Understanding the Legalities 📜

Bitcoin transactions in the Marshall Islands are subject to a complex web of legal considerations that shape the landscape for cross-border transfers. Navigating the legalities requires a nuanced understanding of both local regulations and the global framework governing cryptocurrencies. Key aspects include the recognition of Bitcoin as a legal form of payment, the taxation implications of transactions, and compliance with anti-money laundering laws. Furthermore, the interplay between traditional financial systems and blockchain technology adds an additional layer of complexity. By grasping these legal nuances, individuals and businesses can engage in cross-border Bitcoin transfers with confidence, knowing they are operating within the bounds of the law.

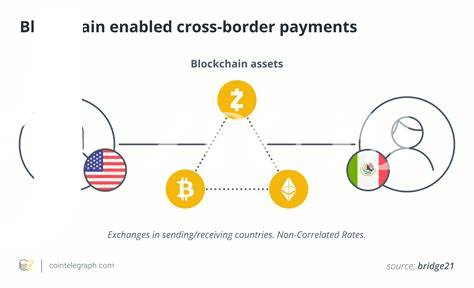

Impact on Cross-border Transactions 💸

The increasing use of Bitcoin for cross-border transactions in the Marshall Islands has brought about significant shifts in the financial landscape. As a decentralized digital currency, Bitcoin offers a borderless and efficient means of transferring funds across international boundaries, reducing the reliance on traditional banking systems. The direct peer-to-peer nature of Bitcoin transactions facilitates quicker settlements and lower transaction fees compared to traditional banking methods. This disruptive technology has the potential to streamline cross-border transactions, particularly in regions where access to banking services is limited or costly. However, the regulatory environment surrounding Bitcoin transfers presents challenges that require careful navigation to ensure compliance with local laws and regulations. Despite these challenges, the adoption of Bitcoin for cross-border transactions in the Marshall Islands signals a promising future for the digital asset in revolutionizing the way money moves across borders.

Regulatory Challenges and Opportunities 🚦

Navigating the ever-evolving regulatory landscape presents both challenges and opportunities for Bitcoin cross-border transfers in the Marshall Islands. The dynamic nature of regulations means that staying compliant can be a complex task, requiring a thorough understanding of the legal framework. However, these challenges also create room for innovative solutions and new approaches to compliance. By proactively addressing regulatory requirements, businesses can differentiate themselves and gain a competitive edge in the market. Embracing these challenges as opportunities for growth and development can lead to a more robust and sustainable ecosystem for Bitcoin transactions in the Marshall Islands. As the regulatory environment continues to evolve, organizations that adapt effectively will be well-positioned to capitalize on the opportunities that arise, shaping the future of cross-border transfers in the region.

Navigating Compliance Requirements 🧭

Navigating compliance requirements can be a complex journey for individuals and businesses engaging in Bitcoin cross-border transfers in the Marshall Islands. Understanding and adhering to the legal frameworks and regulations in place is crucial to ensure smooth and lawful transactions. Keeping up with evolving compliance standards and staying abreast of regulatory updates will be key in navigating this dynamic landscape. By proactively addressing compliance requirements, stakeholders can mitigate risks and build trust within the ecosystem. Utilizing tools and resources that facilitate compliance, such as regulatory guides and expert advice, can help streamline the process and ensure adherence to the necessary protocols. Embracing a proactive approach to compliance not only fosters legitimacy but also paves the way for sustainable growth and innovation in Bitcoin cross-border transactions. For further insights into similar topics, you can explore more about bitcoin cross-border money transfer laws in Malta on [Wikicrypto News](https://wikicrypto.news/exploring-the-future-of-bitcoin-money-transfers-in-maldives) platform.

Future Outlook for Bitcoin in the Marshall Islands 🔮

As the Marshall Islands continues to explore the integration of Bitcoin into its financial landscape, the future outlook appears promising. With the potential to streamline cross-border transactions and offer new opportunities for economic growth, Bitcoin is poised to play a significant role in shaping the country’s financial future. As regulatory frameworks evolve to accommodate digital currencies, the Marshall Islands has the chance to position itself as a leader in the adoption of innovative financial technologies. By embracing the opportunities presented by Bitcoin and addressing the accompanying regulatory challenges, the Marshall Islands can pave the way for a more efficient and inclusive financial system. As stakeholders work towards establishing a clear roadmap for the future of Bitcoin in the country, there is optimism surrounding the potential benefits that this digital currency can bring to the Marshall Islands.

Conclusion: the Path Forward 🌟

The path forward for Bitcoin in the Marshall Islands is filled with promise and potential. As regulations continue to evolve and adapt to the changing landscape of digital currencies, businesses and individuals alike must stay informed and proactive in navigating the compliance requirements. The future outlook for Bitcoin in this jurisdiction looks positive, with opportunities for growth and innovation on the horizon. By understanding the legalities, impacts on cross-border transactions, and regulatory challenges, stakeholders can position themselves to benefit from the advancements in this space. As we move towards a more interconnected global economy, the role of Bitcoin in cross-border money transfers is likely to increase, offering new avenues for financial inclusion and efficiency. By staying abreast of developments and actively engaging with the regulatory framework, the Marshall Islands can pave the way for a bright future in the realm of digital assets and cross-border transactions.

Bitcoin cross-border money transfer laws in Maldives