Understanding the Basics 🌟

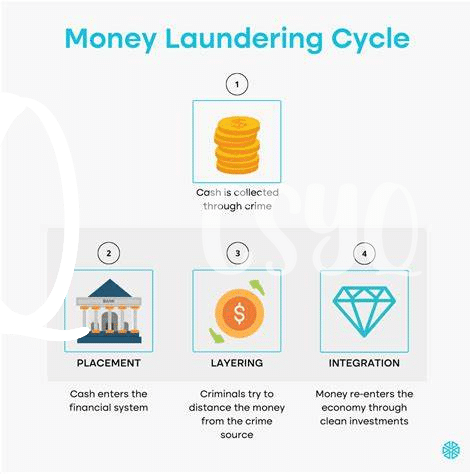

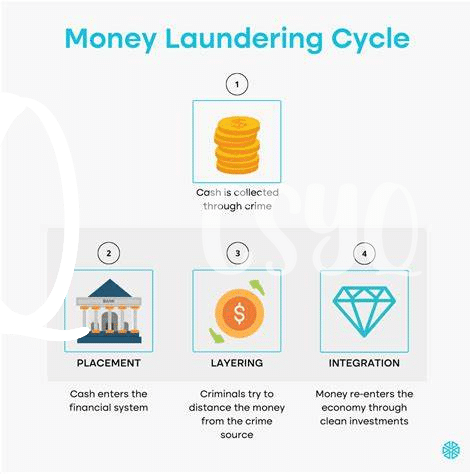

Bitcoin has become increasingly popular in recent years, offering opportunities for financial growth and innovation. Navigating through its Anti-Money Laundering (AML) requirements can seem daunting at first, but grasping the basics is key to ensuring compliance. Understanding how Bitcoin transactions work, the importance of verifying identities, and the significance of AML regulations is crucial. By familiarizing oneself with these fundamentals, individuals and businesses in Micronesia can confidently engage in Bitcoin transactions while adhering to AML guidelines. This knowledge forms the foundation for implementing effective AML practices and safeguarding against illicit activities.

Compliance Tools for Aml Regulations 💼

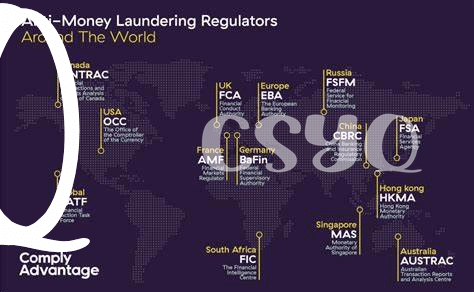

When it comes to navigating AML requirements in Micronesia, having the right compliance tools is crucial. These tools serve as the backbone of your AML efforts, helping you stay in line with regulations and detect any suspicious activities effectively. From robust transaction monitoring systems to sophisticated KYC solutions, the right compliance tools can streamline your AML processes and ensure comprehensive due diligence. By investing in these tools, businesses operating in the Bitcoin space can stay ahead of the curve and demonstrate a strong commitment to combating financial crime.

Ensuring compliance with AML regulations requires a proactive approach, and having the right tools in place is key to achieving that. By leveraging these compliance tools effectively, companies can protect both themselves and their customers from potential risks associated with money laundering and other illicit activities. With the constantly evolving landscape of cryptocurrency regulations, staying abreast of the latest compliance tools and technologies is essential for maintaining a solid AML framework in Micronesia.

Due Diligence Procedures 🧐

During the due diligence procedures, it is crucial to verify the identities of individuals involved in Bitcoin transactions to ensure compliance with AML regulations. This process involves collecting necessary information, such as names, addresses, and financial history, to assess the risk level associated with each transaction. By conducting thorough due diligence, businesses in Micronesia can mitigate the risks of potential money laundering activities and protect themselves from regulatory scrutiny.

Implementing effective due diligence procedures not only strengthens compliance efforts but also builds trust with regulatory authorities and customers. By establishing clear processes for verifying customer identities and conducting ongoing monitoring, businesses can demonstrate their commitment to upholding AML requirements and safeguarding the integrity of the cryptocurrency market in Micronesia.

Reporting Suspicious Activity 🚨

Compliance with reporting suspicious activity is a crucial aspect of navigating Bitcoin AML requirements. Prompt identification and reporting of any suspicious transactions or behaviors help maintain the integrity of the system and prevent illicit activities. By establishing clear protocols and effectively communicating these procedures to all stakeholders, organizations can ensure a proactive approach towards combating financial crimes within the cryptocurrency space.

Additionally, regular reviews and updates to the reporting mechanisms based on emerging trends and regulatory changes are key to staying ahead in compliance efforts. Training staff on the importance of reporting any suspicious activity fosters a culture of vigilance and accountability within the organization, strengthening the overall AML framework. For more insights on AML enforcement in various jurisdictions, including practical tips for compliance, check out this informative resource on bitcoin anti-money laundering (aml) regulations in Mauritius.

Training Staff on Aml Requirements 👩💼👨💼

After ensuring that your staff understands the importance of complying with AML regulations, it’s crucial to provide ongoing training to keep them up-to-date on any changes or new requirements. Engaging in regular training sessions can help reinforce the knowledge and skills needed to identify and report suspicious activities effectively. By investing in the continuous education of your staff members, you demonstrate your commitment to maintaining a culture of compliance within your organization. This not only helps protect your business from potential risks but also empowers your team to play a proactive role in safeguarding against financial crime.

Maintaining Ongoing Compliance Efforts 🔄

Point 6:

Consistent effort is key to staying compliant with Bitcoin AML regulations. Regularly reviewing and updating policies, conducting internal audits, and staying informed about regulatory changes are essential. Implementing a proactive approach to compliance not only ensures adherence to the rules but also builds trust with stakeholders. By fostering a culture of compliance within the organization, businesses can navigate the evolving landscape of AML requirements effectively.