Tax Implications of Cryptocurrency Investments 💰

Cryptocurrency investments can have significant tax implications that investors need to be aware of to ensure compliance with Malawi’s regulations. Understanding how the tax system treats cryptocurrency transactions is crucial for accurately reporting gains and losses. Investors should be mindful of the potential tax pitfalls associated with this dynamic asset class and consider seeking professional advice to navigate the complexities of tax compliance effectively. By staying informed about the regulations and laws in Malawi related to cryptocurrency investments, investors can make informed decisions that align with their financial goals while ensuring they meet their tax obligations.

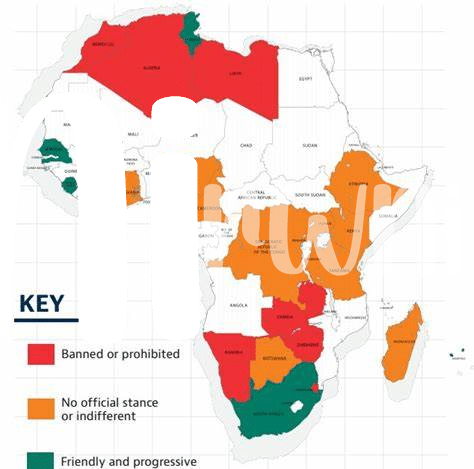

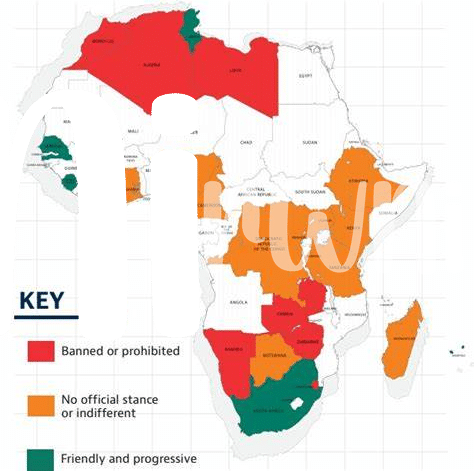

Regulations and Laws in Malawi 📜

Malawi has been actively exploring the landscape of cryptocurrency regulations and laws to provide a structured framework for investors. With a focus on ensuring transparency and security in the cryptocurrency market, Malawi is taking steps to address potential risks and protect investors. These regulations aim to create a conducive environment for cryptocurrency activities while mitigating any associated risks. By establishing clear guidelines and rules, Malawi aims to foster responsible participation in the cryptocurrency ecosystem.

As Malawi continues to evolve its regulatory landscape, the focus remains on striking a balance between innovation and investor protection. By staying abreast of the evolving laws and regulations, cryptocurrency enthusiasts and investors can navigate the Malawian market with confidence. With a commitment to ensuring compliance and transparency, the regulatory framework in Malawi reflects a proactive approach towards embracing the potential of cryptocurrencies in the financial sector.

Reporting Requirements for Cryptocurrency Transactions 📊

Cryptocurrency transactions require careful attention to reporting requirements to ensure compliance with tax regulations. Transparency in recording these transactions is essential, as it enables accurate tracking of gains and losses. Keeping detailed records of each transaction helps in calculating the correct tax liability and provides a clear audit trail for tax authorities. Failure to report cryptocurrency transactions correctly could result in penalties or legal consequences. It is crucial for investors in Malawi to stay informed about the specific reporting requirements related to cryptocurrency dealings to avoid any potential issues with tax authorities. Understanding and adhering to these reporting obligations is key to maintaining good standing and ensuring smooth operations within the cryptocurrency investment landscape. Consulting with tax professionals can provide further guidance on fulfilling these reporting requirements effectively.

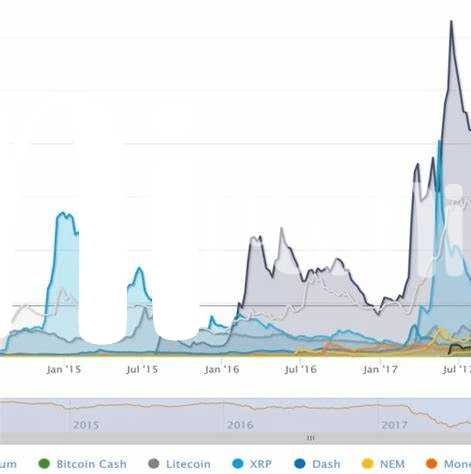

Tax Treatment of Gains and Losses 📈📉

Cryptocurrency investments in Malawi have unique tax implications when it comes to gains and losses. Understanding how these are treated is crucial for investors to navigate the tax landscape effectively. When you make a profit from selling cryptocurrency, it is typically considered a taxable capital gain, subject to capital gains tax. On the other hand, if you incur losses from selling cryptocurrency, these losses can sometimes be used to offset other gains, reducing your overall tax liability. It’s important to keep detailed records of your transactions to accurately report your gains and losses when filing your taxes. Consulting with a tax professional can help ensure compliance with regulations and optimize your tax treatment. By staying informed and proactive, cryptocurrency investors can manage their tax obligations effectively while maximizing their investment potential. For further insights into regulatory considerations for cryptocurrency users, explore the government stance on the future of cryptocurrencies in Marshall Islands.

Potential Tax Pitfalls to Watch Out for ⚠️

Cryptocurrency investments can present potential tax pitfalls for individuals in Malawi. Lack of clear guidance from regulatory bodies, the evolving nature of cryptocurrencies, and the complex tax treatment of digital assets can create confusion and uncertainty for investors. Additionally, the lack of specific laws addressing cryptocurrency transactions in Malawi can lead to misunderstandings regarding tax obligations. It is crucial for investors to stay informed about the latest developments in tax laws related to cryptocurrencies and to seek professional advice to navigate potential pitfalls effectively. Failing to accurately report cryptocurrency transactions or misinterpreting tax implications can result in penalties or legal consequences. Therefore, investors should exercise caution and diligence when engaging in cryptocurrency investments to ensure compliance with tax requirements and minimize risks.

Seeking Professional Advice for Tax Compliance 🤝

When navigating the complex landscape of tax implications associated with cryptocurrency investments, seeking professional advice for tax compliance is paramount. Tax laws and regulations surrounding cryptocurrencies can be intricate and subject to frequent changes, making it crucial to consult with a tax professional to ensure compliance and optimize your financial strategies. Experienced tax advisors can provide tailored guidance based on your specific circumstances, helping you navigate reporting requirements, understand the tax treatment of gains and losses, and avoid potential pitfalls that may arise. By collaborating with a knowledgeable tax professional, you can proactively address any uncertainties or challenges related to cryptocurrency taxation, ultimately safeguarding your financial well-being and ensuring adherence to legal obligations. To stay informed with the evolving regulatory landscape and make well-informed decisions regarding your cryptocurrency investments, consulting with a tax expert is a wise and proactive step in achieving tax compliance and financial sustainability.

government stance on the future of cryptocurrencies in liberia