliance without lifting a finger. In a world more connected than ever, these wallets could act as your personal finance assistant, guiding you through the ever-expanding digital economy. As we edge closer to this future, it’s crucial to stay informed and adopt bitcoin and smart contracts for beginners, ensuring that you’re prepared for the exciting developments in the world of Bitcoin wallets.