Overview of Norwegian Bitcoin Regulations 🇳🇴

Norwegian regulations surrounding Bitcoin are a crucial aspect of the country’s financial landscape, impacting both individuals and businesses engaged in cryptocurrency transactions. These regulations aim to provide clarity on the legal status of Bitcoin, outlining obligations for entities operating in the space. Understanding these regulations is essential for anyone involved in Bitcoin activities within Norway, as adherence to the established guidelines is necessary to avoid potential legal repercussions.

Navigating the Norwegian Bitcoin regulatory framework involves considerations such as registration requirements, taxation rules, and adherence to anti-money laundering (AML) and counter-terrorism financing (CTF) measures. The government’s approach to regulating Bitcoin reflects its commitment to fostering innovation while ensuring financial stability and consumer protection. By staying informed about these regulations and actively engaging with regulatory bodies, individuals and businesses can navigate the Bitcoin landscape in Norway successfully.

Impact on Money Transfers Within Norway 💸

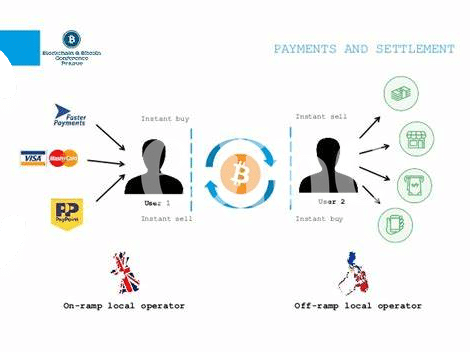

Within Norway, the interplay between Bitcoin regulations and money transfers has significant implications for users looking to engage in transactions. The regulatory framework not only shapes the landscape for local transfers but also influences how international transfers are handled within the country. This impact extends beyond mere compliance considerations, affecting the ease, speed, and cost of moving funds in and out of Norway. As users navigate these regulations, they must grapple with the challenges posed by varying interpretations and enforcement practices, creating a complex environment for conducting Bitcoin transactions in the country. Amidst these challenges, opportunities for innovation and growth arise as users seek ways to optimize their transfer processes while staying compliant with evolving legal requirements.

When engaging in money transfers involving Bitcoin within Norway, individuals and businesses alike must carefully assess the regulatory landscape and adopt strategies that align with the current legal framework. By understanding the nuances of Norwegian legislation and its effects on money transfers, users can proactively address compliance challenges and position themselves for success in a rapidly evolving financial ecosystem. Additionally, staying informed about potential changes and seeking professional guidance can help navigate the complexities of Bitcoin transactions, ensuring a seamless and legally sound transfer experience within the Norwegian jurisdiction.

International Implications and Restrictions 🌍

As the world becomes increasingly interconnected, the international implications and restrictions surrounding Bitcoin transactions in Norway play a crucial role in shaping the cryptocurrency landscape. Different countries have varying regulations and approaches towards Bitcoin, which can impact the ease of transferring money across borders. Norway’s stance on Bitcoin can also influence how users interact with the digital currency on a global scale. These international factors and restrictions highlight the importance of understanding the cross-border implications when utilizing Bitcoin for financial transactions. Adapting to the ever-evolving international regulatory environment is essential for individuals and businesses looking to make use of Bitcoin for cross-border payments or investments. By staying informed and compliant with international regulations, users can navigate the complexities of global Bitcoin transactions and mitigate potential risks associated with varying regulatory frameworks.

Compliance Challenges for Bitcoin Users 📝

Bitcoin users in Norway face a variety of compliance challenges in navigating the legal landscape surrounding cryptocurrency transactions. The ambiguity in regulations, especially when it comes to tax implications and reporting requirements, can be a major hurdle for individuals and businesses looking to engage in Bitcoin activities. Additionally, the lack of clear guidelines on issues like anti-money laundering measures and Know Your Customer (KYC) procedures can make it difficult for users to ensure they are operating within the bounds of the law. These challenges underscore the need for increased clarity and consistency in regulatory frameworks to foster a more secure and stable environment for cryptocurrency transactions in Norway.

For more insights on the government stance on the future of cryptocurrencies in Zimbabwe, visit government stance on the future of cryptocurrencies in Zimbabwe.

Future Outlook and Potential Changes 🔮

In the ever-evolving landscape of cryptocurrency regulation, the future outlook in Norway appears to be a mix of challenges and opportunities. As the global narrative surrounding digital currencies continues to shift, Norway is also expected to adapt its approach to reflect these changes. Potential adjustments in legislation may aim to strike a balance between protecting consumer interests and fostering innovation in the cryptocurrency sector.

Moreover, with the increasing mainstream adoption of Bitcoin and other cryptocurrencies, there is a likelihood of further regulatory clarity to provide a stable environment for users and businesses alike. These potential changes could influence how money transfers are conducted within and beyond Norway’s borders, shaping the future landscape of digital asset transactions in the country. As stakeholders continue to navigate the complexities of regulatory compliance, staying informed and proactive will be key in adapting to the evolving legal framework.

Tips for Navigating Norwegian Legislation 🚀

When navigating Norwegian legislation regarding Bitcoin, it’s essential to stay informed and compliant with the current regulations. Firstly, make sure to keep up to date with any changes or updates in the laws concerning cryptocurrency in Norway. Secondly, consider utilizing reputable and compliant cryptocurrency exchanges or platforms for your transactions within the country. Additionally, seek guidance from legal professionals with expertise in cryptocurrency laws to ensure full compliance. Lastly, staying educated on best practices and security measures in the crypto space can help protect your investments and transactions. By being proactive and informed, you can navigate the Norwegian legislation surrounding Bitcoin with confidence.

government stance on the future of cryptocurrencies in Vanuatu