Understanding Us Legislation 🇺🇸

In the realm of United States legislation, the landscape surrounding financial transactions is intricate and ever-evolving. From traditional banking structures to the disruptive force of cryptocurrencies like Bitcoin, the regulatory framework plays a crucial role in shaping how money moves across borders. Understanding the nuances of U.S. laws and regulations concerning financial transactions is paramount for anyone engaged in cross-border transfers. It involves navigating through a complex web of policies, compliance requirements, and enforcement mechanisms that have direct implications for businesses and individuals alike. As the global economy becomes more interconnected and digital innovations continue to reshape traditional finance, staying abreast of U.S. legislation is key to operating within the boundaries of the law while leveraging the benefits of emerging technologies.

Impact on Bitcoin Transactions 💰

The increasing integration of Bitcoin into the global financial landscape has prompted regulatory scrutiny in the United States. The regulatory framework surrounding Bitcoin transactions has a multifaceted impact, influencing the ease, security, and cost of cross-border money transfers. As government agencies strive to strike a balance between fostering innovation and safeguarding against illicit activities, the compliance landscape for Bitcoin transactions continues to evolve. This evolving regulatory environment not only shapes the operations of cryptocurrency exchanges and service providers but also impacts individual users engaging in cross-border transactions. The intersection of U.S. legislation and Bitcoin transactions underscores the importance of staying abreast of regulatory developments to navigate the complex landscape effectively. By understanding and adapting to the regulatory framework, stakeholders in the cryptocurrency ecosystem can contribute to the maturation and legitimacy of Bitcoin as a viable method for cross-border money transfers.

Compliance Challenges for Cross-border Transfers 🌎

Navigating the complex landscape of cross-border transfers presents a multitude of compliance challenges. Ensuring adherence to varying regulatory requirements across different jurisdictions requires meticulous attention to detail and a deep understanding of the evolving legal frameworks. From anti-money laundering measures to data privacy regulations, businesses engaging in cross-border transactions face a myriad of obstacles that can impact the efficiency and cost-effectiveness of their operations. Harmonizing compliance efforts with the innovative nature of Bitcoin transactions poses a unique set of challenges, necessitating continuous monitoring and adaptation to regulatory changes. Finding the delicate balance between regulatory compliance and seamless cross-border transfers remains a key focus for businesses and regulatory bodies alike as they strive to facilitate secure and efficient global financial transactions.

Innovations in Financial Technology 🚀

Innovations in financial technology have revolutionized the way we conduct cross-border money transfers, offering increased speed, efficiency, and security. With the integration of blockchain technology, platforms like Bitcoin have emerged as viable alternatives to traditional banking systems for international transactions. This shift has paved the way for greater financial inclusion and accessibility, particularly for individuals in underserved regions. As these technologies continue to evolve, the potential for cross-border payments to become seamless and cost-effective grows exponentially. The rapid progression of fintech solutions also presents regulatory challenges, as lawmakers strive to keep pace with innovation while ensuring consumer protection and compliance. To stay informed on the latest developments in financial technology and cross-border money transfers, explore the benefits and challenges of using Bitcoin for such transactions in various global contexts, such as examining Bitcoin cross-border money transfer laws in Tuvalu.

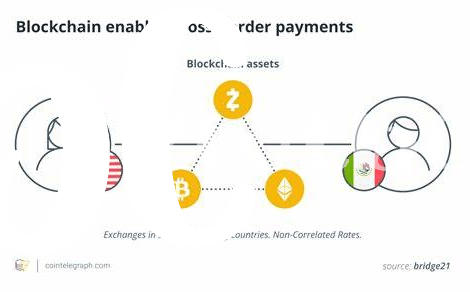

Global Perspectives on Regulation 🌍

From various parts of the world, regulators are closely monitoring the evolving landscape of cross-border payments and the role of cryptocurrencies such as Bitcoin. Different countries approach regulation differently, with some embracing the technology while others exercise caution. The diverse global perspectives on regulation create a complex environment for cross-border transactions, impacting how individuals, businesses, and financial institutions navigate the changing regulatory landscape. As international collaboration becomes increasingly important in addressing regulatory challenges, the need for cohesive frameworks that promote innovation while ensuring security and compliance has never been more crucial. By examining and learning from the regulatory approaches taken by different countries, stakeholders can work towards establishing a balanced and effective global regulatory framework for cross-border money transfers in the digital age.

Looking Ahead: Future of Cross-border Payments 🕰️

As we peer into the horizon of cross-border payments, it’s evident that innovation and collaboration will be key in shaping the future landscape. With emerging technologies like blockchain and digital assets gaining traction, there is a promising opportunity to streamline international money transfers and redefine the traditional financial system. As countries continue to navigate the complexities of regulatory frameworks, striking a balance between fostering innovation and ensuring compliance will be crucial for sustainable growth in the global payments sector. Keeping an eye on evolving trends and adapting to the changing regulatory environment will be fundamental for stakeholders looking to stay ahead in the dynamic realm of cross-border transactions.

Bitcoin Cross-border Money Transfer Laws in United Arab Emirates anchor Bitcoin Cross-border Money Transfer Laws in Uganda.