Current State of Bitcoin Banking in Oman 🌍

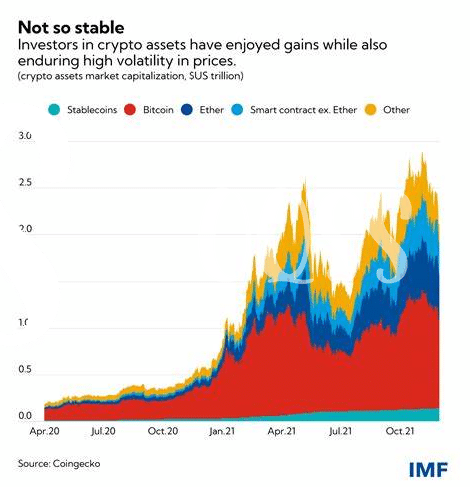

In Oman, the rapidly evolving landscape of Bitcoin banking is attracting keen interest from both users and regulators. The increasing popularity of cryptocurrencies has sparked conversations about their integration into the traditional banking sector. As Oman navigates this dynamic space, stakeholders are closely monitoring developments to understand the implications and opportunities arising from this digital financial revolution.

Impact of Regulatory Changes on Cryptocurrency 📈

The evolution of regulatory frameworks in Oman has catalyzed a profound impact on the cryptocurrency landscape. With each regulatory change, the value and adoption of cryptocurrencies experience significant fluctuations. These changes not only influence market dynamics but also shape the behavior of investors and users within the cryptocurrency ecosystem. As regulations continue to evolve, the future of cryptocurrencies in Oman remains an exciting realm to explore and understand.

Challenges and Opportunities for Bitcoin Users 💼

Bitcoin users in Oman face a unique set of challenges and opportunities as they navigate the evolving landscape of digital currencies. One of the primary challenges is the fluctuating regulatory environment, which can impact the accessibility and acceptance of Bitcoin in the country. On the flip side, there are opportunities for users to leverage Bitcoin as a tool for financial inclusion and independence, especially in a region where traditional banking services may be limited. Educating users on best practices for secure transactions and investment strategies can help mitigate risks and maximize the potential benefits of using Bitcoin in Oman.

Government Initiatives to Monitor Digital Currencies 🏛️

In aiming to oversee the realm of digital currencies, governmental strategies in Oman are evolving to include robust monitoring initiatives. These efforts are designed to enhance transparency, mitigate associated risks, and ensure compliance with regulatory frameworks. By closely monitoring digital currencies, authorities seek to bolster the security and integrity of financial transactions in the burgeoning landscape of Bitcoin banking. Through proactive measures and vigilant oversight, the government envisions fostering a conducive environment for the responsible growth of cryptocurrency activities within the country. To delve deeper into the global landscape of Bitcoin banking regulations, explore the evolution of bitcoin banking services regulations in North Korea.

Ensuring Security and Compliance in Bitcoin Transactions 🔒

Bitcoin transactions require a careful balance of security measures and regulatory compliance to ensure the protection of users’ funds while adhering to the laws. By implementing robust encryption protocols and KYC (Know Your Customer) procedures, the safety of transactions can be enhanced. Compliance with existing financial regulations is essential to prevent illicit activities and maintain trust in the cryptocurrency ecosystem. Regular audits and monitoring are crucial to uphold the integrity of Bitcoin transactions within Oman’s banking sector.

Future Outlook for Bitcoin Banking in Oman 🚀

In the dynamic landscape of digital currencies, the future outlook for Bitcoin banking in Oman is one filled with anticipation and growth. As regulatory frameworks evolve and adapt to this innovative financial ecosystem, there is a sense of cautious optimism among stakeholders. Collaborative efforts between industry players and regulatory bodies are key in shaping a conducive environment for Bitcoin users and investors. Embracing technological advancements while ensuring compliance will be pivotal in fostering a robust Bitcoin banking sector in Oman.

For more information on Bitcoin banking services regulations in Norway, please visit here.