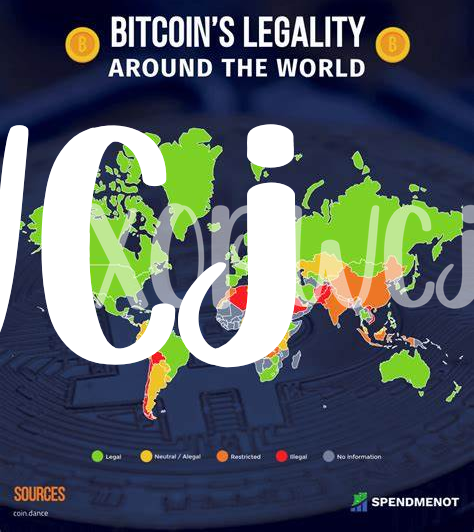

🌍 Overview of Bitcoin Regulations in the Netherlands.

In the Netherlands, Bitcoin regulations aim to provide clarity and guidance for individuals and businesses engaging in cryptocurrency transactions. These regulations seek to address issues related to anti-money laundering, Know Your Customer (KYC) requirements, and the overall integrity of the financial system. By outlining the legal framework surrounding Bitcoin usage, the Netherlands ensures a secure environment for participants in the cryptocurrency market. Complying with these regulations helps to foster trust and transparency within the digital currency ecosystem, promoting responsible and accountable practices among users.

💡 Key Legal Requirements for Using Bitcoin.

Understanding the legal landscape surrounding Bitcoin usage is essential for both individuals and businesses operating in the Netherlands. To navigate the requirements effectively, it’s crucial to prioritize key legal aspects. These include knowing the registration and reporting obligations, understanding anti-money laundering regulations, and being aware of any licensing requirements. Additionally, adhering to consumer protection laws and ensuring compliance with data privacy regulations are fundamental pillars in utilizing Bitcoin securely and ethically within the Dutch regulatory framework. Taking a proactive approach to stay informed and compliant not only fosters trust and transparency but also paves the way for seamless transactions in the digital currency realm.

When engaging in Bitcoin transactions, users must also be vigilant about tax considerations. Tracking and reporting cryptocurrency transactions accurately can help individuals manage their tax obligations effectively. Understanding the tax implications of using Bitcoin is integral in avoiding potential legal pitfalls and ensuring financial compliance. As the regulatory landscape continues to evolve, staying abreast of these key legal requirements is paramount to safeguarding one’s interests and promoting a sustainable environment for Bitcoin adoption in the Netherlands.

💼 Impact of Regulations on Businesses and Individuals.

Regulations on Bitcoin in the Netherlands have a significant impact on both businesses and individuals. For businesses, compliance with these regulations can affect operations, requiring measures to ensure transparency and security in transactions involving Bitcoin. Individuals may also experience changes in how they can buy or use Bitcoin, with potential implications for personal financial activities. Understanding and adapting to these regulations is essential for a smooth experience in the cryptocurrency space, balancing innovation with legal requirements.

🔒 Ensuring Compliance for Smooth Transactions.

Bitcoin transactions in the Netherlands require compliance with specific regulations to ensure smooth operations. This involves verifying the identities of parties involved, adhering to anti-money laundering protocols, and maintaining transparent records of transactions. By following these guidelines, businesses and individuals can navigate the regulatory landscape effectively, minimizing risks and maintaining trust within the ecosystem. Ensuring compliance not only fosters a secure environment for transactions but also contributes to the overall stability and growth of the Bitcoin market in the Netherlands. Travelling with Bitcoin comes with its own set of regulations, as seen in Namibia’s guidelines traveling with bitcoin: regulations in Namibia.

💸 Tax Considerations and Implications for Bitcoin Users.

Understanding tax considerations and implications for Bitcoin users is essential in navigating the cryptocurrency landscape. The evolving nature of Bitcoin regulations in the Netherlands highlights the significance of staying informed about tax obligations related to cryptocurrency transactions. As users engage in buying, selling, and trading Bitcoins, they must be aware of the potential tax implications affecting their financial activities. Ensuring compliance with tax laws is crucial for individuals and businesses to avoid any legal ramifications and maintain transparency in their Bitcoin transactions. By understanding the tax considerations associated with using Bitcoin, users can make informed decisions and navigate the complexities of cryptocurrency taxation with confidence.

🚀 Future Outlook and Potential Changes in Regulations.

In the ever-evolving landscape of Bitcoin regulations, the Netherlands stands at a pivotal juncture. Anticipating future developments, stakeholders are keenly observing potential changes that may influence the utilization of cryptocurrencies within the nation. With an emphasis on compliance and transparency, regulatory bodies are expected to introduce measures that balance innovation with security, shaping the future trajectory of Bitcoin usage.

For more insights on navigating Bitcoin regulations, explore traveling with Bitcoin: regulations in Niger and gain valuable perspectives on the regulatory framework in North Macedonia. Stay informed about the shifting dynamics of cryptocurrency usage to make informed decisions and adapt to the changing regulatory environment effectively.