Overview 🌍

Bitcoin’s rise has captured global attention, with enthusiasts keen on understanding its legal foundations. Navigating the legal landscape of Bitcoin AML rules in Greece sheds light on the evolving regulatory environment. Delving into the complexities and nuances allows for a clearer comprehension of the existing framework. As Greece charts its course in regulating Bitcoin transactions, the broader implications on the global crypto ecosystem cannot be overlooked. This overview serves as a compass, guiding readers through the intricate world of Bitcoin AML regulations.

Greek Aml Regulations 🇬🇷

In Greece, regulations surrounding Anti-Money Laundering (AML) play a crucial role in shaping the environment for Bitcoin transactions. Understanding the Greek AML framework is essential for businesses operating in the cryptocurrency market. Compliance with these regulations is vital to ensure transparency and legitimacy in financial transactions. By adhering to the prescribed guidelines, businesses can navigate the legal landscape effectively and contribute to the overall integrity of the financial system.

Impact on Bitcoin Transactions 💸

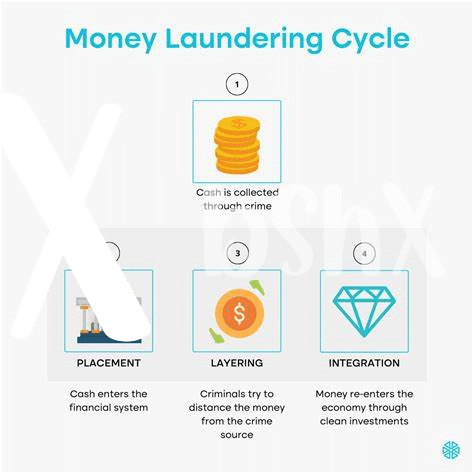

Bitcoin transactions in Greece have seen a notable impact due to the evolving regulatory landscape. With AML rules in place, the way individuals and businesses engage in Bitcoin transactions has shifted. Compliance requirements and enhanced due diligence procedures have influenced the speed and ease of conducting such transactions. The need for transparency and accountability in financial dealings has led to a more structured approach towards Bitcoin transactions within the Greek market. This shift signals a new era of regulatory oversight in the cryptocurrency space.

Compliance Challenges and Solutions 🛠️

Bitcoin transactions in Greece are subject to stringent AML regulations, presenting challenges for compliance. These include verifying the identity of parties involved, monitoring transactions for suspicious activity, and ensuring adherence to reporting requirements. Solutions to these challenges lie in implementing robust KYC procedures, enhancing transaction monitoring capabilities, and fostering cooperation between regulators and industry players. By proactively addressing these compliance hurdles, stakeholders in the Bitcoin ecosystem can mitigate risks and foster a more secure environment for digital asset transactions.

For further insights on AML regulations impacting Bitcoin adoption globally, particularly in Georgia, check out this detailed analysis on bitcoin anti-money laundering (AML) regulations in Georgia. The article sheds light on the legal implications and regulatory landscape surrounding Bitcoin transactions in the region.

Global Perspectives and Best Practices 🌐

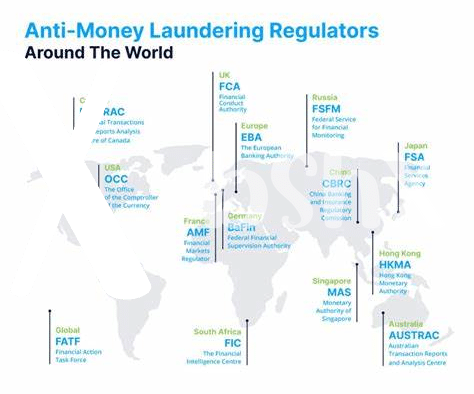

In the realm of Bitcoin and AML compliance, global perspectives and best practices offer valuable insights for stakeholders. Understanding how various countries approach regulatory frameworks and enforcement can inform effective strategies. Best practices often include robust KYC procedures, transaction monitoring, and reporting mechanisms. Collaboration between governments, industry players, and regulatory bodies is key to ensuring a cohesive and effective approach to combating illicit activities in the digital asset space. By sharing knowledge and experiences, countries can work towards harmonizing AML efforts on a global scale.

Future of Bitcoin Aml in Greece 🔮

The future of Bitcoin Anti-Money Laundering in Greece holds a mix of uncertainty and opportunity. As the landscape continues to evolve, key stakeholders must collaborate to address emerging challenges while leveraging innovative solutions to ensure compliance. Regulatory frameworks will likely undergo revisions to adapt to the dynamic nature of cryptocurrency transactions, aiming to strike a balance between security and fostering innovation within the industry. Embracing technological advancements and international cooperation will be pivotal in shaping a robust AML framework that enhances transparency and trust in the emerging digital economy.

In navigating the intricacies of Bitcoin AML regulations, Greece can draw valuable insights from global best practices and emerging trends. Collaborating with international counterparts, policymakers in Greece can stay ahead of developments and proactively address the evolving landscape of financial crimes in the digital age. By fostering a culture of compliance and innovation, Greece can position itself as a progressive jurisdiction in the realm of Bitcoin AML, paving the way for sustainable growth and global recognition in the digital asset sector.