Exploring the Basics of Money Transfer 🏦

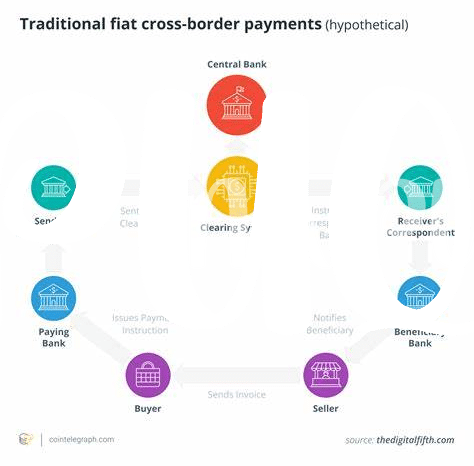

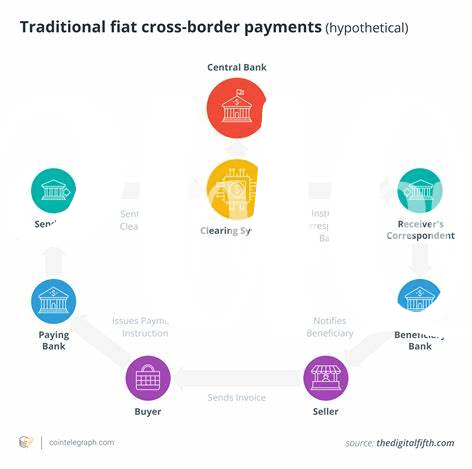

When we send money across borders, it’s like sending a digital postcard from one country to another. Imagine you’re in New York and want to send $100 to a friend in Paris. Traditionally, you’d walk into a bank or use an online service. They’d take your dollars, convert them into euros, and make sure your friend in Paris can pick them up or receive them in their bank account. Sounds simple, right? But, this process involves quite a few steps behind the scenes – like verifying identities, making sure the money isn’t for anything shady, and actually moving the dollars to euros where your friend can pick them up.

| Step in Process | What Happens |

|---|---|

| 1. You Decide to Send Money | You choose an amount and a company to help send it. |

| 2. Identity Verification | The company checks you’re really you to keep things safe. |

| 3. Currency Conversion | Your dollars are turned into the right currency for the receiver. |

| 4. Transfer Executed | The money makes its way to your friend’s pocket or bank account. |

This whole process is designed to be smooth and secure, ensuring that your money reaches its destination safely. However, traditional methods often involve various fees and can take several days, which is why some look for faster and cheaper alternatives, like using digital currencies such as Bitcoin.

What Makes Bitcoin Different? ⚡

Bitcoin sparkles in the world of money transfer for its unique approach. Unlike traditional banking systems that rely on an army of middlemen, Bitcoin operates on a global network called blockchain. Imagine it as a giant ledger where transactions are recorded in real-time and secured by cryptography. This means anyone, anywhere, can send or receive money without needing a bank’s permission or paying hefty fees. Plus, this digital currency isn’t tied to any country or subject to government control, making it a citizen of the world.

But here’s where it gets really interesting. Traditional money transfers can feel like they’re stuck in traffic, with days needed to cross borders. Bitcoin, on the other hand, moves with the speed of an email. And for those interested in the nitty-gritty of maximizing their Bitcoin potential, diving into advanced strategies such as those discussed in https://wikicrypto.news/ai-driven-investment-strategies-tailored-for-the-bitcoin-market can provide keen insights into navigating this dynamic market. Whether for savings, investment, or transfer, Bitcoin’s blend of speed, low cost, and global reach offers a compelling alternative to traditional methods.

Comparing Fees: Banks Vs Bitcoin 💰

When we dive into the world of sending money across borders, the difference in costs between traditional banks and Bitcoin is like night and day 🌓. Banks, with their established systems, often include a series of fees that can quickly add up. From service charges to hidden fees tucked away in the exchange rates, the amount you send is often not the same as what arrives. It’s a bit like expecting a full glass of juice but receiving one that’s three-quarters full because of all the sips taken along the way.

On the flip side, Bitcoin operates on a sleek digital ledger called blockchain, cutting out the middleman and often resulting in lower fees ⚖️. Unlike banks that have opening and closing times, Bitcoin never sleeps, which means you can send money anytime, without the extra wait or cost for it being a weekend or holiday. Yet, it’s not all sunshine and rainbows; the fees for sending Bitcoin can vary depending on how busy the network is. Picture a highway; the more cars (or transactions), the slower the traffic. However, even with this variability, the cost is generally still less than the tall orders charged by banks.

The Speed Factor: Time Is Money ⏱

When we talk about sending money across borders, how quickly it reaches its destination can really make a difference, especially in our fast-paced world. Imagine, you’re trying to help a friend stuck in another country or paying for a service that’s on a tight deadline; every second counts. Traditional banks can take days to process international transfers, leaving both sender and receiver on pins and needles. Now, let’s talk Bitcoin. It’s like a speedy delivery service that operates 24/7, making it possible for money to zip across the globe in minutes or just a few hours. However, it’s not just about speed; knowing how to navigate the waters of digital currency can optimize both time and costs. For those looking to dive deeper into making the most of Bitcoin transactions mastering bitcoin technical analysis for profitable trading market trends offers a treasure trove of insights. So, in the race against time in financial transactions, Bitcoin is like a sleek sports car, weaving through traffic, offering a glimpse into a future where waiting for money to arrive becomes a thing of the past. 🏁💨

How Security Measures up 🔒

When we talk about keeping your money safe, both traditional banks and Bitcoin have their ways of locking the door tight. Imagine a massive vault; banks have been building theirs for centuries, using layers of physical and digital security. They’ve got everything from armored trucks to encrypted data, all to keep your hard-earned cash from falling into the wrong hands. On the flip side, Bitcoin operates in the digital realm, relying on something called blockchain technology. Think of it as a super-secret code that’s not just tough but almost impossible to crack. Every Bitcoin transaction is like a digital puzzle, and only the rightful owner holds the key.

Yet, the question of which is safer tends to pop up like a game of whack-a-mole. The truth is, security in the financial world isn’t just about strong locks; it’s about transparency and control. With banks, there are many eyes on your money, from government agencies to internal audits. Bitcoin, however, offers a unique kind of security: the power is in your hands. Transactions are public but anonymous, and you hold the keys to your digital wallet. But remember, with great power comes great responsibility. If you lose your key (literally, your digital key), your Bitcoin might as well be on the moon.

| Security Feature | Traditional Banking | Bitcoin |

|---|---|---|

| Physical/Digital Safeguards | Yes | Digital Only |

| Regulatory Oversight | High | Minimal |

| User Control Over Security | Limited | High |

| Transaction Privacy | Minimal | High |

| Recovery Options for Lost/Stolen Assets | Yes | Limited |

The Impact of Market Fluctuations 📉

Imagine a rollercoaster – that’s pretty much what it’s like with Bitcoin and other cryptocurrencies when it comes to their prices 📉. Now, think about sending money to a friend in another country. The amount of money they get can swing up and down just like a rollercoaster because of these price changes. This can be exciting, but also a bit nerve-wracking. For instance, you might send $100 worth of Bitcoin, but by the time your friend gets it, it might be worth more or less than $100, depending on how Bitcoin’s price has moved. It’s like the weather 🌦️, unpredictable. This isn’t something you usually face with traditional money transfers through banks, as their rates are pretty stable. However, this unpredictability of Bitcoin can be a double-edged sword. On one hand, you might benefit from a positive swing in value, but on the other hand, there’s a risk it could swing the other way. This is why the topic of market fluctuations is like keeping an eye on the horizon while sailing. To dive deeper into the intricate dance between digital currency prices and their impact, explore bitcoin in literature and film: a cultural study market trends, which sheds light on how artificial intelligence intersects with Bitcoin trading, offering insights into its unpredictable voyage through the market’s waves.