Introduction of Bitcoin Banks 🏦

Bitcoin banks have emerged as a disruptive force in the finance sector, offering innovative financial services powered by blockchain technology. These digital institutions are reshaping the way individuals interact with their money, providing secure and efficient alternatives to traditional banking. With a focus on transparency and decentralized transactions, Bitcoin banks are opening up new avenues for financial inclusion and empowerment. Their introduction marks a significant shift towards a more accessible and democratized financial landscape, paving the way for a digital-first approach to banking.

Impact on Traditional Banking Systems 💥

The growing presence of Bitcoin banks is reshaping the way traditional banking systems operate. As more Filipinos embrace cryptocurrencies as a means of financial transactions, the competition for market share intensifies. This shift challenges traditional banks to adapt and innovate to remain relevant in an increasingly digital financial landscape. With the emergence of Bitcoin banks offering faster, more secure, and cost-effective transactions, traditional banks are compelled to reconsider their business models to meet the evolving needs of their customers.

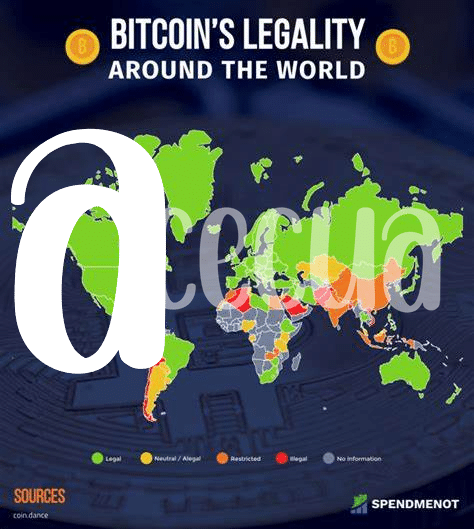

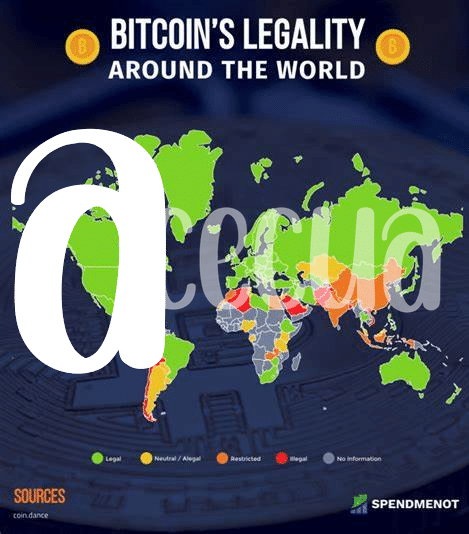

Regulatory Challenges and Opportunities 🚫

Bitcoin banks in the Philippines are faced with navigating a complex regulatory landscape that poses both challenges and opportunities. On one hand, strict regulations can hinder the growth and innovation of these institutions. However, on the other hand, clear regulations can provide a sense of security and legitimacy, enticing more users to adopt digital currencies. Finding the right balance between regulation and innovation will be crucial for the success of Bitcoin banks in the country.

Adoption and Acceptance Among Filipinos 💡

Adoption and acceptance of Bitcoin banks among Filipinos have been steadily growing, reflecting a shift towards embracing digital currency in the country. With an increasing number of individuals opting for the convenience and security offered by these innovative financial services, Bitcoin banks are quickly gaining traction within the local community. This trend signifies a promising future for the integration of cryptocurrency into the everyday lives of Filipinos, paving the way for a more inclusive and accessible financial landscape.

For more insights on Bitcoin banking services regulations in Romania, you can refer to this comprehensive article on bitcoin banking services regulations in Romania.

Future Outlook and Potential Growth 🌱

The emergence of Bitcoin banks in the Philippines signals a promising shift towards a more digitized and accessible financial ecosystem. As these innovative institutions gain traction, the potential for growth in the sector looks promising, opening up new avenues for financial inclusion and digital asset participation. With a forward-looking approach, these Bitcoin banks are poised to play a significant role in shaping the future landscape of finance in the country.

Role in Reshaping the Financial Landscape 🔄

In the ever-evolving landscape of finance, Bitcoin banks are poised to play a pivotal role in reshaping the traditional notions of banking. By leveraging blockchain technology and decentralization, these financial institutions bring about a seismic shift in how transactions are conducted and verified. As they continue to gain traction and acceptance among the masses, the financial landscape of the Philippines is set to undergo a transformative journey towards a more inclusive and efficient system.

Link: bitcoin banking services regulations in Portugal