The Compliance Challenge in International Money Transfers 🌎

The complex web of regulations surrounding international money transfers presents a formidable challenge for individuals and businesses looking to navigate the global financial landscape. From anti-money laundering laws to stringent reporting requirements, ensuring compliance can be a daunting task. The need to adhere to multiple sets of rules and regulations across different jurisdictions adds another layer of complexity to the already intricate process of transferring money internationally. Navigating this intricate web of legal obligations requires a keen understanding of the regulatory landscape and a commitment to upholding the highest standards of compliance.

Addressing the compliance challenge in international money transfers is crucial not only for regulatory compliance but also for building trust among stakeholders. By effectively managing compliance issues, businesses can streamline their operations, reduce risks, and enhance their reputation in the global marketplace. Ultimately, overcoming these challenges is essential for ensuring the integrity and security of cross-border transactions, laying the foundation for a more transparent and efficient financial system.

The Role of Bitcoin in Facilitating Transactions 🔄

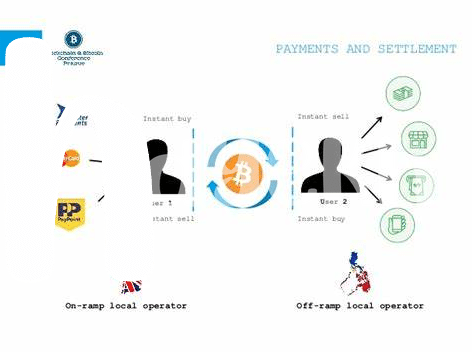

Bitcoin serves as a powerful tool in simplifying international money transfers. Its decentralized nature and underlying technology, blockchain, revolutionize the way transactions are conducted across borders. By eliminating intermediaries and the need for traditional banking systems, Bitcoin provides a more efficient and cost-effective method for transferring funds globally. This not only streamlines the process but also reduces the associated fees and processing times, making it an attractive option for individuals and businesses looking to send money internationally.

Furthermore, Bitcoin’s borderless nature allows for seamless transactions without the limitations imposed by geographical boundaries or fiat currencies. This flexibility opens up new opportunities for cross-border trade and commerce, fostering greater financial inclusion on a global scale. As more individuals and institutions recognize the advantages of using Bitcoin for international transfers, its role in facilitating transactions continues to expand, paving the way for a more interconnected and accessible financial ecosystem.

Benefits of Using Bitcoin for Cross-border Payments 💸

Bitcoin has emerged as a game-changer in the realm of cross-border payments, offering a myriad of benefits for individuals and businesses navigating international financial transactions. One of the key advantages of using Bitcoin for cross-border payments is the speed at which transactions can be processed. Traditional methods often involve lengthy processing times due to intermediaries and multiple layers of verification. With Bitcoin, transactions can be completed within minutes, regardless of the geographic locations of the parties involved. Additionally, the decentralized nature of Bitcoin ensures that there are no middlemen or intermediaries, resulting in lower transaction fees for users. This cost-effective solution is particularly advantageous for individuals and businesses seeking to minimize the expenses associated with international money transfers.

Overcoming Regulatory Hurdles with Cryptocurrency 🚧

Overcoming regulatory hurdles with cryptocurrency can be a complex yet crucial aspect in the realm of international money transfers. Navigating through varying legislations and compliance requirements pose challenges that Bitcoin enthusiasts and businesses alike must address. It is imperative to stay informed and proactive in adhering to evolving regulations to ensure the smooth flow of cross-border transactions. By leveraging the decentralized nature of cryptocurrencies, individuals and organizations can strive to maintain compliance while engaging in efficient and secure financial operations. Embracing innovative solutions and fostering dialogue between regulatory bodies and the crypto community are key in paving the way for a more streamlined and transparent ecosystem for international money transfers. Advocating for clearer guidelines and frameworks can further facilitate the integration of cryptocurrencies like Bitcoin into traditional financial systems.

To delve deeper into how Bitcoin is revolutionizing cross-border money transfers and shaping future legislation, explore this insightful article on bitcoin cross-border money transfer laws in Poland.

Case Studies: Successful Bitcoin Money Transfers 📊

In Malaysia, Maria needed to send money to her family in Peru quickly for an unexpected medical emergency. Traditional methods would have taken days and incurred high fees. With Bitcoin, she completed the transfer within minutes at a fraction of the cost, providing immediate relief to her loved ones. This case exemplifies the real-world impact of successful Bitcoin money transfers, showcasing the efficiency and affordability it offers in cross-border transactions. As more individuals like Maria experience the advantages of using Bitcoin for international remittances, the potential for a widespread shift towards cryptocurrency as a solution to compliance challenges in money transfers becomes increasingly promising.

The Future of International Transactions with Bitcoin 🔮

The evolution of international transactions with Bitcoin is poised to revolutionize the way cross-border payments are conducted. As technology continues to advance, Bitcoin’s decentralized nature offers a glimpse into a future where traditional banking systems may no longer dictate the speed or cost of global money transfers. With blockchain technology as its backbone, Bitcoin introduces a level of transparency and security previously unseen in international financial transactions. This not only streamlines the process but also ensures that funds reach their destination swiftly and securely.

As global regulations adapt to the emergence of cryptocurrencies, the future of using Bitcoin for international transactions holds promise for individuals and businesses alike. With more countries recognizing the value and potential of digital currencies, the landscape of cross-border payments is shifting towards a more efficient and accessible platform. As we step into this new era of financial innovation, the possibilities for leveraging Bitcoin in global money transfers are boundless, offering a glimpse of a future where borders are no longer barriers to seamless financial transactions.

Bitcoin cross-border money transfer laws in Qatar