Introduction to Central Bank’s Role 💡

Central banks play a crucial role in overseeing the financial landscape of a country, including the evolving realm of cryptocurrencies. As the custodians of monetary policy and financial stability, the Central Bank of Gambia faces the challenge of navigating the complexities posed by the rise of digital currencies. By understanding the implications of cryptocurrencies on the country’s economy and financial system, the bank can effectively strategize and implement regulations to protect consumers and maintain the integrity of the financial sector. The Central Bank’s proactive involvement in monitoring and regulating the cryptocurrency market is essential for safeguarding the interests of both investors and the broader economy.

Regulatory Measures on Cryptocurrency 📜

Central banks around the world are taking proactive steps to regulate the use of cryptocurrencies within their jurisdictions. These regulatory measures aim to ensure transparency, consumer protection, and financial integrity in the burgeoning cryptocurrency market. By imposing licensing requirements, monitoring transactions, and setting guidelines for cryptocurrency exchanges, central banks are working towards creating a safer and more stable environment for both investors and the overall financial system.

Furthermore, regulatory measures often include measures to combat money laundering, terrorist financing, and other illicit activities that may be facilitated through the use of cryptocurrencies. Collaboration with other regulatory bodies, both domestically and internationally, is crucial in developing a coherent approach to overseeing the cryptocurrency landscape. With the rapid evolution of digital assets, adapting regulatory frameworks to address new challenges and opportunities remains a key focus for central banks worldwide.

Impact on Financial Stability 💼

As cryptocurrencies continue to gain traction in the financial landscape, the potential impact on a country’s financial stability cannot be overlooked. The fluctuating nature of these digital assets poses challenges for traditional financial systems, requiring Central Banks to navigate carefully to ensure stability. The volatile nature of cryptocurrency markets can have repercussions on overall economic stability, affecting factors such as exchange rates, inflation, and investor confidence. Striking a balance between fostering innovation in the digital economy while safeguarding the stability of the financial sector is a pivotal role for Central Banks in the modern era.

Public Awareness and Education 📚

Public awareness and education play a crucial role in enhancing understanding and acceptance of cryptocurrencies within Gambia. Through targeted educational campaigns and seminars, the Central Bank can empower the public with knowledge about the benefits and risks associated with participating in the cryptocurrency market. By promoting financial literacy and highlighting the importance of regulatory compliance, individuals can make informed decisions when engaging with digital assets. Collaboration with educational institutions and media outlets can further amplify these efforts, fostering a more informed and responsible crypto ecosystem. For more insights on government initiatives on bitcoin and blockchain in Ghana, visit government initiatives on bitcoin and blockchain in Ghana.

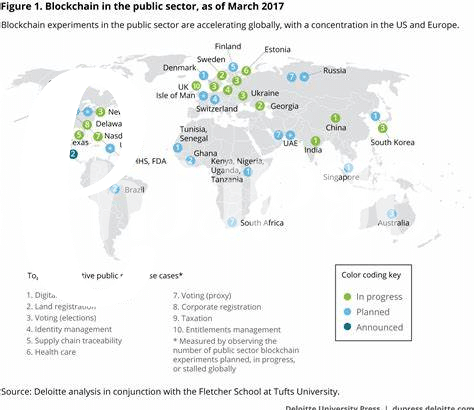

Collaboration with International Bodies 🤝

Central banks often collaborate closely with international bodies to ensure a cohesive approach towards the regulation of cryptocurrencies. By engaging with organizations such as the International Monetary Fund (IMF), Financial Action Task Force (FATF), and the Bank for International Settlements (BIS), central banks can exchange best practices and coordinate efforts on a global scale. This collaboration is crucial in addressing cross-border challenges posed by cryptocurrencies, such as money laundering and terrorist financing risks. Furthermore, it allows for the development of harmonized regulatory frameworks that promote consistency and effectiveness in managing the complexities of the digital asset landscape. Working hand in hand with international bodies underscores the commitment of central banks to fostering a stable and secure environment for the evolving financial ecosystem.

Future Prospects and Challenges 🔮

The evolution of cryptocurrency regulation within The Gambia presents a spectrum of future prospects and challenges. As Central Bank and governmental understanding improves, opportunities for integrating cryptocurrencies into the financial landscape may arise, potentially enhancing technological and economic innovation. However, challenges lie in creating a comprehensive regulatory framework that balances innovation with stability and security. The establishment of robust control mechanisms and cross-border collaborations with international bodies will be crucial in shaping the future landscape of cryptocurrency in The Gambia. Public awareness campaigns and educational initiatives will also play a vital role in fostering responsible cryptocurrency usage among citizens. Additionally, staying aligned with global trends and developments in digital assets will be key to navigating the rapidly evolving cryptocurrency space.

Insert link to government initiatives on bitcoin and blockchain in Gabon: government initiatives on bitcoin and blockchain in Germany