What’s the Big Deal with Bitcoin Halving? 🎉

Imagine a party where the amount of cake gets cut in half every so often, but the number of people wanting a piece stays the same or even grows. That’s a bit like Bitcoin halving. Every four years or so, the prize for those running the Bitcoin network, known as miners, is slashed in half. This isn’t about making things tough for miners; it’s more about keeping Bitcoin rare, sort of like gold. This scarcity is what can make the value of Bitcoin shoot up, as there’s less newly minted Bitcoin available, even though more people might want some.

But why should you care? Well, each halving can be a rollercoaster for Bitcoin’s price, and if you’re holding some Bitcoin or thinking about jumping in, these moments can be quite impactful. It’s a big event that not only affects those mining Bitcoin but potentially anyone interested in the future of this digital gold.

Below is a table that highlights the essence of Bitcoin halving:

| Aspect | Description |

|---|---|

| What it is | A 50% reduction in the reward for mining Bitcoin transactions, occurring approximately every four years |

| Purpose | To limit the supply of Bitcoin, mimicking the scarcity of physical gold |

| Impact | Can lead to an increase in Bitcoin’s value due to reduced supply |

| Why it matters | Affects investors, miners, and the broader financial landscape |

This event ensures the digital currency remains a hot topic for anyone watching their wallets or curious about where this technological journey is heading.

The Countdown Begins: When’s the Next Halving? ⏰

Imagine you’re waiting for your favorite game to update, and you know exactly when it’s going to happen. That’s kind of like bitcoin halving, a special event in the world of digital money set by a clock that ticks every four years. Picture a big digital countdown, not in hours or minutes, but in blocks of transactions. When 210,000 of these blocks get added to the bitcoin blockchain, the blockchain cuts the reward for mining new bitcoins in half. This event doesn’t just occur randomly; it’s built into the fabric of bitcoin itself to make sure the creation of new bitcoins slows down over time, making them more scarce and, traditionally, more valuable.

As we inch closer to the next halving, speculations and excitement build up. Think of it as a big birthday celebration for bitcoin, but instead of getting more gifts, each miner gets half of what they used to – a nerve-wracking yet thrilling twist for those digging in the digital mines. Each halving event reshapes the landscape of bitcoin mining, influencing not just miners but everyone involved in bitcoin, from casual investors to hardcore enthusiasts. It’s a reminder of the ingenious design behind bitcoin, programmed to mimic the scarcity and value increase similar to gold but in a completely digital realm. For more insights into the wider implications of bitcoin’s innovative mechanisms, including its role in global financial activities, check out https://wikicrypto.news/beyond-borders-the-role-of-bitcoin-in-migrant-remittances.

How Halving Hits Your Wallet: Price Fluctuations 🔍

Imagine you’re at an amusement park, and the ticket prices fluctuate based on how many people are in line. Similarly, when Bitcoin cuts its rewards for miners in half, it’s like the park suddenly reduces the number of tickets available. This event makes everyone wonder, “Will there be enough tickets for me next time?” and “Should I get mine now before they’re all gone?” This sense of scarcity can make the price of Bitcoin jump, as people rush to buy before it potentially goes up more. However, just like any roller coaster, what goes up must come down. The excitement can lead to higher prices, but things often stabilize over time.

This rollercoaster effect means your digital wallet feels the impact. If you already own Bitcoin, you might watch its value climb with a smile. But, if you’re considering buying some during or right after a halving, the prices can be sky-high due to the sudden increased demand. It’s a bit like trying to buy water in the desert; the less there is, the more valuable it becomes. However, just like predicting the weather, predicting how much the price will change is tough. It’s always a good idea to approach with caution and think long-term, keeping in mind that what goes up in the world of Bitcoin can also come down.

Mining for Gold: Halving’s Impact on Miners ⛏️

Imagine a world where gold miners suddenly find that the earth yields only half the gold it used to for the same amount of effort. This is what Bitcoin miners experience during a halving event. Essentially, the reward for mining a block of transactions on the Bitcoin blockchain – a task that requires substantial computational effort – is cut in half. This phenomenon, occurring every four years or so, is not just a milestone; it’s a transformative moment for miners. Before a halving, miners might enjoy a certain level of profit, mining with enthusiasm as they secure the blockchain. But post-halving, when rewards are slashed, only the most efficient and well-equipped survive. This survival of the fittest ensures the network remains secure while adjusting to its new economic reality.

The impact on miners can’t be understated; it’s a catalyst for innovation and efficiency. In the lead-up to a halving, you’ll often see a surge in technological advancements as miners seek to lower their costs and maintain profitability. Additionally, the reduced pace at which new bitcoins are generated post-halving has historically led to a tighter supply, influencing the market in unexpected ways. For those curious about the broader implications of such events, including on topics like bitcoin and cybercrime suggestions, a wealth of information can be found at bitcoin and cybercrime suggestions. Here, the interplay between reduced mining rewards and market dynamics illustrates the delicate balance of the Bitcoin ecosystem, showcasing a fascinating blend of technology, economics, and human ambition.

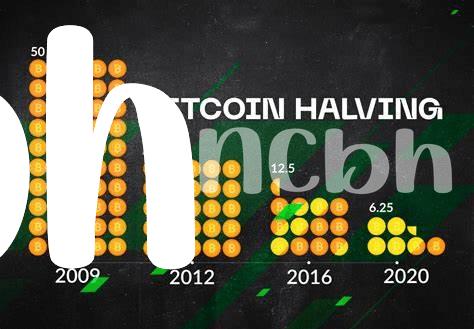

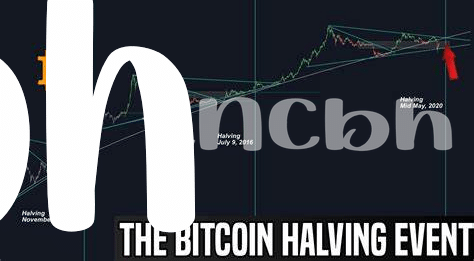

Past, Present, and Predictions: a Halving History 📚

Bitcoin’s journey through halving events has been nothing short of a rollercoaster ride, with twists and turns that keep everyone on the edge of their seats. The first halving in 2012 was greeted with curiosity and speculation, setting the stage for a tradition that impacts not just miners but the entire crypto-ecosystem. As we progressed to subsequent halvings in 2016 and 2020, each event was a spectacle of its own, leading to lively debates and predictions about Bitcoin’s future. These historical moments have shown us the resilience and ever-changing dynamics of Bitcoin, illustrating how scarcity can drive value and interest in the digital gold rush.

Looking ahead, the anticipation builds around what the next halving might bring. Experts toss around predictions like confetti, speculating on how the next reduction in mining rewards will influence Bitcoin’s price and mining community. While crystal balls remain cloudy, examining past events provides valuable insights into potential trends, weaving a tapestry of economic principles with the raw excitement of the crypto world. The table below captures a glimpse of this fascinating history and the speculative future, offering a snapshot of Bitcoin’s halving events and their aftermath:

| Event | Date | Effect on Bitcoin’s Price |

|---|---|---|

| 1st Halving | 2012 | Price increase |

| 2nd Halving | 2016 | Steady growth |

| 3rd Halving | 2020 | Spike in value |

| 4th Halving (Predicted) | ~2024 | Speculated surge |

This historical and predictive overview serves as a reminder of the exhilarating unpredictability that comes with the territory of digital currencies, encouraging both caution and optimism as we navigate the future of Bitcoin.

Beyond the Hype: Real-world Effects of Halving 🌍

So, what happens in the real world when Bitcoin decides to cut its rewards in half? Well, it’s not just folks sitting behind screens watching numbers flicker that feel the change. This event reaches far and wide, affecting more than just the value of Bitcoin itself. For starters, it’s a bit like a heartbeat in the world of Bitcoin, reminding people of its scarcity and value – kind of how gold is treasured because there isn’t an endless supply. This scarcity can draw in new interest, sparking conversations from coffee shops to the biggest financial boards about the future of digital money.

What’s even more fascinating is how these halvings can pave the way for innovation and community projects that aim to make the world a slightly better place. For anyone curious about how Bitcoin is fostering inclusivity and supporting cool projects around the globe, checking out bitcoin community projects suggestions might shine a light on how digital currencies can contribute to financial inclusion. From helping people in remote areas access banking for the first time to funding educational programs that teach the ins and outs of cryptocurrencies – Bitcoin halving is more than just a mechanic of digital currency; it’s a catalyst for change, inspiring a wave of actions that goes well beyond the buzz.