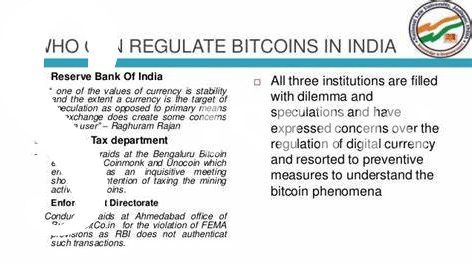

Regulatory Hurdles 🚫

Navigating the financial landscape in Benin poses significant challenges due to evolving regulations. Moving forward requires adapting swiftly to changes set out by governing bodies to ensure compliance and operational sustainability. Streamlining processes and staying informed on regulatory updates are essential for Bitcoin banks to thrive amidst these hurdles.

Cybersecurity Risks 🔒

Bitcoin banks in Benin face numerous challenges when it comes to cybersecurity. With the rise of digital transactions, protecting sensitive data from cyber threats is a top priority. Hackers are constantly looking for vulnerabilities to exploit, posing serious risks to the security of Bitcoin transactions. Implementing robust cybersecurity measures is crucial to safeguarding funds and maintaining the trust of customers. Stay informed about the latest cybersecurity developments to stay ahead of potential threats in the evolving digital landscape.

Efficiently managing cybersecurity risks can significantly impact the success and sustainability of Bitcoin banks in Benin. By staying vigilant and proactive in addressing potential vulnerabilities, these banks can build a secure environment for conducting financial transactions. Collaborating with cybersecurity experts and investing in advanced technologies will be essential in mitigating risks and ensuring the protection of digital assets. Educating staff and customers about best practices in cybersecurity will also play a vital role in safeguarding against threats and maintaining the integrity of Bitcoin banking operations.

Limited Banking Partnerships 🤝

Bitcoin banks in Benin face significant challenges due to limited banking partnerships. The scarcity of cooperative banks hinders their ability to offer diverse financial services to customers. This restriction not only limits the growth potential of these Bitcoin banks but also affects accessibility for individuals seeking alternative financial solutions. Overcoming this hurdle is crucial for expanding the reach and impact of digital banking in Benin, emphasizing the need for strategic collaborations to enhance the banking ecosystem and cater to a broader clientele base.

Customer Trust Concerns 🤔

Customer Trust Concerns in the world of Bitcoin banking can be a significant barrier for both customers and banks alike. With the rising number of cyber incidents and scams, customers are understandably hesitant to trust their funds to digital platforms. Building trust through transparent practices and robust security measures is crucial for the long-term viability of Bitcoin banks in Benin. Establishing a track record of reliability and security can help alleviate customer concerns and pave the way for a more stable and prosperous banking environment.

Payment Infrastructure Challenges 💳

One of the significant hurdles faced by Bitcoin banks in Benin today is the challenge of integrating with existing payment infrastructures. This poses a barrier to seamless transactions and adoption among users. Ensuring smooth and secure payment processes is crucial for the success of these banks in navigating the evolving financial landscape. Looking towards innovative solutions and strategic partnerships can help address this obstacle effectively.

Competition from Digital Wallets 💼

Digital wallets have emerged as fierce competitors to Bitcoin banks in Benin, offering convenient, fast, and user-friendly payment solutions. With their seamless interfaces and widespread acceptance, digital wallets are steadily shaping the financial landscape, attracting tech-savvy users seeking efficient digital payment systems. This evolution poses a challenge to traditional banking models, prompting Bitcoin banks to adapt and innovate to stay relevant in the ever-changing financial ecosystem.

Insert the link to the legal consequences of bitcoin transactions in the Solomon Islands with the anchor “bitcoin banking services regulations in Armenia” using the markup as specified.