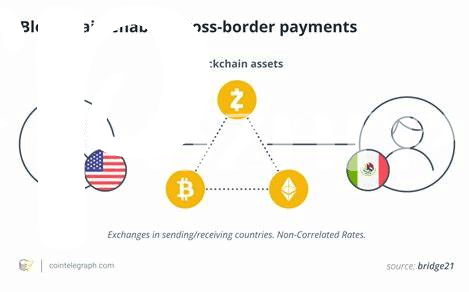

Current Challenges in Cross-border Bitcoin Transfers 🌏

Navigating the complex landscape of cross-border Bitcoin transfers often presents a myriad of challenges for users. Variability in exchange rates, lengthy transaction times, and high fees can impede the seamless flow of funds across borders. Additionally, the evolving regulatory environment globally adds another layer of uncertainty, with differing compliance requirements in various jurisdictions posing obstacles for those looking to engage in international Bitcoin transactions. The inherent volatility of Bitcoin prices further complicates cross-border transfers, as users need to carefully time their transactions to mitigate potential losses. Despite these challenges, the allure of borderless transactions and potential cost savings continues to drive interest in utilizing Bitcoin for cross-border transfers. As the digital currency ecosystem matures and innovative solutions emerge, addressing these current hurdles will be key to fostering a more efficient and accessible cross-border Bitcoin transfer landscape.

Regulations Impacting Bitcoin Transactions in Qatar 📜

Regulations in Qatar play a significant role in shaping the landscape for Bitcoin transactions in the country. As the digital currency continues to gain traction globally, understanding and adhering to the regulatory framework is crucial for individuals and businesses looking to engage in cross-border Bitcoin transfers. Qatar’s regulatory environment surrounding Bitcoin is evolving, with a focus on compliance, consumer protection, and anti-money laundering measures. This dynamic regulatory landscape necessitates a nuanced approach to navigating Bitcoin transactions within and outside Qatar’s borders. Local regulations, in conjunction with international standards, create a framework that impacts the ease and security of cross-border Bitcoin transactions in the country. Understanding and complying with these regulations are essential for fostering trust and sustainability in the Bitcoin ecosystem while ensuring compliance with legal requirements.

In the realm of international finance, regulatory compliance is a cornerstone for fostering trust and transparency. For Bitcoin enthusiasts and investors in Qatar, staying informed about the regulatory environment is crucial for making informed decisions regarding cross-border transactions. Regulation not only serves to protect consumers and businesses but also acts as a catalyst for innovation and adoption in the digital currency space. Adhering to regulatory guidelines promotes the legitimacy of Bitcoin transactions and contributes to a robust and secure cross-border payment ecosystem in Qatar. Education and awareness about regulatory requirements empower individuals and entities to engage confidently in cross-border Bitcoin transfers, driving the future of digital finance in the country and beyond.

Advantages of Using Bitcoin for International Transfers 💸

Bitcoin has revolutionized the landscape of international transfers, offering unique advantages that traditional methods lack. Its decentralized nature enables swift and secure transactions across borders, free from intermediaries and their associated fees. Additionally, the transparency of blockchain technology ensures a traceable record of all Bitcoin transfers, enhancing accountability and trust between parties. The ability to conduct transactions 24/7 further accelerates the speed of cross-border transfers, eliminating delays typically encountered in traditional banking systems. Embracing Bitcoin for international transfers not only streamlines the process but also opens doors to a global economy where individuals can transact without the constraints of geographical boundaries. This decentralized and borderless nature of Bitcoin marks a significant advancement in the world of international finance, offering a promising alternative for individuals seeking efficient and cost-effective cross-border payment solutions.

Future Potential for Bitcoin Adoption in Qatar 🚀

The future potential for Bitcoin adoption in Qatar is brimming with possibilities, offering a pathway towards streamlined and efficient cross-border transactions. As the global landscape continues to evolve, Qatar stands at the cusp of embracing Bitcoin as a viable alternative for international transfers, potentially revolutionizing the traditional financial ecosystem. With increasing awareness and acceptance, coupled with technological advancements, the future holds promising prospects for Bitcoin to establish itself as a go-to method for cross-border remittances in Qatar.

In the coming years, the integration of Bitcoin into mainstream financial practices in Qatar could unlock new avenues for economic growth and financial inclusion. As the regulatory framework adapts to accommodate digital currencies, the adoption of Bitcoin presents an exciting opportunity for individuals and businesses to navigate cross-border transactions with heightened efficiency and reduced costs. The evolving landscape in Qatar signals a shift towards embracing Bitcoin as a transformative force in cross-border money transfers, paving the way for a digital financial revolution with global implications.

Promising Technologies Shaping the Future of Bitcoin 🌐

As the landscape of digital currencies continues to evolve 🔮, there are several promising technologies that are shaping the future of Bitcoin. One of these key advancements is the Lightning Network, a layer-two scaling solution that aims to enhance Bitcoin’s scalability and speed of transactions. By enabling off-chain transactions and micropayments, the Lightning Network has the potential to significantly improve the efficiency and cost-effectiveness of cross-border Bitcoin transfers.

Additionally, technologies such as Schnorr signatures and Taproot are poised to enhance the privacy and security features of Bitcoin transactions. These advancements not only offer improved confidentiality for users but also contribute to a more robust and resilient ecosystem for cross-border transfers in Qatar and beyond. Embracing these innovative technologies could pave the way for a more seamless and accessible future for Bitcoin adoption in the realm of international transfers.

Tips for Navigating Cross-border Bitcoin Transfers Successfully 💡

When delving into the realm of cross-border Bitcoin transfers, it’s crucial to approach the process with mindfulness and preparation. Understanding the dynamics of different markets and regions plays a pivotal role in navigating the volatility and regulations associated with international Bitcoin transactions. One key tip is to stay updated on the ever-evolving landscape of regulations governing cross-border Bitcoin transfers, ensuring compliance and minimizing risks. Additionally, fostering relationships with reputable cryptocurrency exchanges and platforms can enhance the efficiency and security of your transactions. Embracing a proactive attitude towards security measures, such as utilizing two-factor authentication and secure wallets, adds an extra layer of protection to your cross-border Bitcoin transfers.

For in-depth insights into the legal framework of Bitcoin cross-border money transfers in various countries, including the Bitcoin cross-border money transfer laws in the Philippines, refer to the comprehensive guide on Bitcoin cross-border money transfer laws in Romania. Stay informed, stay vigilant, and set forth confidently into the realm of cross-border Bitcoin transfers.