Introduction to the Central African Republic’s Stance 🌍

Within the Central African Republic’s landscape, there exists a burgeoning curiosity surrounding the realm of Bitcoin banking. This digital currency, with its decentralized nature, captivates the government’s attention as they navigate the uncharted waters of regulation. Exploring the potentials and pitfalls, the country stands at a pivotal juncture, shaping its stance amidst a global wave of cryptocurrency evolution.

Potential Benefits and Risks of Bitcoin Banking 💰

Bitcoin banking presents a dynamic landscape with the potential to revolutionize financial transactions. As with any emerging technology, there are both benefits and risks associated with its adoption. On one hand, Bitcoin banking offers secure and efficient cross-border transactions, reducing the reliance on traditional banking systems. However, the decentralized nature of cryptocurrencies also poses risks, including price volatility and security concerns. Understanding these factors is crucial for policymakers in Central African Republic to navigate the regulatory terrain effectively.

Impact of Government Regulations on Financial Inclusion 🏦

Government regulations play a pivotal role in shaping the landscape of financial inclusion within the Central African Republic. By implementing clear guidelines and oversight, the government can not only mitigate potential risks associated with Bitcoin banking but also foster an environment conducive to broader access to financial services. Successful regulation can pave the way for marginalized populations to participate in the formal economy, empowering individuals who were previously excluded from traditional banking systems. Consequently, the impact of government regulations on financial inclusion extends beyond mere compliance, influencing the very foundation of economic participation for all citizens.

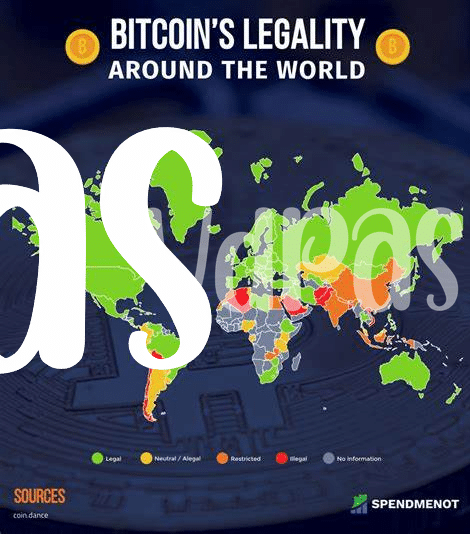

Comparison with Other Countries’ Approaches to Cryptocurrency 🌐

When examining various countries’ approaches to cryptocurrency regulation, it becomes evident that each nation has a unique perspective and strategy in place. Some countries embrace Bitcoin and other cryptocurrencies with open arms, facilitating their integration into traditional financial systems. On the other hand, some nations take a more cautious approach, imposing strict regulations to mitigate potential risks associated with digital currencies. Understanding these diverse approaches can provide valuable insights into crafting effective regulatory frameworks. To delve deeper into this topic, you can explore the latest innovations in compliance with Bitcoin banking services regulations in cabo verde on Wikicrypto News.

Public Perception and the Future of Bitcoin in the Car 🤔

Public perception of Bitcoin in the Central African Republic is a fascinating blend of curiosity and skepticism. While some view it as a revolutionary tool for financial empowerment, others express concerns about its stability and regulatory uncertainties. As the Car navigates its path towards embracing innovative financial technologies, the future of Bitcoin remains an area of intense debate. Will it serve as a catalyst for economic growth and inclusion, or will regulatory challenges impede its adoption? Only time will reveal the true impact of Bitcoin on the Car’s financial landscape.

Call to Action for a Balanced Regulatory Framework 📜

A balanced regulatory framework is crucial to oversee Bitcoin banking in Central African Republic. By promoting transparency and security while fostering innovation, such guidelines can create a thriving environment for financial services. It is essential to involve various stakeholders in the process and consider the unique socio-economic context of the region. Striking a balance between oversight and flexibility will be key to harnessing the potential of cryptocurrencies for economic growth and financial inclusion.

Bitcoin banking services regulations in Cameroon