The Rise 🚀 of Bitcoin Investments

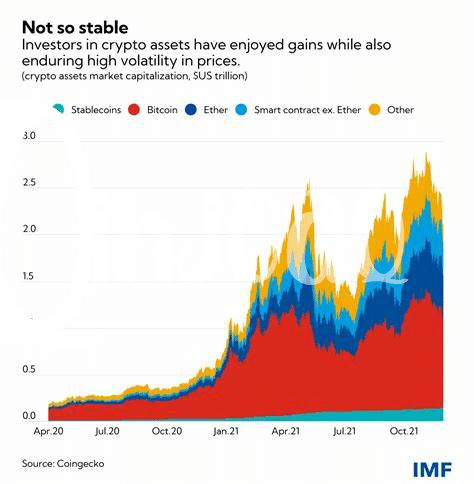

The rapid surge in popularity and adoption of Bitcoin investments has been nothing short of remarkable. Investors around the globe are increasingly drawn to the potential returns and diversification benefits that digital assets offer. This meteoric rise has not only captured the attention of individual investors but has also piqued the interest of institutional players seeking exposure to this burgeoning asset class. The allure of decentralized finance and the promise of blockchain technology have propelled Bitcoin investments into the mainstream, signaling a fundamental shift in the traditional investment landscape.

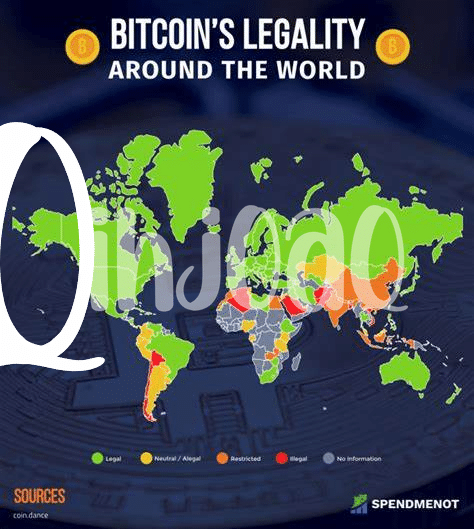

Regulatory Landscape 📜 in Djibouti

Within Djibouti’s dynamic financial landscape, the regulatory framework for Bitcoin investment funds is evolving. The authorities are carefully assessing the implications of digital assets on the traditional investment landscape. The regulatory landscape reflects a balancing act between fostering innovation and ensuring investor protection. As the country evaluates the role of Bitcoin funds, regulatory clarity is essential to nurture a conducive environment for investment growth. Despite challenges, such as the need for comprehensive regulations, Djibouti is poised to leverage opportunities in the digital asset space.

Challenges ↔️ and Opportunities 💡

The evolving regulatory landscape in Djibouti poses both challenges and opportunities for Bitcoin investment funds. As regulations continue to shape the investment environment, fund managers face the challenge of navigating complex compliance requirements while also capitalizing on the growing interest in digital assets. However, these regulatory frameworks also present opportunities for innovation and growth within the sector. By staying abreast of regulatory changes and adapting their strategies, investment funds can position themselves to thrive in this dynamic market.

Investor Confidence 💰 in Bitcoin Funds

Investor confidence in Bitcoin funds is crucial for the growth of the cryptocurrency market. With the increasing popularity of Bitcoin investments, potential investors in Djibouti are seeking reassurance on the security and reliability of these funds. Establishing trust through transparent practices and compliance with regulatory standards can enhance investor confidence and attract more participation in the Bitcoin investment sector. Educating investors about the opportunities and risks associated with these funds is essential for building a strong foundation of trust in the evolving digital asset landscape. Interested in exploring more about Bitcoin investment funds regulation in Cyprus? Check out this insightful article on bitcoin investment funds regulation in Cyprus for valuable insights.

Future Outlook 🔮 for Investment Funds

In the realm of Bitcoin investment funds in Djibouti, the future outlook is both promising and challenging. As the regulatory landscape continues to evolve, so do the potential opportunities for investors. With increasing awareness and acceptance of digital assets, there is a growing sense of optimism surrounding the future of investment funds in the region. However, navigating this dynamic environment will require a strategic approach and ongoing adaptability to regulatory changes. Embracing innovation while maintaining compliance will be key to the long-term success of Bitcoin investment funds in Djibouti.

Navigating 🧭 the Regulatory Environment

Bitcoin investment funds in Djibouti face the challenge of navigating a regulatory landscape that is still evolving. To succeed in this environment, fund managers must stay informed about the latest regulatory updates and guidelines. Engaging with local authorities and industry experts can help in understanding and complying with regulations effectively. Building strong relationships within the regulatory community and actively participating in industry discussions can also provide valuable insights and guidance for managing compliance requirements. By proactively adapting to regulatory changes and fostering transparency, investment funds can enhance their credibility and sustainability in Djibouti’s growing Bitcoin investment market.

If you want to learn more about how Bitcoin investment funds are regulated in different countries, you can explore the regulations governing these funds in the Dominican Republic and the Democratic Republic of the Congo. Click here to read about bitcoin investment funds regulation in the Dominican Republic and gain insights into the regulatory framework impacting investment funds in the Democratic Republic of the Congo.bitcoin investment funds regulation in democratic republic of the congo