Overview 🌍

Bitcoin has gained popularity in financial circles globally, prompting concerns about its implications for money laundering regulations. Understanding these laws is crucial for individuals and businesses navigating the intricate landscape of digital currency in Cameroon. By delving into the intersection of money laundering and Bitcoin, one can grasp the complexities of this evolving issue and its impact on the region’s financial system. This overview sets the stage for exploring how regulatory frameworks in Cameroon are adapting to the challenges posed by the intersection of cryptocurrencies and illicit financial activities.

Money Laundering and Bitcoin Basics 💰

Money laundering and Bitcoin basics are intertwined in a complex web of financial transactions that can be difficult to untangle. Bitcoin, being a decentralized digital currency, presents both challenges and opportunities in the realm of money laundering. Understanding how individuals can exploit the anonymity of Bitcoin to conceal illicit funds is crucial for combating financial crimes. By delving into the fundamental principles of blockchain technology and the pseudonymous nature of Bitcoin transactions, one can begin to grasp the nuances of money laundering schemes in the digital realm.

The inherent features of Bitcoin, such as pseudonymity and borderless transactions, have attracted both legitimate users and illicit actors seeking to obfuscate the origins of ill-gotten gains. Unlike traditional banking systems, Bitcoin operates outside the control of centralized authorities, offering a level of anonymity that can be exploited by money launderers. It is essential to navigate the intersection of financial regulations and technological innovation to develop effective strategies for combating money laundering in the digital age.

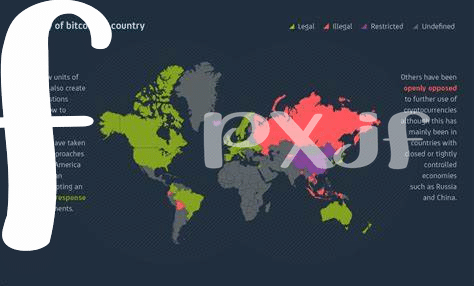

Regulatory Landscape in Cameroon 🇨🇲

In Cameroon, the regulatory landscape regarding Bitcoin and money laundering is evolving as authorities work towards creating a framework that addresses the unique challenges posed by digital currencies. Government agencies are actively looking into ways to regulate the use of Bitcoin and prevent illicit activities such as money laundering. Various stakeholders, including financial institutions and law enforcement, are engaging in discussions to develop policies that strike a balance between fostering innovation in the digital currency space and safeguarding against financial crimes. This collaborative effort reflects a growing awareness of the need for effective regulatory measures to mitigate risks associated with Bitcoin transactions within Cameroon’s financial ecosystem.

Challenges and Concerns 💼

Money laundering in the context of Bitcoin in Cameroon presents a web of challenges and concerns that authorities and individuals alike must navigate. The inherent nature of cryptocurrencies, including the anonymity they offer, raises red flags concerning potential illicit activities. Moreover, the lack of clear regulations specific to Bitcoin in the country poses a significant hurdle in combating money laundering effectively. Keeping up with ever-evolving tactics employed by criminals in this digital sphere adds another layer of complexity to the situation. Addressing these concerns requires a multidimensional approach that balances security measures with fostering innovation in the financial sector. One must remain vigilant and proactive in the face of these pressing issues to uphold the integrity of financial systems. For further insights on the legal consequences of bitcoin transactions, especially concerning consumer protection laws in different jurisdictions, visit legal consequences of bitcoin transactions in Cambodia.

Enforcement Measures 🔒

Enforcement Measures: The authorities in Cameroon have taken significant steps to combat money laundering related to Bitcoin transactions, implementing stringent regulations and enforcement measures to deter illicit activities. These measures include thorough monitoring of financial transactions, conducting investigations, and collaborating with international agencies to track and apprehend individuals involved in money laundering schemes. Furthermore, the government has increased penalties for offenders, sending a strong message that such actions will not be tolerated. By implementing and enforcing these measures effectively, Cameroon aims to create a secure and transparent financial environment that upholds the integrity of its financial system.

Educational Initiatives for Awareness 📚

Educational initiatives play a crucial role in raising awareness about the implications of money laundering laws for Bitcoin in Cameroon. By providing accessible resources and workshops, individuals can better understand their responsibilities and the risks associated with non-compliance. These initiatives aim to empower users to engage in safe and legally compliant practices when dealing with cryptocurrencies. Education not only helps to protect individuals from unwittingly participating in illegal activities but also contributes to a more transparent and secure financial ecosystem. Through ongoing educational efforts, the community can work towards a common understanding of the regulatory landscape and foster a culture of compliance and accountability. For further insights on legal consequences of bitcoin transactions in Central African Republic, refer to the article on legal consequences of bitcoin transactions in Cabo Verde.