Overview of Bitcoin Aml Regulations in Benin 🌍

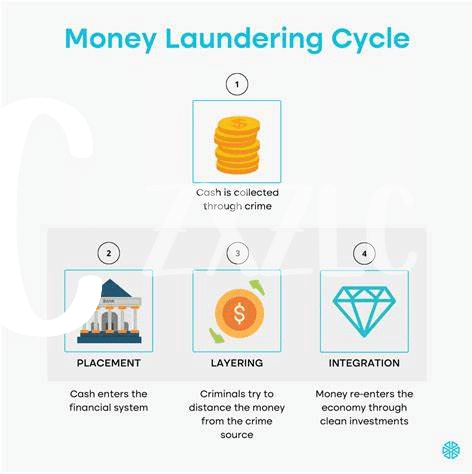

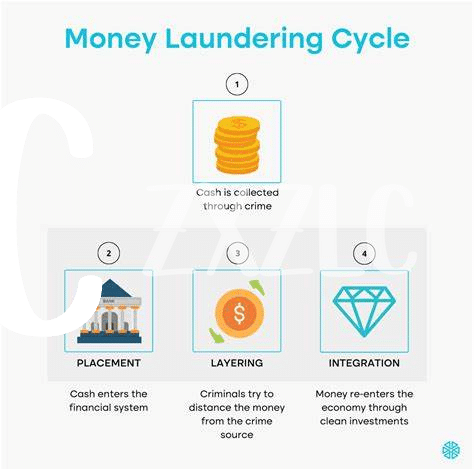

In Benin, the implementation of Bitcoin AML regulations marks a pivotal step towards enhancing financial transparency and security. These regulations aim to ensure that transactions involving Bitcoin adhere to strict anti-money laundering protocols, safeguarding against illicit activities in the digital currency space. By establishing clear guidelines and requirements, Benin’s AML regulations seek to foster a more compliant and accountable ecosystem for Bitcoin users, aligning with global efforts to combat financial crimes and uphold regulatory standards. As the digital landscape continues to evolve, the oversight provided by these regulations plays a crucial role in shaping the future of cryptocurrency governance in Benin.

Role of Regulatory Authorities in Enforcement 🕵️

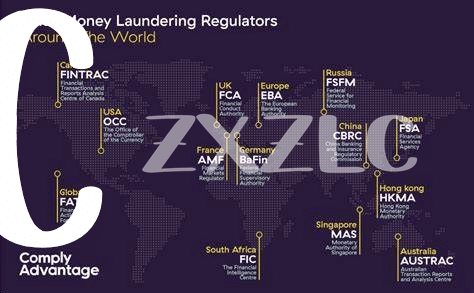

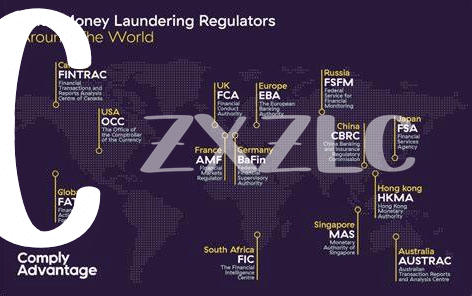

Regulatory authorities play a crucial role in upholding and enforcing Anti-Money Laundering (AML) laws within the realm of Bitcoin transactions in Benin. They act as overseers, ensuring that entities engaging in Bitcoin-related activities comply with the stipulated AML regulations. By implementing robust monitoring mechanisms, regulatory authorities can detect and investigate any suspicious transactions effectively. Additionally, they work to promote awareness among stakeholders regarding the importance of AML compliance to maintain the integrity of the financial system. Through their vigilance and enforcement efforts, regulatory authorities aim to safeguard against illicit activities while fostering a more secure environment for Bitcoin users and the wider community.

Challenges Faced in Implementing Aml Laws 💼

Implementing AML laws related to Bitcoin in Benin faces several challenges. One major hurdle is the lack of clear guidelines and frameworks specific to digital currencies, making it difficult for regulatory authorities to monitor and enforce compliance effectively. Additionally, the rapidly evolving nature of cryptocurrency technology poses a challenge in keeping up with the latest trends and methods used by illicit actors to bypass AML measures. Inadequate resources and expertise within regulatory bodies also hinder the efficient implementation of AML laws, leading to gaps in oversight and enforcement that could be exploited by money launderers and other criminals.

Despite these challenges, there is growing recognition of the importance of addressing AML risks in the cryptocurrency sector, spurring efforts to enhance regulatory capacity and collaboration both domestically and internationally. Improved coordination among regulatory authorities, financial institutions, and other stakeholders will be crucial in overcoming the complexities involved in enforcing AML laws in the context of Bitcoin transactions, ensuring a more secure and compliant environment for users and businesses alike.

Impact of Aml Regulations on Bitcoin Users 💳

Bitcoin users in Benin are directly impacted by Anti-Money Laundering (AML) regulations, which aim to ensure transparency and accountability in cryptocurrency transactions. By enforcing these regulations, users may experience increased scrutiny and verification processes when engaging in Bitcoin-related activities. This can lead to a more secure environment for all parties involved, promoting trust and legitimacy within the Bitcoin ecosystem. To learn more about compliance strategies for Bitcoin investors in Benin’s AML environment, check out this insightful article on bitcoin anti-money laundering (AML) regulations in Bhutan.

International Cooperation for Effective Enforcement 🤝

International cooperation plays a crucial role in ensuring the effective enforcement of Bitcoin AML regulations in Benin. Collaboration between regulatory authorities from different countries helps in sharing information and expertise to combat money laundering activities involving cryptocurrencies. By working together, these agencies can coordinate efforts, investigate cross-border transactions, and strengthen regulatory frameworks to protect the integrity of the financial system. This cooperative approach not only enhances the enforcement of AML laws but also fosters a unified global response to emerging challenges in the Bitcoin ecosystem.

Future Outlook for Bitcoin Aml Compliance 🚀

Sure, I will do it.

The future outlook for Bitcoin AML compliance involves a growing emphasis on leveraging advanced technology solutions to enhance detection and prevention capabilities. With the continuous evolution of cryptocurrency markets and regulatory requirements, stakeholders are expected to adopt more sophisticated tools to address emerging risks effectively. Moreover, increased collaboration between regulatory bodies and industry players will play a pivotal role in developing robust frameworks that ensure compliance with AML regulations while fostering innovation in the cryptocurrency ecosystem. Overall, the proactive approach towards compliance and the integration of technological advancements are key factors that will shape the future landscape of Bitcoin AML enforcement efforts.

If you’re interested, you can learn more about Bitcoin anti-money laundering (AML) regulations in Barbados by visiting Bitcoin anti-money laundering (AML) regulations in Bolivia.