Vietnam’s Curious Relationship with Digital Currencies 🌐

Vietnam has been cautiously exploring the realm of digital currencies, navigating the uncharted waters of this evolving financial landscape. As a country with a growing tech-savvy population, Vietnam has shown interest in the potential of digital currencies to revolutionize traditional monetary systems. Various discussions and debates have emerged regarding the risks and benefits associated with embracing such innovations in the local economy. This curious relationship reflects a desire to balance the potential opportunities for financial inclusion and technological advancement with the need to mitigate potential risks such as regulatory challenges and security concerns. As Vietnam continues to navigate this dynamic space, stakeholders from government officials to entrepreneurs are closely monitoring the developments in the digital currency arena, eager to harness its transformative power while ensuring the stability and security of the financial ecosystem.

The Regulatory Landscape: Challenges and Opportunities 📜

Navigating the evolving regulatory landscape surrounding digital currencies poses both challenges and opportunities for Vietnam. As the country grapples with the growing influence of digital currency innovations, policymakers face the task of striking a delicate balance between fostering innovation and ensuring consumer protection. This dynamic environment presents a unique set of challenges as authorities seek to implement effective regulatory frameworks that can keep pace with the rapidly changing landscape of digital currencies.

Amid these challenges, there also lie significant opportunities for Vietnam to position itself as a hub for digital currency innovation in the region. By fostering a conducive regulatory environment that balances risk management with innovation, Vietnam has the potential to attract investment, spur technological advancements, and enhance financial inclusion. As the regulatory landscape continues to evolve, stakeholders across the financial sector stand to benefit from the opportunities that digital currencies present in reshaping the traditional financial landscape.

Tech Innovation in Vietnam’s Financial Sector 🚀

Vietnam’s financial sector has been experiencing a wave of technological innovation, propelling the industry towards a new era of efficiency and accessibility. With a growing number of fintech startups emerging in Vietnam, the landscape is rapidly evolving to cater to the digital age. These tech-driven solutions are not only streamlining operations within financial institutions but also revolutionizing the way services are delivered to consumers. From mobile payment platforms to blockchain technologies, the sector is embracing innovation to meet the changing needs of a tech-savvy population.

Furthermore, the integration of artificial intelligence and machine learning is enhancing decision-making processes and risk assessment within the financial sector. These advancements are not only boosting operational efficiency but also improving the overall customer experience. By leveraging technology to create user-friendly interfaces and personalized services, financial institutions in Vietnam are staying ahead of the curve in a rapidly evolving digital economy. As tech innovation continues to reshape the financial landscape, Vietnam is poised to establish itself as a regional hub for fintech advancements.

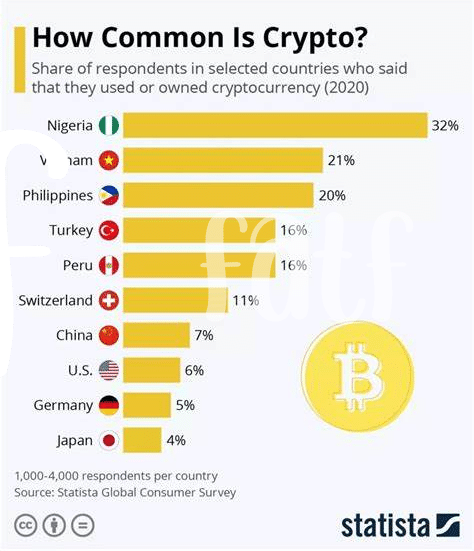

Public Reception and Adoption of Digital Currencies 💰

As digital currencies gain momentum globally, Vietnam is witnessing a growing interest and acceptance among the public. More and more Vietnamese individuals and businesses are exploring the potential benefits of using digital currencies for various transactions. This shift towards embracing digital currencies is not only driven by the convenience they offer but also by the increasing awareness of their potential impact on the traditional financial landscape. As people become more comfortable with the idea of digital currencies, we can expect to see a gradual integration of these innovative payment methods into everyday financial transactions in Vietnam. This evolving trend highlights the changing attitudes towards digital currencies in the country and sets the stage for a potentially transformative shift in how money is perceived and utilized. To learn more about government stances on the future of cryptocurrencies in other countries, such as Zambia, check out this insightful article on government stance on the future of cryptocurrencies in zambia.

Impact on Traditional Banking Practices 🏦

Traditional banking practices in Vietnam are undergoing a noticeable shift in response to the rise of digital currencies. With the increasing popularity and acceptance of digital assets, traditional banks are facing the challenge of adapting their services to meet the changing needs and preferences of customers. This shift is not only about incorporating new technologies but also about reevaluating the fundamental principles of banking to stay relevant in a rapidly evolving financial landscape. As digital currencies offer new ways of transacting and storing value, traditional banking practices are being redefined to ensure they remain competitive and convenient for consumers. Adapting to this new reality requires banks to embrace innovation, enhance their digital infrastructure, and explore collaborative opportunities with fintech companies in order to stay ahead of the curve.

Future Prospects for Digital Currency in Vietnam 🔮

Vietnam’s evolving stance on digital currency innovations holds significant promise for the country’s financial landscape. As the regulatory environment continues to adapt to the growing influence of digital currencies, new opportunities for tech innovation in the financial sector are on the horizon. The public reception and adoption of digital currencies in Vietnam are increasingly positive, indicating a shift towards embracing this new form of monetary exchange. This growing acceptance is likely to have a substantial impact on traditional banking practices, prompting a need for adaptation and evolution within the industry. Looking ahead, the future prospects for digital currency in Vietnam appear bright, with the potential to revolutionize the country’s financial sector and drive further economic growth. The path forward holds exciting possibilities for the integration of digital currencies into everyday transactions and financial systems, shaping Vietnam’s financial landscape for years to come.

Government stance on the future of cryptocurrencies in Uruguay