Understanding Uzbekistan’s National Digital Currency Initiative 🇺🇿

Uzbekistan’s foray into the realm of digital currency marks a significant shift towards modernizing its financial landscape. By embracing this digital initiative, the country is poised to revolutionize the way transactions are conducted, moving away from traditional currency systems towards a more efficient and technologically advanced future. This bold step showcases Uzbekistan’s commitment to staying ahead in the digital age, setting a precedent for other nations to follow suit in the ever-evolving financial sector.

Benefits of Adopting a National Digital Currency 💰

Adopting a national digital currency opens up a world of possibilities for Uzbekistan. With reduced transaction costs and increased financial transparency, this initiative can drive economic growth and financial stability. The convenience of digital payments can empower citizens, especially those in remote areas, to access and utilize financial services more efficiently. Additionally, by leveraging blockchain technology, the country can enhance security and trust in its financial system, paving the way for a more robust and resilient economy. This shift towards a digital currency can also attract foreign investment and position Uzbekistan as a pioneer in the global digital economy.

The adoption of a national digital currency has the potential to revolutionize the way transactions are conducted within the country. By embracing this technology, Uzbekistan can streamline payment processes, eliminate intermediaries, and promote financial inclusion for all its citizens. This forward-thinking approach not only aligns with global trends but also showcases Uzbekistan’s commitment to innovation and progress in the financial sector. With the right infrastructure and regulatory framework in place, the benefits of a national digital currency can extend beyond borders, creating new opportunities for economic development and cooperation on an international scale.

Impacts on Financial Inclusion and Access 🌐

Uzbekistan’s move towards a national digital currency promises to revolutionize financial inclusion and access within the country. By embracing this digital currency initiative, Uzbekistan aims to provide its citizens with easier and more convenient ways to engage in financial transactions, particularly for those who may have been underserved by traditional banking systems. This shift has the potential to empower individuals who previously faced barriers to accessing financial services, leading to a more inclusive economy where all members of society can participate and thrive. The integration of a national digital currency paves the way for a more equitable and efficient financial landscape, ultimately benefiting the entire population.

Potential Challenges and Risks to Consider ⚠️

Potential Challenges and Risks to Consider in Uzbekistan’s National Digital Currency initiative involve navigating regulatory uncertainties and ensuring robust cybersecurity measures to safeguard against potential cyber threats. Additionally, the adoption of a digital currency may face resistance from traditional financial institutions and require significant educational efforts to gain public trust. Addressing these challenges will be crucial to ensure the successful implementation and widespread acceptance of the national digital currency. It is essential for Uzbekistan to proactively address these risks and challenges through comprehensive strategies and risk management protocols. Additionally, staying vigilant and adaptive in an evolving technological landscape will be key to mitigating potential future obstacles. For a deeper exploration of blockchain technology innovation policies in Venezuela, check out this insightful article on blockchain technology innovation policies in Venezuela.

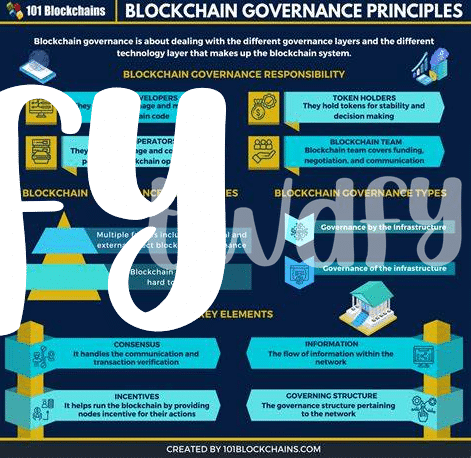

The Role of Blockchain Technology in This Initiative 🔗

Uzbekistan’s national digital currency initiative is poised to revolutionize the country’s financial landscape. Embracing blockchain technology, this move offers a secure and transparent platform for transactions, ensuring data integrity and reducing fraud risks. By utilizing blockchain, Uzbekistan aims to enhance the efficiency of its financial system, paving the way for digital innovation and economic growth.

This shift towards blockchain technology not only strengthens the security of transactions but also streamlines processes, making financial interactions more accessible and cost-effective. With its decentralized and tamper-resistant nature, blockchain plays a pivotal role in establishing trust and fostering digital financial inclusion, ultimately reshaping Uzbekistan’s economic landscape for the better.

Future Outlook: Global Implications and Opportunities 🌍

As we consider the future outlook of Uzbekistan’s national digital currency initiative, it becomes evident that the global implications and opportunities are vast. The adoption of a national digital currency could potentially pave the way for other countries to explore similar avenues, leading to a broader acceptance and integration of digital currencies in the global economy. This could create new possibilities for cross-border transactions, trade, and financial collaborations, reshaping the current financial landscape.

In this context, exploring blockchain technology innovation policies in different countries becomes crucial. For example, Uruguay and blockchain technology innovation policies in Vanuatu are noteworthy cases to study, providing insights into regulatory frameworks that support blockchain development and adoption on a national level. By understanding and harnessing these policies, countries can potentially enhance their technological infrastructures and position themselves strategically in the digital economy.