Unveiling the Mystery: What’s Bitcoin? 💰

Imagine a world where money isn’t just pieces of paper with famous faces on them but something you can’t touch, like a secret password that only you know. This is where Bitcoin steps in, a kind of money called “cryptocurrency” because it’s protected by really, really good computer puzzles called cryptography. Imagine sending a gold coin over the internet, directly to someone else without anyone else, not even a bank, standing between. That’s what Bitcoin lets you do. It’s like sending a virtual high-five that actually has value.

Bitcoin sprang up in 2009, cooked up by a mysterious person (or group of people) we only know as Satoshi Nakamoto. It was the first of its kind, a spark that set off a whole fireworks display of other digital currencies. But unlike the coins jingling in your pocket, Bitcoin’s special because there’s only ever going to be 21 million of them. No more, no less. This digital scarcity is part of what makes people believe it’s valuable, kind of like finding a rare comic book in your attic.

| Feature | Description |

|---|---|

| Creation Year | 2009 |

| Creator | Satoshi Nakamoto (Pseudonym) |

| Type | Cryptocurrency (Digital Asset) |

| Scarcity | Limited to 21 million Bitcoins |

| Technology | Blockchain & Cryptography |

Digging into Gold: a Tale of Rarity 🏆

Once upon a time, folks dug deep into the Earth, searching for something shiny and rare: gold. This precious metal has sparked quests and dreams for centuries, all because it’s not easy to find. Imagine playing a giant game of hide and seek with the Earth, where gold is the ultimate prize. Now, why do people go bonkers over it? It’s all about rarity. Gold is like that one super rare collectible; you can’t just make more of it even if you wanted to. This scarcity is what makes it valuable. You can’t just say “Abracadabra” and make gold appear. It takes a lot of work to find and dig it out, making every little piece precious. This quest for gold has filled storybooks, inspired adventurers, and even shaped economies. It’s a timeless dance of supply and demand, where the less there is of something, the more people seem to want it. And just like in those epic tales of yore, the challenge of finding gold has taught us a lot about determination, value, and the thrill of the chase.

Limit in the Limelight: Bitcoin’s Cap Explained 🔒

Imagine a giant candy store where only 21 million candies were ever going to be made, and that’s it, no more candies after that. In the world of digital money, Bitcoin is like that limited-edition candy. The creators of Bitcoin set a cap, a maximum limit, of how many bitcoins can ever exist – and that magic number is 21 million. Why such a cap? Well, it’s all about making Bitcoin special, like a rare jewel. Just as gold is dug from the earth in limited amounts, making it precious and valuable, Bitcoin’s cap ensures it remains scarce and desired. This scarcity is a big reason people view it as digital gold 🌟. By having a fixed limit, Bitcoin is shielded from the trap of endless copying, which can decrease value. Think of it as securing a place for Bitcoin in the digital vaults of the future, making sure it’s a treasure that keeps its shine, no matter the changing tides of digital finance 🏦🔑.

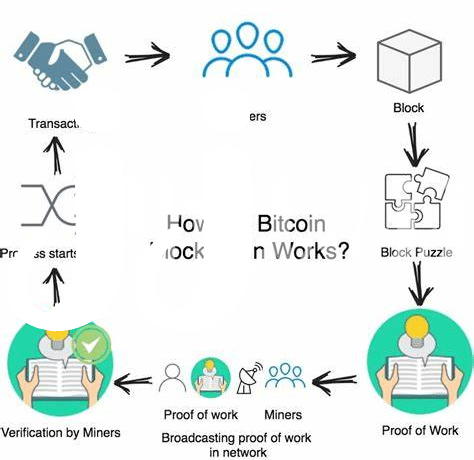

Gold Diggers and Digital Miners: a Comparison ⛏️

In the world of treasure hunting and wealth accumulation, there’s a fascinating parallel between the adventurers of yesteryears, those digging and panning for gold, and today’s digital pioneers mining Bitcoin. Imagine gold diggers, with their pans and pickaxes, venturing into wild rivers and deep mines, all in the hope of uncovering shiny nuggets. Now, picture modern-day miners, not in rugged terrains but in the digital realm, using powerful computers to solve complex puzzles. Both sets of miners are driven by the thrill of discovery and the potential for riches. However, unlike traditional gold mining, which can go on indefinitely as long as there’s gold to be found, Bitcoin mining has a clear endpoint, solidifying its rarity and value in the digital age. For those curious about diving deeper into the mechanics of this digital treasure hunt, how does bitcoin work in 2024 offers a gateway into the intricate world of cryptocurrencies, mirroring the transformative journey from tangible gold to digital gold. 🌐💎🔍

The Value Rollercoaster: Demand Meets Limit 🎢

Imagine going to an amusement park and seeing the biggest rollercoaster you’ve ever seen, with ups and downs that make your stomach jump just looking at it. Now, picture that as the journey of Bitcoin’s value, driven by how many people want it and how much is available. Just like gold, there’s only so much Bitcoin to go around. This cap creates a sort of game where everyone’s eyeing the limited seats on the ride, making those seats more desirable the fewer there are. So, as more people want to hop on, the value skyrockets, swooping up and down wildly as the day goes by.

This whole scenery can be better understood with a simple look at numbers. Below is a quick glance into Bitcoin’s world, highlighting the exciting dance between demand and the limit set on this digital treasure.

| Year | Bitcoin Value Peaks | Demand Surges |

|---|---|---|

| 2017 | $20,000 | Public Hype 🚀 |

| 2021 | $64,000 | Investment Boom 💥 |

Yet, what makes this dance even more thrilling is the unpredictability. Like a rollercoaster that suddenly drops or shoots up when you least expect it, Bitcoin’s value depends on its rarity and how much people are willing to chase after that limited golden ticket. This unpredictable adventure of ups and downs ensures Bitcoin remains a hot topic, much like the allure of discovering a hidden treasure, keeping everyone on their toes and watching closely, ready for the next big climb.

Future Predictions: Digital Gold in Your Wallet 🚀

Imagine peering into a future where your wallet doesn’t just carry old receipts and a bit of cash, but holds a shining beacon of the digital age – bits of Bitcoin, akin to pieces of digital gold. As we sail into tomorrow, envision Bitcoin transforming from a pioneering curiosity into a staple nestled alongside traditional currency, securing a spot in the financial portfolios of the adventurous and the prudent alike. This isn’t just wishful thinking; experts are nodding in agreement, predicting a landscape where Bitcoin’s scarcity – much like gold – elevates its appeal and solidifies its position as a treasure of the digital era. Its finite quantity, a mere 21 million coins, works its magic, enticing both seasoned investors and newcomers to dip their toes in these digital waters. 🚀💼📈 Just as gold once spurred a rush of miners, Bitcoin’s limited bounty is the modern sirens’ call to digital miners, promising a future where holding Bitcoin is as common as having a bank account. This allure is not just about wealth; it’s about being part of a revolutionary shift in how we perceive value and trust in a digital age. To start this journey, a peek into its origins is essential. Learn more about this groundbreaking technology and its enigmatic creator through who created bitcoin and the blockchain, laying the groundwork for understanding why Bitcoin is poised to be the digital gold of the future.