Historical 🕰️ Background of Bitcoin in Uruguay

Uruguay has seen a gradual emergence of Bitcoin within its borders, reflecting the global trend towards digital currencies. The concept of decentralized digital currency first gained traction among tech-savvy Uruguayans looking for alternative payment methods. Despite initial skepticism from traditional financial institutions, Bitcoin steadily grew in popularity due to its potential for faster and cheaper transactions. As more merchants and individuals began accepting Bitcoin, its presence in the Uruguayan economy became more pronounced. This shift towards digital currency sparked discussions among policymakers about the need for regulations to ensure the proper use of Bitcoin within the country. The historical journey of Bitcoin in Uruguay showcases a mix of grassroots adoption and regulatory considerations, setting the stage for the evolving landscape of digital currencies in the region.

Current 💼 Bitcoin Money Transfer Regulations

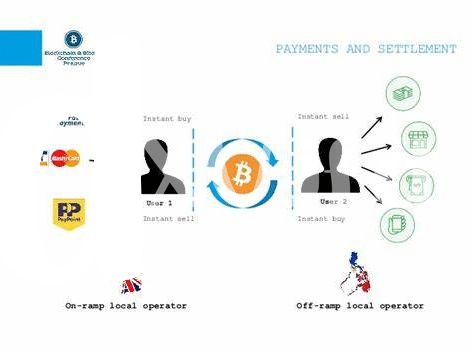

Uruguay has established clear regulations surrounding Bitcoin money transfers, offering a structured framework for individuals and businesses engaging in such transactions. The guidelines provide transparency and security, ensuring that these transfers are conducted in a compliant manner. By outlining the specific requirements and procedures for Bitcoin money transfers, Uruguay aims to foster a safe and regulated environment for digital currency transactions within the country.

These regulations serve to protect both the financial institutions and users involved in Bitcoin money transfers, reducing the risk of fraud and illicit activities. By imposing guidelines and oversight, Uruguay safeguards the integrity of its financial system while promoting innovation and growth in the cryptocurrency sector. Understanding and adhering to these regulations is essential for businesses operating in the Bitcoin space, as compliance is key to maintaining trust and credibility in the market.

Impact 💥 on Financial Institutions and Users

Bitcoin’s impact on financial institutions and users in Uruguay is significant, sparking a wave of changes and opportunities in the local financial landscape. For financial institutions, the adoption of Bitcoin has meant exploring new ways to facilitate cross-border transactions, improve efficiency, and reduce costs associated with traditional payment methods. Users, on the other hand, have embraced the decentralized nature of Bitcoin, finding freedom in managing their finances outside the constraints of traditional banking systems. This shift has brought about a sense of empowerment and financial inclusion, particularly for individuals who may have been underserved by traditional financial institutions. As Bitcoin continues to gain traction in Uruguay, both financial institutions and users are adapting to the evolving regulatory framework, shaping the future of money transfers in the country.

Comparison 📊 with Global Bitcoin Regulations

When considering Bitcoin money transfer regulations, it’s crucial to examine how Uruguay compares to global standards. This comparative analysis sheds light on the varying approaches taken by different countries, highlighting the diverse regulatory landscape within the cryptocurrency space. Understanding the differences and similarities with global Bitcoin regulations can offer valuable insights for policymakers, businesses, and users navigating this evolving ecosystem.

For further insights into the legal frameworks governing Bitcoin cross-border transfers, particularly in the United States, you can explore the detailed analysis provided by WikiCrypto News on Bitcoin cross-border money transfer laws in the United States. This resource offers a comprehensive overview of the regulatory environment in the U.S. and how it relates to international standards in the realm of digital asset transfers.

Compliance ✔️ Challenges for Businesses

Navigating the regulatory landscape in Uruguay poses significant challenges for businesses looking to comply with Bitcoin money transfer regulations. From understanding the complex requirements to implementing robust compliance measures, companies must stay updated on the evolving regulatory framework. One of the key challenges faced by businesses is the need to strike a balance between innovation and adherence to regulatory standards. Ensuring KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures are appropriately implemented adds another layer of complexity. Moreover, businesses operating in Uruguay may encounter difficulties in aligning their operations with the requirements set forth by the government, leading to potential compliance pitfalls. Addressing these challenges requires a strategic approach that encompasses a thorough understanding of local regulations and proactive risk management practices. By overcoming these compliance hurdles, businesses can establish a strong foothold in the Uruguayan market while demonstrating their commitment to regulatory compliance.

Future 🔮 Outlook for Bitcoin in Uruguay

Uruguay’s embrace of Bitcoin signals a promising future for digital currency in the country. With an increasing interest in blockchain technology and a growing awareness of the benefits of decentralized finance, Uruguay is poised to become a hub for Bitcoin innovation. The government’s proactive approach to regulating Bitcoin money transfers demonstrates a commitment to fostering a supportive environment for financial innovation. As more businesses and users adopt Bitcoin for cross-border transactions, the ecosystem is expected to thrive, offering new opportunities for economic growth and financial inclusion. By staying abreast of global trends and best practices, Uruguay can position itself as a leader in the evolving landscape of digital currencies. The future 🔮 outlook for Bitcoin in Uruguay is bright, with the potential to revolutionize the traditional financial sector and empower individuals to take control of their financial futures.

Insert link to bitcoin cross-border money transfer laws in Tuvalu with anchor “Bitcoin Cross-Border Money Transfer Laws in United Arab Emirates”: Bitcoin Cross-Border Money Transfer Laws in United Arab Emirates.