Overview of Finnish Bitcoin Regulations 🇫🇮

Finnish Bitcoin regulations set a clear framework for digital currency operations within the country. With a forward-thinking approach, Finland has established guidelines that promote innovation while ensuring compliance. By providing legal certainty, these regulations contribute to a stable environment for the development of Bitcoin banking services, fostering growth and attracting investors seeking a robust regulatory landscape.

Impact on Banking Services 🏦

Finnish laws regarding Bitcoin have significantly influenced the banking sector in the country. These regulations have prompted banks to adapt their services to accommodate the growing demand for crypto transactions. As a result, traditional banks are exploring innovative ways to incorporate blockchain technology into their operations to ensure compliance and enhance customer trust. Despite facing challenges, such as regulatory compliance issues, Finnish banks are striving to provide secure and transparent Bitcoin banking services to their customers.

Challenges and Compliance Issues 💼

Finnish laws shape the landscape for Bitcoin banking services, sparking various challenges and compliance issues. Adhering to stringent regulations requires financial institutions to navigate complex legal frameworks while ensuring customer privacy and security. Striking a balance between regulatory requirements and technological innovation poses a significant obstacle for Bitcoin banking services operating in Finland, necessitating continuous monitoring and adaptation. Complying with anti-money laundering and know your customer regulations are among the top priorities for businesses in the cryptocurrency industry, aiming to foster trust and legitimacy within the evolving financial sector.

Innovation and Blockchain Technology 🚀

Finnish laws play a pivotal role in shaping the landscape of Bitcoin banking services, particularly in fostering innovation and adoption of blockchain technology within the banking sector. These regulations provide a framework that encourages financial institutions to explore new ways of incorporating blockchain solutions to improve their services and operations. By embracing these advances, banks can offer customers more efficient and secure transactions while also driving forward-thinking strategies that benefit both the institution and its clients.

For a deeper understanding of the regulatory challenges facing Bitcoin businesses in Greece, and the impact on banking services, visit bitcoin banking services regulations in Gabon.

Customer Protection and Transparency 🔒

Customer protection and transparency are paramount in the realm of Bitcoin banking services. Finnish regulations play a crucial role in ensuring that users are safeguarded against potential risks and fraudulent activities. By promoting transparency, customers can have confidence in the security measures implemented by banks and other service providers, ultimately fostering trust in the system. This focus on protection and transparency not only benefits individual users but also contributes to the overall stability and integrity of the Bitcoin ecosystem.

Future Prospects and Global Influence 🌍

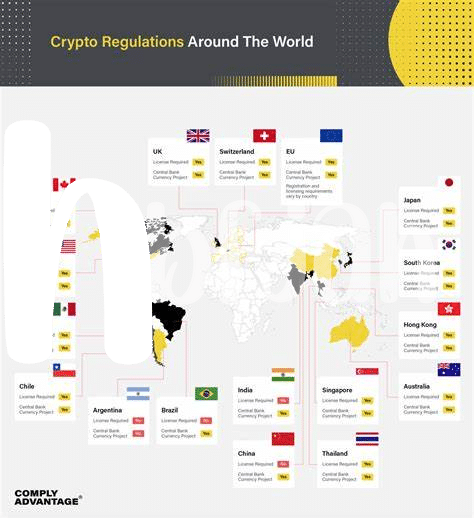

Finnish laws on Bitcoin have the potential to shape the future landscape of global banking services. The forward-thinking approach of Finland in regulating cryptocurrencies could serve as a model for other countries seeking to navigate the complexities of this emerging technology. By addressing challenges, fostering innovation, and prioritizing customer protection, Finland’s regulatory framework stands to influence the broader international community. As blockchain technology continues to evolve, the impact of Finnish laws on Bitcoin is likely to extend beyond borders, contributing to a more transparent and secure financial ecosystem.

Bitcoin Banking Services Regulations in Germany with anchor “bitcoin banking services regulations in Greece” offer a comparative insight into how different countries are approaching the regulation of digital currencies.