Background on Uzbekistan’s Cross-border Money Transfer Rules 🌍

Uzbekistan’s cross-border money transfer rules have undergone significant developments in recent years, reflecting the country’s stance on financial regulations. These rules dictate how funds can be sent and received across borders, impacting not only traditional banking transactions but also the emerging field of cryptocurrency. Understanding the nuances of these regulations is crucial for anyone looking to engage in financial activities involving Uzbekistan.

For individuals involved in Bitcoin trading, Uzbekistan’s cross-border money transfer rules play a pivotal role in shaping their strategies and approaches. The regulations set in place can either facilitate or hinder the flow of funds related to cryptocurrency transactions, influencing the overall landscape of digital asset trading within the country. As Uzbekistan continues to refine its policies in this area, the implications for Bitcoin users are multifaceted, requiring a nuanced understanding of both regulatory compliance and the evolving digital economy.

Impact of Regulations on Bitcoin Trading 💰

Uzbekistan’s cross-border money transfer rules have sparked significant repercussions for Bitcoin trading within the region. The regulatory landscape has cast a shadow of uncertainty over the once-thriving cryptocurrency market, leading to a cautious approach among traders and investors alike. The restrictions imposed on cross-border transactions have not only hindered the free flow of Bitcoin but have also raised concerns about the future viability of digital assets in Uzbekistan.

Despite the challenges posed by regulatory constraints, Uzbek Bitcoin users have been resilient in navigating the shifting landscape. Many have turned to innovative solutions and alternative methods to continue engaging in cryptocurrency trading while staying compliant with the evolving regulations. This adaptability showcases the determination of the community to uphold the principles of decentralization and financial autonomy, even in the face of regulatory pressures.

Challenges Faced by Uzbek Bitcoin Users 🔒

Uzbek Bitcoin users face a unique set of challenges in navigating the cryptocurrency landscape within the country. The primary hurdle lies in the limited infrastructure and support for accessing and utilizing Bitcoin securely. With restrictive regulations in place, users often encounter difficulties in finding reliable exchanges and platforms for trading and storing their digital assets. Additionally, the lack of widespread awareness and education about Bitcoin poses a barrier, leading to skepticism and hesitation among potential users. Moreover, the volatile nature of cryptocurrency markets adds another layer of complexity, making it challenging for Uzbek Bitcoin users to effectively manage and grow their investments. Despite these obstacles, the growing interest and demand for Bitcoin in Uzbekistan point towards a resilient community eager to adapt and thrive in the evolving financial landscape.

Potential Opportunities for Cryptocurrency Innovation 🚀

Potential Opportunities for Cryptocurrency Innovation 🚀

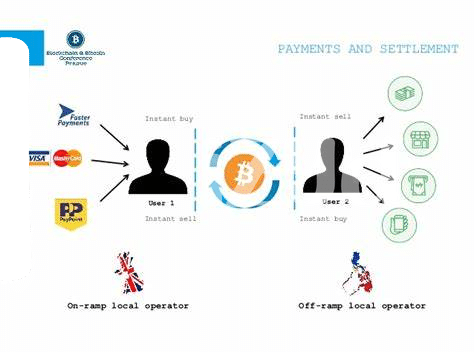

Within Uzbekistan’s evolving regulatory landscape, there lies a compelling opportunity for cryptocurrency innovation to flourish. As traditional financial systems adapt to the changing dynamics of cross-border money transfers, there is a growing space for digital assets like Bitcoin to redefine how value is exchanged globally. The embrace of blockchain technology and decentralized finance principles could pave the way for novel solutions that cater to the needs of both businesses and individuals in Uzbekistan. By leveraging the inherent transparency and security features of cryptocurrencies, innovative platforms and services can facilitate seamless cross-border transactions, enhance financial inclusion, and empower users to take control of their assets. This shift towards embracing digital currencies not only presents efficiencies in the financial sector but also opens up avenues for new forms of economic empowerment and technological advancement. As Uzbekistan navigates this terrain of regulatory change, the potential for cryptocurrency innovation to drive progress and foster financial independence remains a compelling prospect for the future.

(Associated link: bitcoin cross-border money transfer laws in venezuela)

International Implications of Uzbekistan’s Policy Shifts 🌐

Uzbekistan’s recent policy shifts regarding cross-border money transfer rules have sparked significant interest and attention on the international stage. These changes have led to discussions and debates within the global financial community about the implications for Bitcoin and other cryptocurrencies. The evolving regulatory landscape in Uzbekistan has raised questions about how these shifts could influence the broader cryptocurrency market and affect cross-border transactions involving digital assets. As stakeholders closely monitor and analyze the unfolding developments in Uzbekistan, there is a growing recognition of the need for collaboration and coordination among countries to address the challenges and opportunities presented by these policy changes. The international implications of Uzbekistan’s policy shifts underscore the interconnected nature of the global financial system and highlight the importance of proactive engagement and dialogue among regulators, industry players, and technology innovators to navigate the evolving landscape of cross-border payments and digital currencies.

Conclusion and Future Outlook for Bitcoin in Uzbekistan 🌱

The future outlook for Bitcoin in Uzbekistan signifies a pivotal moment in the country’s financial landscape. With evolving cross-border money transfer rules shaping the regulatory framework, the cryptocurrency industry is set to navigate both challenges and opportunities. As Uzbek Bitcoin users adapt to regulatory shifts and restrictions, there emerges a potential for innovative solutions within the cryptocurrency space. Looking ahead, the international implications of Uzbekistan’s policy decisions can influence broader trends in digital asset transactions, sparking conversations on global regulatory harmonization. Despite the complexities, the trajectory for Bitcoin in Uzbekistan hints at a landscape ripe for growth and adaptation, where the intersection of technology and regulation will continue to redefine financial dynamics in the region.

To learn more about Bitcoin cross-border money transfer laws in the United Kingdom, click bitcoin cross-border money transfer laws in Ukraine.