Regulatory Oversight 🔍

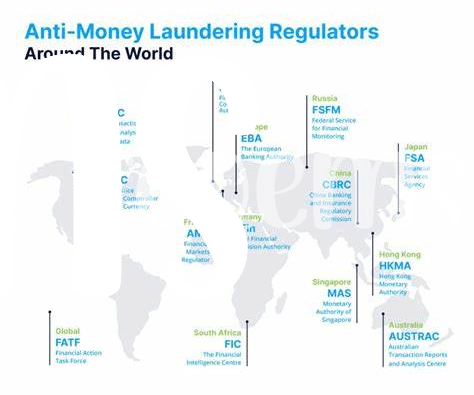

Regulatory oversight in the realm of Bitcoin plays a crucial role in maintaining transparency and security within the digital currency landscape. By closely monitoring and setting guidelines for the use of Bitcoin, regulatory authorities aim to prevent illicit activities such as money laundering and ensure compliance with legal standards. Their vigilant oversight helps to build trust among users, investors, and the wider community, fostering a safer environment for the adoption and utilization of digital currencies. As the digital economy continues to evolve, the role of regulatory authorities in overseeing Bitcoin transactions will remain pivotal in upholding integrity and protecting against financial crimes.

Role of Authorities 🛡️

Regulatory oversight ensures that authorities play a crucial role in shaping the landscape of Bitcoin AML policies. They act as guardians to protect the integrity of the financial system by implementing regulations that aim to prevent illicit activities within the cryptocurrency space. These authorities set the standards and guidelines, enforce compliance measures, and collaborate with stakeholders to enhance transparency and accountability. Their diligence in monitoring and regulating the ecosystem is paramount in fostering trust and legitimacy in the digital asset realm. By understanding and acknowledging the role of authorities, stakeholders can work together towards a safer and more secure environment for Bitcoin transactions.

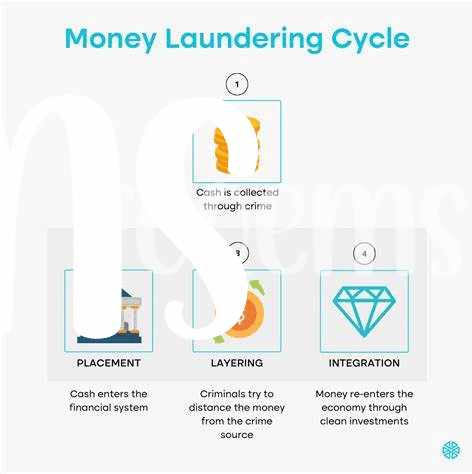

Safeguarding Against Money Laundering 💰

A crucial aspect of regulatory oversight in the realm of cryptocurrencies, particularly Bitcoin, involves implementing robust measures to safeguard against money laundering activities. By establishing stringent guidelines and protocols, regulatory authorities aim to prevent illicit financial transactions and maintain the integrity of the digital currency ecosystem. These efforts not only enhance transparency within the market but also instill trust among users and investors. Through continuous monitoring and enforcement actions, regulatory bodies play a pivotal role in mitigating the risks associated with money laundering, ultimately contributing to the long-term stability and credibility of Bitcoin as a legitimate form of digital asset.

Compliance Measures and Reporting 📝

In navigating the regulatory landscape, businesses must implement robust compliance measures to detect and prevent illicit activities within the Bitcoin ecosystem. Reporting plays a crucial role in this process, as it facilitates transparency and accountability. By adhering to stringent reporting requirements, companies not only fulfill their regulatory obligations but also contribute to the overall integrity of the cryptocurrency market.

Embracing compliance measures and proactive reporting is essential in fostering a secure environment for all participants involved in Bitcoin transactions. It signals a commitment to combating financial crimes and upholding the principles of integrity and transparency within the digital asset space. To delve deeper into the evolution of AML regulations in different jurisdictions, including Japan, explore the insights shared on the importance of bitcoin anti-money laundering (AML) regulations in a recent article by WikiCrypto News.

Impact on Bitcoin Ecosystem 🌐

The integration of regulatory oversight into the Bitcoin ecosystem has brought about both challenges and opportunities for participants. As authorities establish guidelines and requirements, the landscape of bitcoin transactions is evolving to prioritize transparency and compliance. This shift towards a more regulated environment is reshaping how businesses and individuals engage with Bitcoin, influencing everything from investment strategies to operational practices. While some may view this increased scrutiny as a barrier, others see it as a step towards legitimizing and stabilizing the cryptocurrency market. The impact of regulatory authorities on the Bitcoin ecosystem is not just about enforcement but also about setting standards that could potentially foster greater trust and participation in the digital currency realm.

Future Trends and Challenges ⏳

As the bitcoin landscape continues to evolve, future trends and challenges in AML oversight are becoming more apparent. Technological advancements, such as privacy-focused features, present new hurdles for regulatory authorities to navigate. Moreover, the global nature of Bitcoin transactions complicates oversight efforts, requiring cooperation between different jurisdictions. As regulators strive to keep pace with innovation, balancing security and innovation will be key. Ensuring effective AML practices without stifling growth will be a delicate equilibrium to maintain. Additionally, the emergence of new financial products and services within the Bitcoin ecosystem will pose challenges in terms of classification and oversight. Adapting regulations to address these complexities will be crucial for the sustainable development of the industry.

Bitcoin Anti-Money Laundering (AML) Regulations in Kenya