Bitcoin Investment Funds: the Future of Finance 💰

Bitcoin investment funds represent an exciting evolution in the financial landscape, offering investors a unique opportunity to participate in the growing cryptocurrency market. As digital assets continue to gain traction globally, these funds provide a convenient and regulated way for individuals to access and benefit from the potential returns of cryptocurrencies. With the potential for diversification and attractive returns, bitcoin investment funds are reshaping traditional investment strategies and paving the way for a new era of finance.

Mongolia’s Regulatory Landscape 👮♂️

Mongolia is taking significant steps in regulating Bitcoin investment funds to ensure investor protection and financial stability. The regulatory landscape in Mongolia reflects a balanced approach, aiming to foster innovation while mitigating risks associated with digital assets. Authorities are increasingly focused on creating a transparent and secure environment for cryptocurrency investments, emphasizing compliance with anti-money laundering and counter-terrorism financing measures. As the country continues to refine its regulatory framework, investors can expect greater clarity and confidence in navigating the evolving landscape of digital finance.

Benefits of Investing in Bitcoin Funds 💸

Investing in Bitcoin funds opens up a world of potential financial growth and opportunity. With the ability to diversify a portfolio beyond traditional assets, investors can benefit from the potential for high returns in the dynamic cryptocurrency market. Additionally, Bitcoin funds provide a convenient way to gain exposure to digital assets without the need for individual wallet management or security concerns. This accessibility, coupled with the potential for significant gains, makes Bitcoin funds an appealing option for those looking to expand their investment horizons.

Risks and Challenges Investors Face ⚠️

Investing in Bitcoin funds can present investors with a myriad of risks and challenges to navigate. Volatility in the cryptocurrency market is a primary concern, with prices capable of experiencing sudden and significant fluctuations. Security breaches and regulatory uncertainties add another layer of complexity, potentially impacting the investment landscape. Furthermore, the lack of traditional investor protections and the evolving nature of digital assets pose additional challenges for those considering Bitcoin funds. Understanding these risks is crucial for informed decision-making in this dynamic investment space. For further insights on regulatory compliance in the cryptocurrency realm, particularly for Bitcoin investment funds, check out the guidelines provided by bitcoin investment funds regulation in moldova.

Comparing Bitcoin Funds with Traditional Investments 💼

Bitcoin funds and traditional investments differ significantly in terms of accessibility, volatility, and regulatory oversight. While traditional investments like stocks offer stability but limited growth potential, bitcoin funds can provide high returns but come with greater risks. Additionally, traditional investments are typically more heavily regulated, offering investors a sense of security, whereas the decentralized nature of bitcoin funds can lead to uncertainty. Understanding these distinctions can help investors make informed choices based on their risk tolerance and investment goals.

Looking Ahead: Trends and Predictions 🔮

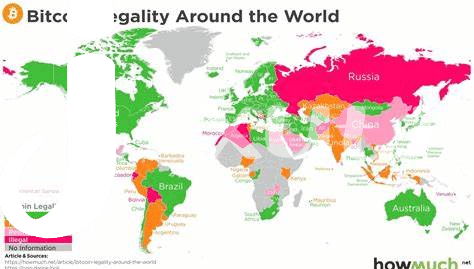

In the dynamic world of cryptocurrency, the future of Bitcoin investment funds is set to evolve rapidly. As technology advances and markets mature, trends and predictions suggest a continued surge in interest and adoption of these innovative financial instruments. Increased regulatory clarity, growing institutional participation, and a shifting global economic landscape are poised to shape the trajectory of Bitcoin funds in the coming years, offering investors new opportunities and challenges to navigate. Embracing these changes can lead to exciting prospects for those engaging in this burgeoning sector.

Bitcoin Investment Funds Regulation in Malta