Regulatory Hurdles 🚫

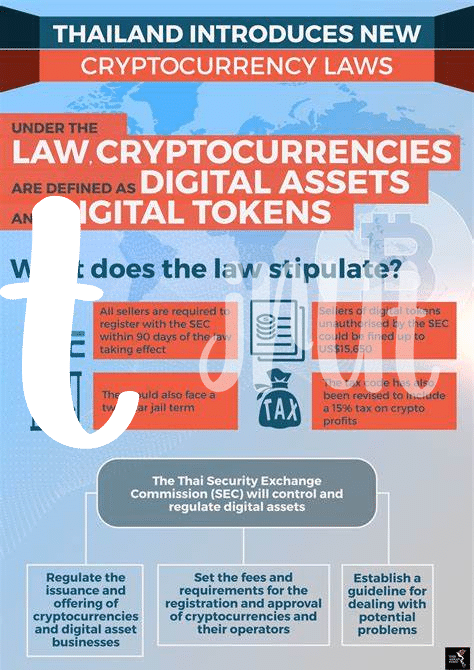

Embracing the world of cryptocurrency startups in Thailand’s market comes with a myriad of regulatory hurdles to overcome. Navigating the complex landscape of regulations set forth by governmental bodies requires a deep understanding of the legal framework in place. Stay informed about the latest updates and ensure compliance to avoid potential legal entanglements that could hinder the growth of your startup. By proactively addressing regulatory challenges, you can position your cryptocurrency venture for long-term success in the evolving market.

Tax Implications 💸

Tax Implications in Thailand can significantly impact cryptocurrency startups. Understanding the tax obligations and implications of operating in the market is crucial for financial planning and compliance. From income tax to capital gains tax, navigating the complex tax landscape is essential for startups to avoid penalties and ensure sustainable growth.

Moreover, tax considerations extend beyond traditional areas, with VAT and withholding tax playing a significant role in the financial operations of cryptocurrency startups. Ensuring compliance with tax laws not only fosters a positive relationship with authorities but also builds credibility with investors and customers. By proactively addressing tax implications, startups can position themselves for long-term success in Thailand’s evolving cryptocurrency market.

Licensing Requirements 📜

Licensing requirements pose a crucial aspect for cryptocurrency startups in Thailand, often serving as a gateway to legitimacy within the market. Obtaining the necessary licenses showcases commitment to regulatory compliance and instills confidence among stakeholders, including investors and users. Navigating the intricate landscape of licensing demands diligence and strategic planning to streamline the process efficiently.

Meeting licensing criteria signifies a proactive approach by startups to demonstrate their willingness to operate transparently and ethically in the burgeoning cryptocurrency sector. It also serves as a foundation for building credibility and establishing a strong foothold in the competitive market environment. By embracing licensing requirements, startups can enhance their reputation and foster trust with both regulators and consumers, paving the way for sustainable growth and long-term success.

Security Concerns 🔒

The dynamic landscape of the cryptocurrency market in Thailand presents a unique set of challenges for startups, with Security Concerns remaining a key focal point. As digital assets become increasingly targeted by cyber threats, ensuring robust cybersecurity measures is paramount for safeguarding both the platform and its users. From potential hacks to phishing attempts, the ever-evolving nature of cyber risks necessitates a proactive approach towards implementing comprehensive security protocols. Maintaining trust and credibility within the market hinges on the ability to combat these threats effectively, thereby fostering a secure environment for all stakeholders involved. By prioritizing security measures and staying abreast of the latest developments in cybersecurity, cryptocurrency startups can fortify their defenses and instill confidence in their offering. Find out more about upcoming regulatory changes for bitcoin in Guatemala here.

Fostering Trust 🤝

Fostering trust is paramount for cryptocurrency startups in Thailand to gain credibility and reliability in the market. Building trust involves transparency in operations, secure handling of user data, and a commitment to compliance with regulations. By prioritizing integrity and accountability, startups can establish strong relationships with investors, customers, and regulatory bodies, enhancing their reputation and viability in the competitive cryptocurrency landscape. Emphasizing trustworthiness not only contributes to the long-term success of the startup but also cultivates a positive perception within the industry and among stakeholders. It is essential for cryptocurrency startups to instill trust through ethical practices, robust security measures, and consistent communication to foster confidence and loyalty among their target audience.

Navigating Legal Ambiguities 🌐

Navigating the legal landscape as a cryptocurrency startup in Thailand can feel like exploring uncharted territory, filled with ambiguity and uncertainty. The evolving regulatory framework presents challenges in understanding how to operate within the boundaries of the law while still fostering innovation and growth. Amidst shifting tax implications and licensing requirements, startups must tread carefully to ensure compliance and mitigate risks. Security concerns loom large, requiring robust measures to safeguard both assets and user data. Establishing trust within the market is paramount, as users seek transparency and accountability from blockchain-based ventures. Navigating these legal ambiguities demands a delicate balance of legal expertise, technological proficiency, and adaptability in an ever-changing landscape. Keeping abreast of updates and clarifications from regulatory bodies is crucial to steer clear of potential pitfalls and maintain a competitive edge in the dynamic cryptocurrency industry.

To explore the government stance on the future of cryptocurrencies in Venezuela, click here for insights into Bitcoin cross-border money transfer laws in Norway.