Bitcoin’s Impact on International Remittances 🌍

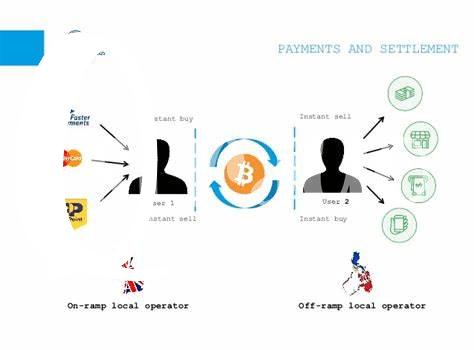

Bitcoin, with its decentralized nature, has revolutionized international remittances by offering a borderless and efficient means of transferring funds across borders. Its impact on international remittances has been profound, providing a faster and more cost-effective alternative to traditional banking channels. By enabling peer-to-peer transactions without the need for intermediaries, Bitcoin has empowered individuals to send money globally with reduced fees and quicker settlement times. This innovation has particularly benefited individuals in countries like Senegal, where traditional remittance services can be expensive and slow. The use of Bitcoin for international remittances has the potential to improve financial inclusion and create greater economic opportunities for individuals in regions where access to traditional banking services may be limited.

Regulatory Challenges for Bitcoin in Senegal 📜

Bitcoin has significantly impacted international remittances in Senegal, offering a faster and more cost-effective way to transfer funds across borders. However, this innovation has also brought about regulatory challenges for Bitcoin use in the country. The decentralized nature of Bitcoin raises concerns for regulating authorities, leading to uncertainties in defining its legal status and oversight mechanisms within the existing financial framework.

In navigating these challenges, ensuring compliance with anti-money laundering laws emerges as a pivotal aspect. Regulators in Senegal are tasked with establishing robust measures to prevent illicit financial activities while maintaining an environment conducive to technological advancements. Collaboration between policymakers, financial institutions, and technology experts becomes crucial in striking a balance between fostering innovation and safeguarding the financial system’s integrity.

Ensuring Compliance with Anti-money Laundering Laws 💰

Bitcoin’s increasing popularity in cross-border transfers brings with it the critical need to ensure compliance with anti-money laundering laws. In Senegal, as in many countries, regulators are grappling with the challenges posed by the decentralized nature of cryptocurrencies and the potential for anonymity in transactions. Upholding the integrity of the financial system while embracing the innovation of Bitcoin requires a delicate balance between fostering technological advancements and preventing illicit activities.

Moving forward, collaboration between regulatory bodies, financial institutions, and technology experts will be crucial in developing robust mechanisms to detect and deter money laundering through Bitcoin transactions. By leveraging advanced monitoring tools, implementing know-your-customer protocols, and promoting transparency in cross-border transfers, Senegal can harness the benefits of Bitcoin while safeguarding its financial ecosystem against illicit activities. As the regulatory landscape evolves, continued vigilance and proactive measures will be essential in safeguarding against potential risks and ensuring the responsible use of Bitcoin in international remittances.

Technological Solutions for Secure Cross-border Transfers 🔒

When it comes to secure cross-border transfers, technology plays a crucial role in ensuring the safety and efficiency of the process. From utilizing blockchain technology to implementing advanced encryption methods, technological solutions are continuously evolving to meet the growing demands of cross-border transactions. These solutions not only provide a secure platform for transferring funds internationally but also offer transparency and traceability, which are essential in the realm of digital finance. By leveraging cutting-edge technologies, the potential risks associated with cross-border transfers can be mitigated, offering users peace of mind and confidence in their transactions.

For further insights on how Bitcoin is impacting cross-border money transfers globally, especially in light of regulatory challenges, you can explore more detailed information on bitcoin cross-border money transfer laws in San Marino at WikiCrypto News.

Tax Implications of Bitcoin Transactions in Senegal 💸

Bitcoin transactions in Senegal may have varying tax implications depending on the nature of the transaction. Understanding the taxation aspects of Bitcoin can be complex, as the regulatory environment is still evolving. Ensuring compliance with tax laws is crucial to avoid potential penalties or legal issues. Individuals and businesses involved in Bitcoin transactions should keep detailed records of their activities to accurately report income and pay the appropriate taxes. Seeking professional advice from tax experts can help navigate the complexities of this emerging area. As Senegal continues to develop its regulatory framework for Bitcoin, clarity on tax implications will be essential for both regulatory compliance and fostering a transparent financial ecosystem.

Future Outlook for Bitcoin in Senegal 🚀

As Senegal continues to navigate the evolving landscape of Bitcoin, there are promising signs for the future of cryptocurrency in the country. With increasing awareness and adoption rates, Bitcoin has the potential to revolutionize the financial sector in Senegal, offering individuals and businesses efficient and cost-effective cross-border transfer solutions. As the regulatory framework becomes clearer and more accommodating, the path forward for Bitcoin in Senegal appears optimistic. Additionally, technological advancements and secure platforms are enhancing the overall user experience, ensuring smoother transactions and heightened security measures. While tax implications remain a point of consideration, the overall outlook for Bitcoin in Senegal is imbued with promise and potential for continued growth and integration within the financial ecosystem. It’s exciting to witness the transformation and possibilities that Bitcoin brings to Senegal’s financial landscape.

For more information on Bitcoin cross-border money transfer laws in Saint Kitts and Nevis, please refer to the regulations outlined in Bitcoin cross-border money transfer laws in Saint Kitts and Nevis.