🌍 a Quick Tour: How Payments Cross Borders Today

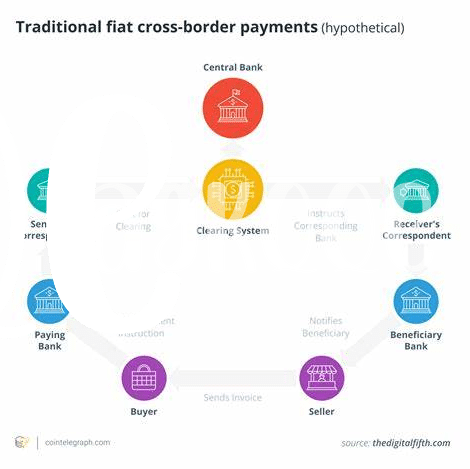

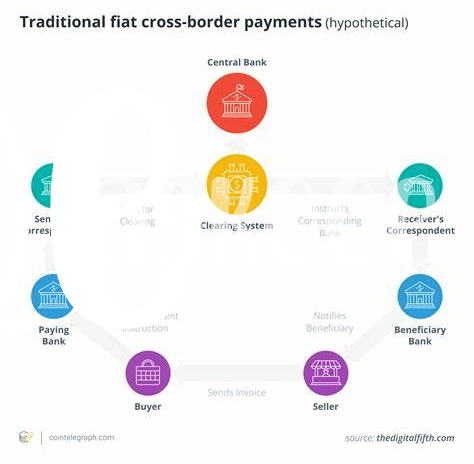

When we think about sending money across the world, it’s kind of like being at the airport. There are many steps and processes before your flight (in this case, money) can take off to its destination. Traditionally, when you send money abroad, it hops from one bank to another – sometimes even through several different banks – before it finally lands in the receiver’s account. This journey isn’t just long; it’s filled with paperwork, verification processes, and sometimes, unexpected delays. Each stop adds a little more time, making the whole process slow and sometimes frustrating.

| Step | Description | Time Taken |

|---|---|---|

| 1. Sender Initiates Transfer | The process begins with the sender deciding to send money internationally. | Varies |

| 2. Bank Processing | The sender’s bank processes the transaction and may send it to a correspondent bank. | 1-2 days |

| 3. Intermediate Banks | The money might pass through one or more intermediary banks, each adding their own time and fees. | 1-3 days per bank |

| 4. Receiver’s Bank | The final bank receives the funds and credits the recipient’s account. | 1-2 days |

| Total | Complex multi-step process. | 3-10 days |

Modern technology is pushing the boundaries, making these international money journeys faster and more direct. Yet, the traditional method, with its many stopovers, still feels a lot like taking a slow boat when we could be flying. The comparison sets the stage for understanding just how transformative faster alternatives, like Bitcoin, could be in this globalized world of ours.

⏳ Understanding Bitcoin: a Speedy Overview

Imagine a digital currency, kind of like having Euros or Dollars, where sending money is as simple as sending an email. That’s Bitcoin for you; it’s not a physical coin but a piece of high-tech magic that lives online. Picture every Bitcoin as a tiny message being sent across a vast network of computers, without the need for a bank to say, “Yes, this goes through.” This means when you send Bitcoin to a friend across the world, it moves from your digital wallet to theirs almost instantly, skipping the long waiting times and hefty fees often seen with traditional bank transfers. If you’re eager to dive deeper into how Bitcoin can streamline transactions while boosting privacy and security, you might find this resource incredibly insightful.

💸 Bitcoin Vs. Traditional Banks: the Speed Test

Imagine you’re in a race, and your choices are a speedy sports car or a reliable but older model car. That’s a bit like comparing Bitcoin and traditional banks when we talk about transferring money across borders. Bitcoin, much like our sports car, aims to zip your money across the finish line faster than traditional banks can. It’s all about getting from point A to point B in less time. Traditional banks, on the other hand, are like our dependable old car. They’ll get your money where it needs to go, but it might take a bit longer because they have to navigate through more checkpoints, like verifying your identity and making sure everything is secure.

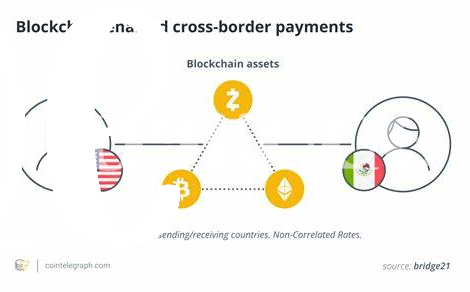

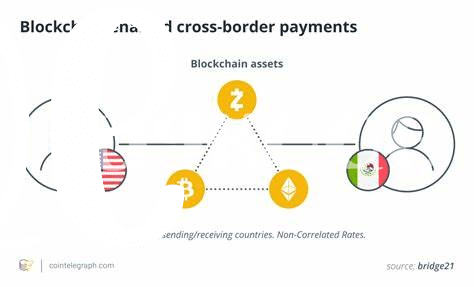

Now, let’s dive deeper. When using Bitcoin for international payments, the idea is that you skip the traffic jams — the bank holidays, the processing times, and all those little stops along the way that traditional banks have to make. This doesn’t mean Bitcoin wins every time. Sometimes, the road is a bit bumpy, and there are delays, but the potential to speed things up is what makes it exciting for many. It’s about harnessing the power of new technology to make our financial journeys quicker and more direct. This could mean a lot for businesses and individuals who need to move money quickly and without fuss.

🚀 How Bitcoin Speeds up International Transactions

Imagine waving goodbye to the days when sending money abroad felt like a test of patience. Thanks to Bitcoin, what once took days can now happen in minutes. This digital cash allows money to zip across borders without getting caught up in the usual banking maze. It’s like sending an email instead of mailing a letter – straightforward and fast. By sidestepping traditional bank checkpoints and using blockchain technology, Bitcoin cuts down on the usual wait times. Whether you’re a business paying an international supplier or sending a gift to a loved one overseas, Bitcoin makes it quick and less hassle.

But how does this all work in the real world? For starters, it means you can settle transactions over your morning coffee without waiting for banks to open or clear funds. Plus, with help from resources like integrating bitcoin payment gateways into online platforms explained, even online businesses are joining the revolution, making global trade not just faster but smoother. The beauty of Bitcoin lies in its ability to turn what used to be a cumbersome, time-consuming process into something that’s as easy as a few clicks. No more navigating through complicated banking procedures or hefty fees; just simple, speedy transactions that keep pace with the speed of business today.

🌐 Real Stories: Bitcoin in Global Trade

From small business owners in bustling cities to artists in quiet towns, everyone’s starting to feel the impact of Bitcoin in global trade. Imagine a craftsman in Kenya, creating beautiful, handmade jewelry. Before, selling his goods internationally seemed like a dream, tangled in the web of slow bank transfers and hefty fees. Now, thanks to Bitcoin, he can receive payments from customers across the globe in a snap, opening up a world of opportunities. This isn’t just a story; it’s a reality for many, demonstrating Bitcoin’s power to connect people and businesses everywhere, making distances feel shorter and ambitions more attainable.

| Country | Business Type | Impact of Bitcoin |

|---|---|---|

| Kenya | Handmade Jewelry | Quicker international sales |

| Germany | Software Development | Efficient global client payments |

| Brazil | Coffee Export | Smooth, fast transactions with overseas buyers |

On the other side of the world, a small software development company in Germany leverages Bitcoin to work seamlessly with clients from the United States to Japan. Gone are the days of waiting for international wire transfers to clear. Now, transaction speeds are faster than ever, helping them manage their cash flow better and focus on creating innovative solutions. Meanwhile, in Brazil, a coffee exporter uses Bitcoin to revolutionize the way they deal with buyers abroad. The swift, secure transactions have not just saved time, but also increased trust in their business relationships, proving that Bitcoin is not just changing the landscape of digital currency but redefining international trade itself.

🔧 Overcoming Challenges: Making Bitcoin Faster and Safer

Just like anything new, Bitcoin comes with its own set of puzzles to solve. One of the big head-scratchers is how to make Bitcoin transactions both quicker and more secure. Think of it like upgrading your internet connection while making sure your personal information is safe from hackers. The community behind Bitcoin is always buzzing, trying to come up with new ways to solve these challenges. From tech wizards to everyday users, everyone’s chipping in with ideas, from tweaking the underlying code to introducing new layers that can handle more transactions at lightning speed.

If you’re intrigued by the idea of making Bitcoin both a speedster and a fortress, there’s a place for you in this adventure. By joining the ranks of those shaping Bitcoin’s future, you can contribute to something big. Whether you’re a coder dreaming in lines of code or someone with fresh ideas on making Bitcoin better, your input is valuable. To dive in, here’s a great starting point: bitcoin as a modern-day store of value explained. This community is about more than just discussions; it’s about taking action to ensure Bitcoin remains a leading light in the world of digital currency, making cross-border transactions not just a possibility, but a smooth, safe reality.