Technology Advancements in Aml Compliance for Bitcoin 🌐

Technological advancements have revolutionized the landscape of AML compliance for Bitcoin, ushering in a new era of efficiency and effectiveness. These innovations enable faster processing of large volumes of data, enhancing the detection of potential risks and suspicious activities in the cryptocurrency realm. By leveraging cutting-edge technologies, such as machine learning and big data analytics, companies can now stay ahead of evolving regulatory requirements and combat financial crimes more proactively. This intersection of technology and compliance marks a crucial turning point in the fight against illicit activities in the digital currency space.

Automated Transaction Monitoring and Risk Detection System 🚨

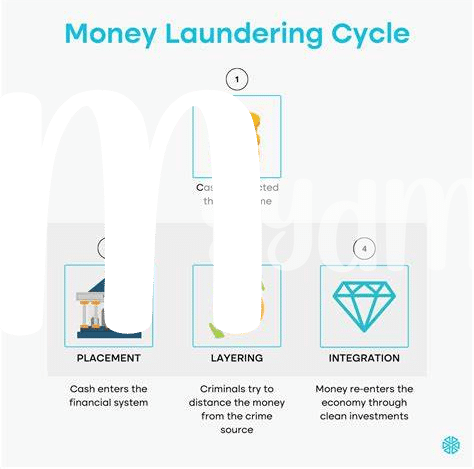

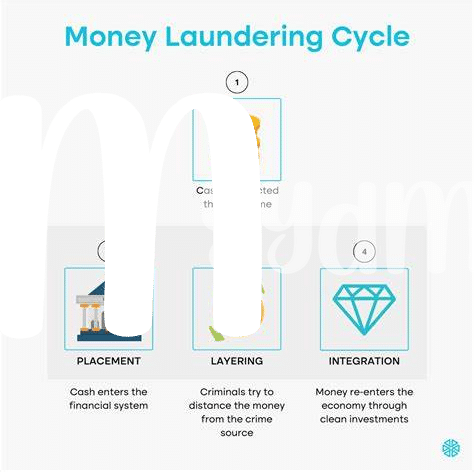

Automated transaction monitoring and risk detection systems play a vital role in ensuring AML compliance for Bitcoin. These innovative technologies enable real-time tracking of transactions and the identification of potentially suspicious activities. By utilizing sophisticated algorithms and data analysis, these systems can flag transactions that deviate from expected patterns or exhibit red flags. Implementing such systems not only strengthens compliance measures but also enhances the overall security and integrity of the Bitcoin ecosystem. Embracing automated transaction monitoring is crucial in staying ahead of evolving AML risks and safeguarding against potential threats.

Importance of Data Analytics in Detecting Suspicious Activities 📊

Data analytics plays a crucial role in uncovering patterns and anomalies that could indicate suspicious activities in the realm of Bitcoin transactions. By sifting through vast amounts of data, analytics tools can pinpoint irregularities or potential risks, enabling compliance teams to take proactive measures. This proactive approach is essential in combating financial crime and ensuring the legitimacy of transactions within the cryptocurrency space. The utilization of data analytics empowers organizations to stay ahead of emerging threats and maintain robust AML practices.

Role of Blockchain Technology in Enhancing Aml Processes 🔗

Blockchain technology plays a pivotal role in revolutionizing AML processes within the realm of Bitcoin. Through its immutable and transparent nature, blockchain enhances the traceability of transactions, enabling quicker identification of suspicious activities and streamlining compliance efforts. By leveraging the decentralized ledger system, AML frameworks can achieve greater efficiency and accuracy in monitoring and ensuring regulatory adherence. This integration of blockchain technology marks a significant step forward in fortifying the integrity of AML procedures for Bitcoin transactions. To learn more about AML regulations in the crypto sphere, check out this insightful article on bitcoin anti-money laundering (AML) regulations in Libya.

Leveraging Artificial Intelligence for Real-time Monitoring 🤖

Artificial Intelligence has revolutionized the landscape of AML compliance for Bitcoin, particularly in real-time monitoring. By harnessing AI algorithms, organizations can swiftly analyze vast amounts of transactional data and detect suspicious activities with greater precision. This proactive approach enables quicker responses to potential risks, enhancing overall security measures. Additionally, AI-powered systems continually learn and adapt to evolving threats, making them indispensable tools in the fight against financial crimes. The combination of AI and real-time monitoring not only streamlines compliance processes but also sets a new standard for efficiency and effectiveness in safeguarding digital assets.

Challenges and Future Trends in Aml Compliance for Bitcoin 💡

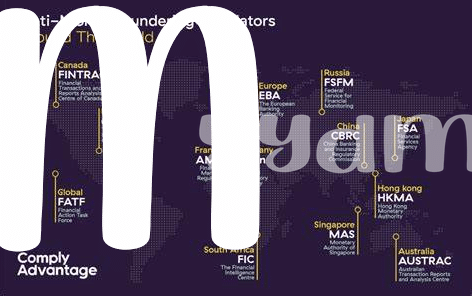

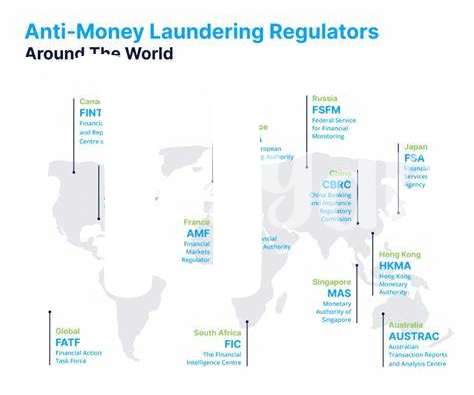

In the evolving landscape of AML compliance for Bitcoin, the industry faces a multitude of challenges alongside promising future trends. Amidst the rapid pace of technological advancements, regulatory frameworks struggle to keep up with the complexities of digital currencies. Transparency, scalability, and cross-border collaboration remain focal points for enhancing AML practices. Looking ahead, the convergence of blockchain, AI, and regulatory oversight is poised to reshape the landscape, requiring continuous adaptation and innovation to combat emerging threats to financial integrity.

To learn more about Bitcoin anti-money laundering (AML) regulations in Luxembourg, visit Bitcoin anti-money laundering (AML) regulations in Lithuania.