Understanding Turkmenistan’s Current Financial Landscape 🌍

Turkmenistan’s financial landscape is a tapestry woven with traditional banking systems and evolving digital frameworks. Amidst this backdrop, a growing interest in fintech solutions like mobile payments is reshaping how transactions are conducted. The country’s economy, heavily reliant on natural gas exports, is slowly integrating modern financial technologies to streamline processes and enhance efficiency. While traditional banking prevails in many sectors, the emergence of digital platforms signals a shift towards a more interconnected global economy.

The intersection of traditional values and technological advancements offers a unique perspective on Turkmenistan’s financial landscape. As the country embraces digital transformation, opportunities arise for inclusive financial services and enhanced accessibility. Understanding the nuances of this evolving terrain is key to unlocking the potential for financial growth and prosperity in Turkmenistan.

Exploring the Impact of Bitcoin on Cross-border Transactions 💸

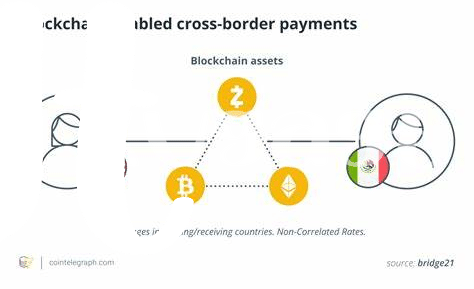

Bitcoin has revolutionized how money moves across borders, transcending traditional banking limitations. Its decentralized nature cuts out intermediaries, enabling direct peer-to-peer transactions without the need for costly conversions or delays. This seamless process streamlines cross-border transactions, making them faster, more accessible, and significantly more cost-effective. As a result, individuals and businesses can now navigate the global financial landscape with newfound ease, opening up a world of possibilities for international trade and commerce. The impact of Bitcoin on cross-border transactions extends far beyond mere practicality; it represents a fundamental shift in how we perceive and engage with financial systems on a global scale.

The transformative power of Bitcoin in cross-border transactions is evident in its ability to transcend geographical boundaries and expedite financial interactions with unprecedented efficiency. By leveraging blockchain technology, Bitcoin facilitates secure and transparent transactions, fostering trust and eliminating the need for lengthy verification processes. As more individuals and businesses embrace this digital currency for international transactions, the financial landscape is evolving, paving the way for a future where borders are no longer barriers to economic growth and innovation. Bitcoin’s impact on cross-border transactions underscores its role as a catalyst for a more connected and financially inclusive world.

Legal Framework Surrounding Cryptocurrency Usage in Turkmenistan ⚖️

Turkmenistan has taken steps towards regulating cryptocurrency within its borders, signaling a growing recognition of this digital asset. The legal framework surrounding cryptocurrency usage in Turkmenistan aims to provide clarity and structure in an evolving financial landscape. While specific regulations may still be developing, the government’s acknowledgment of the importance of cryptocurrency highlights a potential shift towards integrating digital currencies into the country’s economic ecosystem.

Moreover, the legal framework surrounding cryptocurrency usage in Turkmenistan reflects the need to address key issues such as consumer protection, financial stability, and anti-money laundering measures. By establishing guidelines and protocols for cryptocurrency transactions, policymakers aim to balance innovation with risk management in this dynamic sector. As Turkmenistan navigates the complexities of regulating cryptocurrency, stakeholders will play a crucial role in shaping a framework that supports responsible and secure usage of digital assets.

Challenges and Opportunities for Bitcoin Adoption in the Region 📈

Turkmenistan presents a unique landscape for Bitcoin adoption, with both challenges and opportunities shaping its potential impact in the region. The lack of clear regulatory frameworks and awareness among the population pose significant hurdles to widespread cryptocurrency usage. However, the growing interest in digital assets and the potential for financial inclusion present promising opportunities for Bitcoin to establish itself as a viable alternative payment method. Despite the existing challenges, the evolving nature of Turkmenistan’s financial ecosystem provides a fertile ground for innovative solutions to pave the way for greater Bitcoin adoption.

For a deeper dive into the challenges and opportunities of using Bitcoin for international transfers, especially in regions like Timor-Leste, check out this insightful article on bitcoin cross-border money transfer laws in Tanzania to gain valuable insights and comparisons.

Regulatory Compliance and Risks Associated with Cryptocurrency 🚫

Navigating the regulatory landscape of cryptocurrency in Turkmenistan poses both challenges and opportunities for users and businesses. Ensuring compliance with evolving laws and regulations is crucial to mitigating risks associated with engaging in digital assets. The lack of clear guidelines and oversight from regulatory bodies can create uncertainty and potential pitfalls for individuals and organizations operating in this burgeoning sector. Educating oneself on the legal framework and staying abreast of developments can help navigate the complexities of regulatory compliance and minimize exposure to potential risks that come with cryptocurrency transactions.

Embracing best practices for regulatory compliance is essential for fostering a safe and transparent environment for cryptocurrency activities in Turkmenistan. By understanding the regulatory requirements and associated risks, stakeholders can make informed decisions that contribute to the sustainable growth of the crypto economy in the region. Despite the challenges, proactive engagement with regulators and industry peers can lead to the establishment of guidelines that promote responsible usage and adoption of cryptocurrencies, paving the way for a more secure and resilient financial frontier in Turkmenistan.

Future Outlook: Navigating Turkmenistan’s Growing Crypto Economy 🚀

Turkmenistan’s emerging crypto economy holds promise for a future of financial innovation and inclusivity. As the landscape continues to evolve, businesses and individuals alike are navigating the opportunities and challenges presented by the growing adoption of cryptocurrencies. With a focus on regulatory compliance and risk management, stakeholders are looking towards sustainable practices that will facilitate the integration of Bitcoin into cross-border transactions. The legal framework surrounding cryptocurrency usage in Turkmenistan is shaping how businesses operate within the digital asset space. By staying informed and adaptable to regulatory changes, the region can harness the potential of cryptocurrencies for economic growth and financial stability. Embracing this shift towards a digital economy requires collaboration and forward-thinking strategies to unlock the full potential of Turkmenistan’s financial frontier. Bitcoin cross-border money transfer laws in Timor-Leste provide insight into the regulatory considerations for cross-border transactions involving cryptocurrencies.