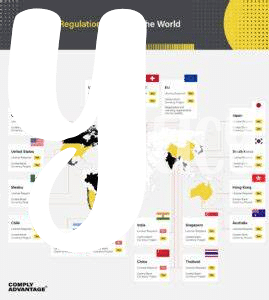

Overview of Bitcoin Banking Regulations in Mauritania 🌍

Bitcoin banking regulations in Mauritania provide a structured framework for the operation of digital currency transactions within the country. These regulations aim to ensure transparency, security, and accountability in the emerging Bitcoin banking sector. By establishing clear guidelines and oversight mechanisms, Mauritania seeks to foster a conducive environment for the growth of digital financial services while safeguarding the interests of both consumers and service providers.

Key Players in the Bitcoin Banking Sector 🏦

In the realm of Bitcoin banking in Mauritania, the landscape is shaped by a diverse array of entities driving innovation and growth within the sector. These key players, ranging from established financial institutions to emerging fintech startups, play a pivotal role in shaping the future of digital currency services in the country. By leveraging their expertise and resources, these entities are not only enhancing the accessibility of Bitcoin banking but also fostering a dynamic ecosystem that caters to the evolving needs of users and investors alike.

Impact of Legal Framework on Customer Experience 💼

The legal framework surrounding Bitcoin banking in Mauritania plays a crucial role in shaping the overall customer experience within the sector. From ensuring transparent practices to safeguarding customer assets, the regulations set forth by authorities significantly impact how individuals interact with Bitcoin banking services. As customers navigate through the landscape of digital transactions, the adherence to legal requirements not only provides a sense of security but also influences their trust and satisfaction levels with Bitcoin banks. This intertwining of regulations and customer experience underscores the importance of a well-defined legal framework in fostering a positive and reliable environment for users.

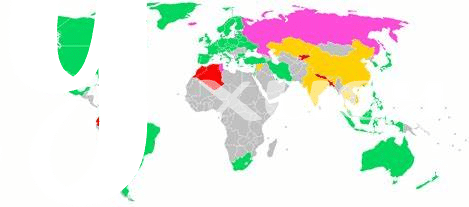

Challenges and Opportunities for Bitcoin Banks 🚀

Challenges for Bitcoin banks in Mauritania involve navigating evolving regulations and ensuring compliance, which can be complex due to the rapidly changing landscape of cryptocurrency laws. On the flip side, the growing acceptance of Bitcoin presents a unique opportunity for banks to expand their customer base by offering innovative financial services tailored to cryptocurrency users.

In this exciting era, Bitcoin banks in Mauritania must strike a balance between embracing opportunities for growth and addressing challenges to stay competitive in the ever-evolving digital financial ecosystem. For further insights on navigating legal frameworks in the cryptocurrency space, explore this informative article on bitcoin banking services regulations in Maldives.

Compliance Requirements and Security Measures 🔒

Bitcoin banks in Mauritania must adhere to stringent compliance requirements and implement robust security measures to safeguard customer assets and ensure regulatory adherence. These measures encompass thorough KYC procedures, transaction monitoring, and reporting to relevant authorities to combat money laundering and illicit activities. Additionally, implementing encryption protocols, multi-factor authentication, and regular security audits are vital to fortify the platform against cyber threats and data breaches. Striking a balance between compliance and security is crucial for fostering trust among customers and fostering a safe environment for conducting Bitcoin transactions.

Future Outlook for Bitcoin Banking in Mauritania 🔮

In a rapidly evolving financial landscape, the future outlook for Bitcoin banking in Mauritania reveals promising opportunities for growth and innovation. As the regulatory framework continues to unfold, Bitcoin banks are expected to adapt and thrive in this dynamic environment, catering to a tech-savvy customer base seeking alternative financial solutions. Led by key players driving digital transformation, the sector is poised for expansion, fostering a new era of financial inclusion and accessibility.

For further insights on Bitcoin banking services regulations in Mauritania, explore the detailed guidelines provided by the authorities in charge of overseeing these pivotal developments bitcoin banking services regulations in malta.