Legal Requirements 📜

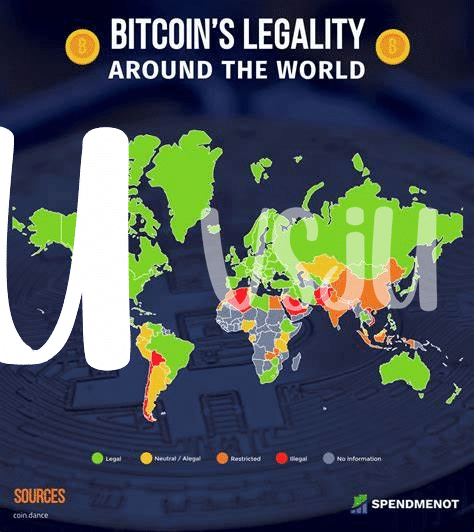

Navigating the legal landscape for Bitcoin investment funds in San Marino requires a keen understanding of regulatory frameworks and compliance standards. From registration requirements to disclosure obligations, these legal stipulations play a crucial role in shaping the operational structure of investment funds in the digital asset space. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is paramount to ensure transparency and accountability within the fund’s activities. Seeking legal counsel and staying abreast of regulatory updates are essential practices for maintaining a robust and legally compliant investment fund.

Tax Implications 💰

Tax implications in San Marino for Bitcoin investment funds play a crucial role in shaping the overall profitability of such ventures. Understanding the tax landscape is essential for investors to make informed decisions and optimize their returns. Knowing how different tax laws and regulations apply to cryptocurrency investments can aid in strategic financial planning and compliance. By navigating the tax implications effectively, investors can enhance their investment strategies and mitigate potential risks, contributing to the long-term success of their funds.

Compliance Regulations 📊

Navigating the legal landscape of Bitcoin investment funds in San Marino involves adhering to a complex web of regulations and guidelines. Compliance is key to ensuring transparency, accountability, and trust among investors and regulatory bodies. Stakeholders must stay abreast of evolving laws and directives to mitigate risks and ensure a secure investment environment. By prioritizing compliance regulations, investment funds can build a solid foundation for long-term success and sustainability in the dynamic cryptocurrency market.

Investment Strategies 💡

Investment in Bitcoin funds often involves careful consideration of market trends, asset allocation, and diversification strategies. Diversifying across various cryptocurrencies and traditional assets can help spread risk and optimize returns. Additionally, staying informed about regulatory changes and market developments is crucial for making informed investment decisions. To learn more about the impact of regulatory changes on Bitcoin investment funds in different regions, including San Marino, check out this insightful article on the bitcoin investment funds regulation in Samoa.

Risk Management ⚖️

Effective risk management is crucial for Bitcoin investment funds in San Marino. This involves carefully assessing potential risks, implementing strategies to mitigate them, and constantly monitoring the market to adapt to changing conditions. By diversifying investments, setting clear risk tolerance levels, and staying informed about regulatory developments, funds can better protect their assets and navigate uncertainties. Additionally, establishing contingency plans and maintaining transparent communication with stakeholders can help minimize the impact of unforeseen events and safeguard the long-term sustainability of the fund.

Future Outlook 🔮

As the cryptocurrency landscape continues to evolve, the future outlook for Bitcoin investment funds in San Marino appears promising. With advancements in technology and increasing interest from investors, the potential for growth and innovation within this sector is substantial. As regulatory frameworks become more established and market trends shift, staying informed and adaptable will be crucial for navigating the changing landscape of Bitcoin investment funds in San Marino.

Bitcoin investment funds regulation in Russia is essential for investors to understand, as it can significantly impact investment strategies and compliance requirements. By keeping abreast of regulatory developments and market trends, investors can position themselves strategically for the future.