Introduction to Bitcoin Banking in San Marino 🌟

In San Marino, the emergence of Bitcoin banking has brought about a transformative shift in the financial landscape. With its innovative approach and forward-thinking mindset, this small country is paving the way for a new era of digital banking. As more traditional institutions embrace the power of blockchain technology, San Marino stands at the forefront of this exciting evolution.

Regulatory Challenges and Implications 💡

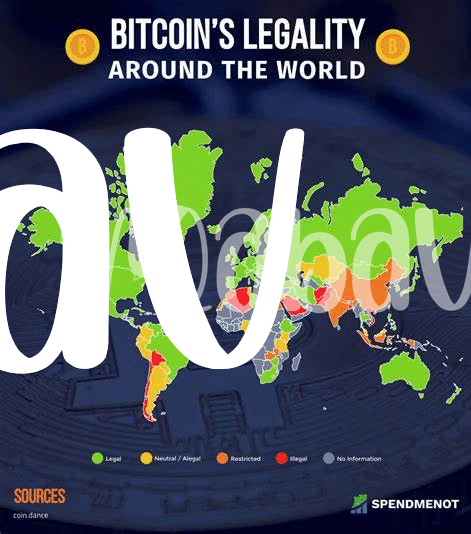

Regulatory challenges in the Bitcoin banking sector of San Marino present a complex landscape that requires careful navigation. The implications of varying regulatory frameworks on market stability and investor protection are significant. Striking a balance between fostering innovation and ensuring compliance is crucial for the sustainable growth of this emerging financial ecosystem. Addressing these challenges proactively can pave the way for a more secure and resilient financial environment.

The Innovative Role of Blockchain Technology 🚀

Blockchain technology, with its decentralized nature and transparent framework, has revolutionized the way transactions are conducted. By utilizing a secure and immutable digital ledger, blockchain eliminates the need for intermediaries, streamlining processes and reducing costs. This innovation has empowered San Marino to explore new possibilities in financial services, paving the way for efficient and secure Bitcoin banking solutions. The ability to validate transactions in real-time and ensure data integrity has positioned blockchain as a key player in reshaping the future of banking in San Marino and beyond.

Benefits of Bitcoin Banking for San Marino 🌈

Bitcoin banking in San Marino brings a spectrum of benefits to the small European nation. By embracing the potential of blockchain technology, the financial landscape is imbued with enhanced security, transparency, and efficiency. Not only does this foster trust among residents and investors, but it also positions San Marino at the forefront of financial innovation. The integration of Bitcoin banking services not only modernizes the financial sector but also opens up new avenues for economic growth and global partnerships. To read more about navigating regulatory hurdles in similar jurisdictions, visit bitcoin banking services regulations in Saint Vincent and the Grenadines.

Future Outlook and Potential Growth 🌿

In the ever-evolving landscape of Bitcoin banking in San Marino, the future outlook holds immense promise and potential growth. With increasing recognition and adoption of digital currencies, the path ahead for San Marino’s embrace of Bitcoin banking is poised for expansion and innovation. As new regulations are set in place and infrastructure is enhanced, the foundation is laid for a thriving ecosystem that can cater to the unique needs of this progressive approach. The continued integration of blockchain technology is set to further bolster the growth trajectory, paving the way for increased efficiency, security, and accessibility in the realm of financial services.

Global Impact and Implications of San Marino’s Approach 🌎

The approach taken by San Marino in embracing Bitcoin banking has far-reaching global implications. As one of the first countries to regulate this innovative financial sector, San Marino sets a precedent that other nations may follow. The impact of San Marino’s forward-thinking approach reverberates across borders, influencing discussions and decisions related to cryptocurrency banking regulations worldwide. This can potentially lead to a more standardized and cohesive framework for the future of digital banking services regulation. To know more about Bitcoin banking services regulations in Samoa, click here: Bitcoin banking services regulations in Sao Tome and Principe.