🌍 Global Reaction to Bitcoin Regulation Changes

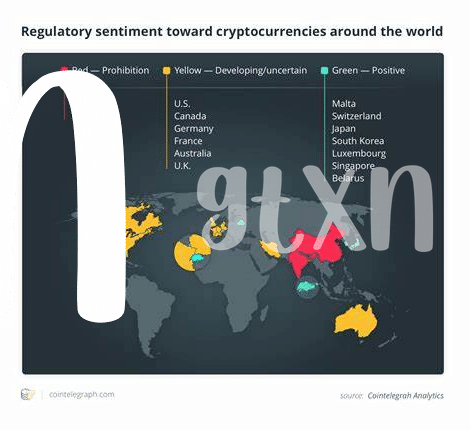

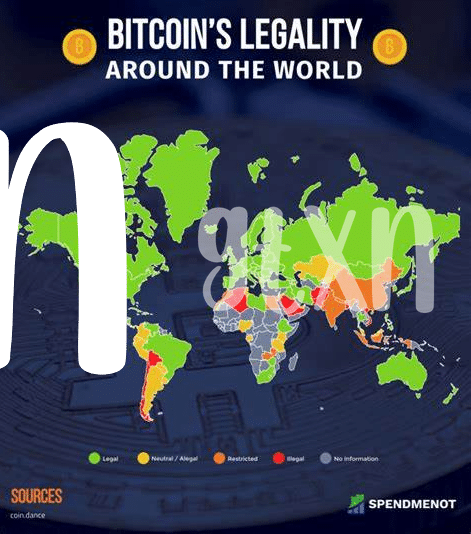

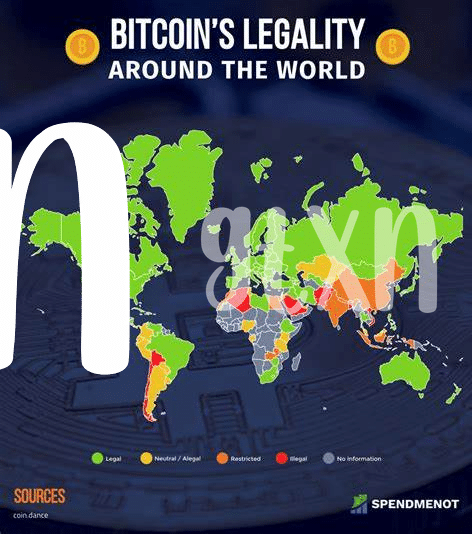

Imagine living in a world where a change in rules for digital money, like Bitcoin, sends ripples across countries, affecting everything from big businesses to the money in your wallet. It’s happening right now. Countries around the globe are watching each other, ready to react as soon as one decides to tighten or loosen its grip on Bitcoin. This game of financial follow-the-leader isn’t just for kicks; it’s reshaping how we think about money. In some parts of the world, new rules have made it easier for businesses to use Bitcoin, encouraging them to innovate and grow. In others, tighter controls have caused a bit of worry, making companies and everyday folks think twice about how they use digital cash. It’s a global conversation, with everyone from government leaders to the person next door tuning in to see how a single change in regulation halfway across the world can affect their wallets.

| Region | Reaction Type | Potential Impact |

|---|---|---|

| Asia | Fast Adoption | Innovative Business Growth |

| Europe | Cautious Regulation | Stability and Predictability |

| Americas | Mixed Approaches | Varied Impact on Investment |

💼 Impact on Businesses and Financial Institutions

When governments start tinkering with Bitcoin regulation, it’s not just the crypto enthusiasts who sit up and take notice. Businesses large and small, as well as the big guns in finance, find themselves on a rollercoaster ride. Imagine a local coffee shop that accepts Bitcoin struggling to keep up with changing rules, while a huge bank scrambles to update its investment strategies. This is more than just a tech issue—it’s a whole new world of challenges and puzzles that these establishments need to solve swiftly to keep their doors open and lights on.

Meanwhile, for companies that have dipped their toes into the digital currency pool, these regulatory shifts can send waves through their operations. It’s like planning a picnic and not knowing if it’ll rain or shine. They might find new hoops to jump through just to stay compliant, or see golden opportunities to innovate and lead the pack. With every new rule, the landscape shifts, pushing everyone from your neighborhood bank to global financial titans to adapt, innovate, or risk falling behind. For a deeper dive into navigating these waters, especially around Bitcoin’s privacy enhancements and the hurdles that still exist, a valuable resource is https://wikicrypto.news/ultimate-guide-choosing-the-safest-bitcoin-wallet.

🛒 Effects on Everyday Shopping and Transactions

Imagine going to your favorite coffee shop and instead of paying with your usual credit card or cash, you use digital currency like Bitcoin. This could become more common as rules around Bitcoin change. For businesses, this means they might need to update their systems to accept this new type of money. For us, it could make buying things quicker and maybe even cheaper because it cuts out some of the middlemen like banks. However, if the rules around Bitcoin keep changing, shops and online sellers might be hesitant to accept it, fearing the value could drop suddenly.

As the world starts to embrace these changes, we could see our shopping habits transform significantly. Imagine buying a sofa from another country without worrying about exchange rates or bank fees. This could make products from around the globe more accessible and potentially cheaper. On the other hand, it puts pressure on local businesses to adapt to these new ways of paying or risk losing out. The key will be finding a balance that protects consumers, supports businesses, and keeps up with the fast pace of technology, all while making sure everyone plays by the rules.

📈 Bitcoin’s Price Fluctuations and Market Predictability

Imagine the roller coaster ride that is Bitcoin’s value; it’s been up and down like a thrilling theme park attraction, making it hard for everyday folks and serious investors alike to guess what’s coming next. This unpredictability isn’t just about making or losing money quickly. It’s closely tied to new rules or changes in how countries feel about Bitcoin, adding more twists and turns. When a big country says, “We’re going to watch Bitcoin more closely,” or “Let’s welcome Bitcoin with open arms,” the price can soar or dip in response. This dance between new rules and Bitcoin’s price also opens the door for smart minds to dream up fresh tech goodies that could make using Bitcoin smoother and more secure. Meanwhile, understanding the delicate balance between privacy in the Bitcoin network: enhancements and challenges regulatory outlook can offer insights into potential shifts in this ongoing saga. Businesses, seeing these ups and downs, might scratch their heads, thinking about how to dip their toes into Bitcoin or blockchain technology without getting swept away by sudden waves in the market. This entire scenario isn’t just about watching numbers go up and down; it’s a lively chapter in the story of Bitcoin that impacts everyone from the techy neighbor next door tinkering with a new blockchain project to the big suits in finance tracking their investments.

🌱 Growing Opportunities for New Tech Innovations

As the winds of Bitcoin regulation sweep across the globe, a seed of opportunity is planted in the fertile soil of technology. With each change in regulation, creative minds and tech wizards spring into action, envisioning and crafting innovations that could redefine our digital world. From secure, blockchain-based voting systems to smart contracts that shake up traditional legal frameworks, these advancements promise to address some of the most pressing challenges of our time. This surge in innovation isn’t just about making transactions faster or more secure; it’s about reimagining what’s possible in a world where digital currency is as commonplace as email. Plus, as governments and regulatory bodies adapt to these changes, the landscape for these technologies becomes even more intriguing, fostering a hotbed for the next big breakthroughs in tech.

| Innovation Area | Potential Impact |

|---|---|

| Blockchain Voting Systems | Enhances security and transparency in elections. |

| Smart Contracts | Automates and enforces agreements without intermediaries. |

| Digital Identity Verification | Streamlines and secures the process of identity verification. |

🏛️ Government Responses and Future Regulation Speculations

Around the world, governments are waking up to the buzz of Bitcoin and are crafting rules to keep up with the fast-paced changes. This wave of regulation is not just about keeping things in order, but it’s also about laying down the groundwork for the future of finance. Imagine a world where buying your morning coffee or investing your savings is safer and simpler because the rules are clear and fair. That’s the dream, but getting there is a big task for governments. They’re discussing and debating, trying to find that sweet spot where innovation can bloom without causing chaos. Some are cautious, worried about the unknown, while others are embracing the challenge, ready to take the lead in shaping the future.

In the midst of all this, there’s a lot of talk about what comes next. It’s like a puzzle where each piece represents different interests — from protecting consumers to keeping the economy stable. Curious about how this affects you, from your wallet to the wider world of shopping and saving? A deep dive into the future of digital identity verification with Bitcoin regulatory outlook might just have the answers. As these conversations continue, one thing is clear: the decisions made today will ripple through the markets and technology of tomorrow. Embracing change while securing the basics is the balancing act at the heart of it all.