🕵️♂️ Uncovering Hidden Fees: a Treasure Hunt

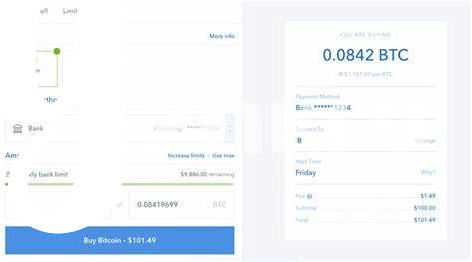

Embarking on an adventure to find the best Bitcoin interest account feels a bit like searching for treasure. You’re on the lookout for the best rewards, but along the way, you might stumble upon hidden fees that aren’t so obvious at first glance. Think of it like a map that leads to treasure; you need to read between the lines and look under the X to find what’s truly buried there. It’s not just about the big, shiny number that shouts “Interest!” but also about the tiny, sneaky fees that whisper “Catch me if you can.” These could be anything from withdrawal fees to account maintenance charges, all waiting to be uncovered with a keen eye.

To help you on your quest, imagine having a magnifying glass that lets you zoom in on the fine print. Here’s what a typical treasure map (or, in our case, fee schedule) might look like:

| Type of Fee | Description |

|---|---|

| Withdrawal Fees | Charges applied whenever you move your Bitcoin out of the account. |

| Maintenance Fees | Monthly charges for keeping the account active. |

| Transaction Fees | Fees incurred with each deposit or transfer. |

| Inactivity Fees | Charges if your account stays dormant for a certain period. |

This table helps to underline that the devil is truly in the details. By equipping yourself with knowledge and attention to these often-overlooked costs, you’re not just digging at random; you’re following a map that leads to the genuine treasure of maximizing your returns without being undercut by unseen charges.

💼 Comparing Apples to Apples: Fee Structures Explained

Imagine you’re at a fruit market, comparing the prices of apples from different stalls. Some have price tags that seem low at first glance, but then you notice extra charges for bags or a premium for choosing your own apples. This is what it’s like navigating the world of Bitcoin interest accounts in 2024 – a quest to understand not just the “how much” but the “what for” of the fees involved. Each service has its unique fee structure, from the straightforward to the complex, incorporating maintenance fees, withdrawal charges, or even rates that change based on the amount of Bitcoin you hold. It’s a puzzle that requires patience and attention to detail to solve. Understanding these fees is crucial because they directly impact the profit you earn from your Bitcoin savings. For those diving deeper into the world of Bitcoin and looking for enhanced security measures, considering smart contracts might be the next step. It’s worth exploring information on https://wikicrypto.news/using-multi-signature-wallets-for-enhanced-bitcoin-security to get a grasp of how these contracts can safeguard your investments while navigating the complex fee structures of Bitcoin interest accounts. By comparing these structures carefully, you ensure that you’re not just seeing the numbers, but understanding the real cost and value behind them, making your investment journey both insightful and profitable.

🚦 Red Flags: What to Watch Out for

Navigating the world of Bitcoin interest accounts can sometimes feel like walking through a minefield, especially when it comes to deciphering the myriad fees you might encounter. It’s like playing a detective game, but instead of looking for clues to solve a mystery, you’re on the lookout for any costs that might nibble away at your investments without you realizing it. A particularly sneaky fee to watch out for is the ‘withdrawal fee’ that tags along like an unwanted guest whenever you decide to move your Bitcoin. It’s all too easy to overlook these charges in the enthusiasm of earning interest.

Then, there’s the infamous ‘maintenance fee.’ Picture this: you’re happily watching your Bitcoin grow, all while a tiny part of it leaks out regularly as if through a small, almost invisible hole. This fee is often justified as necessary for account upkeep, but if you’re not careful, it can eat into your returns like a silent pest. Both of these fees can vary widely between accounts, so putting on your detective hat and scrutinizing the fine print becomes crucial. By understanding these potential pitfalls, you’re not only safeguarding your investment but also ensuring that it grows healthily, just as you intended.

🧮 Crunching Numbers: Calculating the Real Cost

When trying to figure out the real cost of Bitcoin interest accounts, think of it like planning a trip. You know the big expenses, like the flight and hotel, but it’s the smaller, unexpected costs that can really add up. It’s similar with these accounts. The interest rates look inviting, but what matters more is what’s going on behind the scenes. These could include service charges, withdrawal fees, and transaction costs that aren’t always clear upfront. Some accounts might dazzle you with high interest rates, but after you factor in these extra fees, the deal might not be as sweet as it seemed.

To really understand what you’re signing up for, you need to do a bit of homework. Thankfully, there are resources out there to help decode the world of bitcoin and smart contracts for beginners. These tools can guide you through the maze of fees and help you uncover the true cost of your investment. By taking the time to crunch the numbers and look beyond the surface, you can protect your investment and avoid unwanted surprises. Remember, in the world of Bitcoin interest accounts, knowledge is not just power—it’s profit.

🌍 Beyond Borders: International Fees Explored

When you step into the world of Bitcoin interest accounts, especially those that operate across countries, it’s like entering a maze of costs that can surprise you. Imagine you’re sending a digital letter with some money attached to a friend overseas. Just as postal services charge more for international deliveries, Bitcoin accounts sometimes come with extra costs when crossing borders. These might include currency conversion fees, where your Bitcoin’s value changes as it moves from one country’s currency to another, or even transfer fees that get tacked on when you send or receive Bitcoin internationally. It’s a bit like when you find a great online deal only to discover shipping costs more than the item itself. But here’s a secret: not all accounts charge the same rates. Here’s a simple breakdown to help you see what I mean:

| Fee Type | Description | Average Cost |

|---|---|---|

| Currency Conversion | Changing your Bitcoin into another currency | 1-3% |

| Transfer Fees | Moving Bitcoin across borders | $5-$50 (depending on the amount) |

So, understanding these fees is like packing the right gear before a trip. By knowing what to expect, you can plan better and keep more of your money safe and sound, ensuring your investment journey is smooth, no matter the distance or destination.

🛡️ Protecting Your Investment: Fee Avoidance Strategies

In the ever-evolving landscape of Bitcoin interest accounts, keeping a close eye on the fine print is key to safeguarding your investment from unnecessary fees. Think of it as setting up a defensive shield for your digital treasure trove. 🛡️ A great start is understanding the basics of digital currency management; for beginners eager to dive deeper, a useful resource can be found here: bitcoin and micropayments in 2024. Familiarizing yourself with the ins and outs not only boosts your confidence but empowers you to make informed decisions. By comparing different accounts and their associated costs, you’re essentially playing a game of financial chess, strategizing each move to ensure it aligns with your long-term goals. 🌍 Moreover, adopting strategies like utilizing accounts with tiered fee structures or taking advantage of promotions and loyalty rewards can lead to significant savings. Remember, in the world of Bitcoin, knowledge is not just power—it’s profit. So, embracing a proactive approach to learning about and utilizing fee avoidance strategies doesn’t just protect your investment; it maximizes its potential growth. 🚀