Overview of Financial Authorities 🌐

Financial authorities play a crucial role in overseeing and regulating financial activities within their jurisdictions. They serve as watchdogs, ensuring that the financial system operates in a fair and transparent manner. These authorities work tirelessly to protect consumers, maintain market integrity, and uphold the stability of the financial system. By monitoring and enforcing regulations, they help prevent fraud, money laundering, and other illicit activities. Overall, the oversight provided by financial authorities is essential for maintaining trust and confidence in the financial markets.

Regulation Challenges in the Digital Age 💻

Regulation challenges in the digital age pose a unique set of hurdles for financial authorities to navigate. As the landscape of financial transactions evolves with advancing technology, traditional regulatory frameworks must adapt to encompass the complexities of digital currencies like Bitcoin. The decentralized nature of cryptocurrencies presents a challenge in monitoring and enforcing regulations, requiring authorities to stay ahead of innovative methods used by individuals and entities in the digital space. Embracing digital innovation while maintaining oversight is a delicate balancing act that financial regulators grapple with in the modern era.

Strategies for Monitoring Bitcoin Transactions 🔍

Efficiently monitoring Bitcoin transactions requires a dynamic approach that adapts to the ever-evolving digital landscape. By employing a combination of sophisticated tracking tools and analytical techniques, financial authorities aim to stay ahead of illicit activities within the cryptocurrency space. These strategies delve deep into the blockchain technology that underpins Bitcoin, utilizing forensic analysis to trace transaction histories and identify potential risks. Real-time monitoring and pattern recognition algorithms play a crucial role in enhancing surveillance capabilities, enabling authorities to swiftly respond to suspicious transactions. Collaboration with industry experts and continuous updates to monitoring techniques are key components in the ongoing effort to safeguard the integrity of the financial system.

Collaborations between Authorities and Tech Companies 🤝

Collaborations between authorities and tech companies play a crucial role in ensuring effective monitoring of Bitcoin activities. By working together, financial bodies and technology firms can leverage their respective expertise to develop innovative solutions for detecting and preventing illicit transactions in the digital currency space. This partnership fosters a proactive approach to addressing potential risks and staying ahead of evolving trends in the crypto market. Additionally, it facilitates the exchange of knowledge and resources, contributing to a more robust regulatory framework. For further insights on the legal consequences of bitcoin transactions in Serbia, visit legal consequences of bitcoin transactions in Serbia.

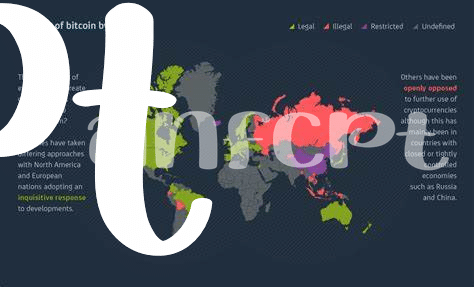

Global Efforts to Combat Money Laundering 💰

Global efforts to combat money laundering are crucial in the world of digital currencies like Bitcoin. Various countries have been actively working together to create and enforce regulations that aim to prevent money laundering activities within the crypto space. Through international collaborations and information sharing, financial authorities can track and trace suspicious transactions more effectively, making it harder for illicit funds to be laundered through Bitcoin. By adopting a unified approach, these global efforts play a significant role in safeguarding the integrity of the financial system and ensuring that cryptocurrencies are not misused for illegal purposes.

Impact of Monitoring on Bitcoin Market 📉

Bitcoin market fluctuations are closely tied to the monitoring efforts of financial authorities, impacting investor sentiment and market stability. The increased scrutiny on Bitcoin transactions can lead to heightened levels of accountability and transparency within the market. This, in turn, may influence the price dynamics of Bitcoin, as regulatory actions and monitoring practices shape market behaviors. As authorities continue to refine their monitoring strategies, the Bitcoin market is experiencing a shift towards greater regulation and oversight.

For more information on the legal consequences of Bitcoin transactions in San Marino, please refer to the legal consequences of bitcoin transactions in Saint Vincent and the Grenadines.