Overview of Kyc and Aml Regulations in Bitcoin 📜

Understanding the regulations surrounding KYC (Know Your Customer) and AML (Anti-Money Laundering) in the realm of Bitcoin transactions is crucial for both users and authorities alike. These rules and procedures are in place to ensure transparency, security, and legality in cross-border transfers involving cryptocurrencies. By abiding by these regulations, individuals and businesses can help prevent illicit activities such as money laundering and terrorist financing. KYC processes require individuals to verify their identity, while AML regulations focus on monitoring and reporting suspicious transactions. The intersection of these regulations with the decentralized nature of Bitcoin presents unique challenges and opportunities for enforcement and compliance. Familiarizing oneself with these regulations is paramount for navigating the evolving landscape of digital finance responsibly.

Importance of Compliance for Cross-border Transfers 💼

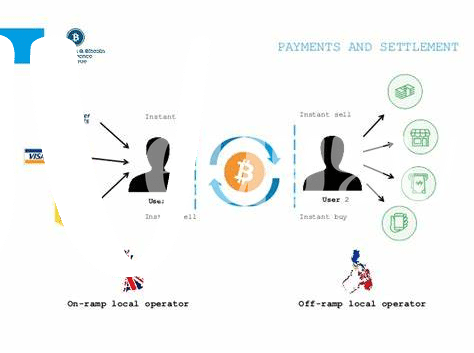

When it comes to cross-border Bitcoin transfers in Kyrgyzstan, adhering to KYC and AML regulations is crucial. These regulations not only ensure the legality and transparency of transactions but also play a fundamental role in combating money laundering and other illicit activities. By complying with these regulations, Bitcoin users can contribute to a more secure and trustworthy financial ecosystem for cross-border transfers.

Maintaining compliance with KYC and AML standards not only protects the integrity of Bitcoin transactions but also fosters trust among users and regulatory authorities. It signifies a commitment to upholding ethical practices and accountability in the realm of cross-border transfers, thereby promoting a more resilient and regulated environment for financial activities. Embracing compliance is not just a legal requirement; it is a proactive step towards creating a sustainable framework that supports the growth and stability of cross-border Bitcoin transactions.

Challenges Faced by Bitcoin Users in Kyrgyzstan 🌍

Bitcoin users in Kyrgyzstan face various challenges when it comes to utilizing the digital currency for cross-border transfers. Limited awareness and understanding of cryptocurrency, coupled with fluctuating regulations, create uncertainty for users. Additionally, the lack of clear guidelines on tax implications and reporting requirements further complicates the landscape. Accessibility to reliable platforms and services for Bitcoin transactions is another hurdle, with some users resorting to informal channels due to limited options. Moreover, the volatile nature of Bitcoin prices adds another layer of complexity for users in Kyrgyzstan, impacting the cost-effectiveness of cross-border transfers. Overcoming these challenges is crucial for fostering trust and confidence in Bitcoin as a viable means of financial transactions in the country.

Role of Regulatory Authorities in Enforcing Regulations 🛡️

Regulatory authorities play a vital role in ensuring compliance with KYC and AML regulations for Bitcoin transactions in Kyrgyzstan. By actively enforcing these regulations, authorities aim to mitigate the risks of money laundering and terrorist financing associated with cross-border transfers. Their oversight helps to safeguard the integrity of the financial system and protect consumers from illicit activities within the realm of cryptocurrency transactions.

To learn more about how regulatory authorities oversee compliance with Bitcoin cross-border money transfer laws in Kyrgyzstan, you can read the comprehensive guide on the topic on bitcoin cross-border money transfer laws in Kiribati. This resource provides valuable insights into the evolving landscape of regulatory frameworks and their implications for the cryptocurrency industry.

Impact on Bitcoin Adoption and Financial Inclusion 💰

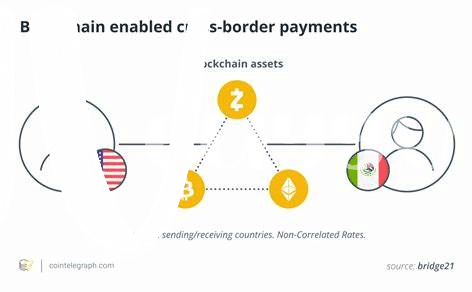

Bitcoin’s integration into the financial landscape of Kyrgyzstan could have a significant impact on both adoption and financial inclusion. As more individuals and businesses embrace Bitcoin for cross-border transfers, the potential for greater financial accessibility and inclusion increases. This digital currency offers a decentralized and borderless option, potentially giving those excluded from traditional banking systems a new avenue for participating in the financial world.

Moreover, increased Bitcoin adoption in Kyrgyzstan could lead to innovative solutions for financial access, especially for underserved populations. By understanding and complying with the relevant regulations, Bitcoin could pave the way for a more inclusive financial ecosystem in the country, empowering individuals and businesses to participate in the global economy more seamlessly.

Future Outlook and Potential Changes in Regulations 🔮

In looking ahead to the future of Bitcoin cross-border transfers in Kyrgyzstan, it is evident that the landscape of regulations will continue to evolve. Potential changes in regulations hold the key to shaping how individuals and businesses engage with cryptocurrencies. As the global financial ecosystem adapts to the rapid growth of digital currencies like Bitcoin, regulatory frameworks must strike a balance between fostering innovation and mitigating risks. The collaborative efforts of regulatory authorities and industry stakeholders will play a crucial role in establishing a conducive environment for safe and compliant cross-border transactions. Keeping a close eye on the evolving regulatory landscape can provide valuable insights for market participants navigating the complexities of the digital asset space.

To learn more about Bitcoin cross-border money transfer laws in Laos, visit Bitcoin cross-border money transfer laws in Japan.