Bitcoin Acceptance 💸

In recent years, the Bahamas has witnessed a gradual but significant shift towards embracing Bitcoin in various sectors of the economy. This shift not only reflects a growing acceptance of digital currencies but also signifies a shifting mindset towards modern financial technologies. Businesses, both large and small, are beginning to recognize the benefits of incorporating Bitcoin as a payment option, leading to increased convenience for locals and tourists alike. The widespread adoption of Bitcoin in the Bahamas is not just a reflection of global trends but also a step towards creating a more financially inclusive society.

Financial Inclusion 🌍

In the context of the Bahamas’ economy, embracing Bitcoin can have a significant impact on boosting financial inclusion among various segments of society. By integrating Bitcoin into the financial ecosystem, individuals who are typically excluded from traditional banking services can now access secure and cost-effective digital financial solutions. This advancement not only promotes greater participation in the economy but also empowers underserved communities to engage more actively in financial activities, thereby fostering a more inclusive economic landscape.

Furthermore, the integration of Bitcoin can catalyze the development of innovative financial products and services that cater to the diverse needs of the population. This can lead to a more dynamic and competitive financial sector, offering a broader range of options for individuals and businesses to manage their finances efficiently. Ultimately, the promotion of financial inclusion through Bitcoin adoption lays a foundation for sustainable economic growth and empowers individuals to make meaningful contributions to the overall economic vibrancy of the Bahamas.

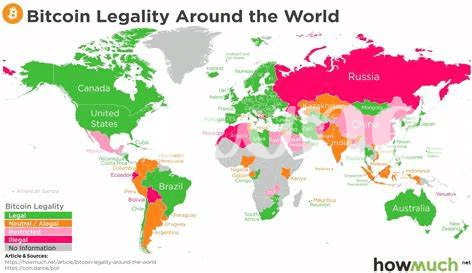

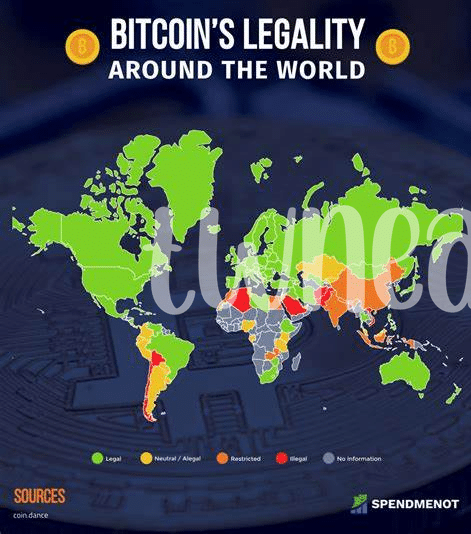

Regulatory Challenges 🚫

When exploring the landscape of Bitcoin in the Bahamas, it becomes evident that navigating regulatory challenges is a crucial aspect that stakeholders must address. The evolving regulatory framework surrounding cryptocurrencies poses both opportunities and obstacles for the country’s economic landscape. Striking a balance between fostering innovation and ensuring consumer protection requires a comprehensive approach to policy-making. As the Bahamas grapples with defining the legal status of Bitcoin, policymakers face the task of creating a robust framework that promotes market integrity while mitigating potential risks. Embracing this challenge with foresight and adaptability will be instrumental in harnessing the full potential of this emerging financial landscape.

Economic Growth Potential 💰

The potential for economic growth in the Bahamas through the acceptance and integration of Bitcoin is significant. By embracing this digital currency, the country opens up new avenues for investment, trade, and financial innovation. This move can attract both local and international interest, boosting economic activity and creating opportunities for businesses and entrepreneurs. With the right regulations and infrastructure in place, Bitcoin can serve as a catalyst for job creation, technological advancement, and overall prosperity. The Bahamas has the chance to position itself as a forward-thinking economy, embracing the digital revolution and reaping the rewards that come with it.

Tourism Impact 🌴

The integration of Bitcoin into the Bahamas’ economy has the potential to revolutionize the tourism industry. With the ease and speed of cryptocurrency transactions, visitors can enjoy a seamless payment experience, leading to increased tourist satisfaction. Additionally, businesses that embrace Bitcoin payments can attract tech-savvy tourists who appreciate the convenience and innovative approach. This shift towards digital currency in tourism not only enhances the overall visitor experience but also signals the Bahamas as a forward-thinking destination in the global market.

Future Outlook 🔮

In the ever-evolving landscape of cryptocurrencies, the future outlook for Bitcoin in the Bahamas appears promising. As global interest in digital currencies continues to grow, the legalization of Bitcoin could pave the way for innovative financial solutions and increased investment opportunities. The adoption of Bitcoin may lead to greater financial inclusion for marginalized communities, bridging the gap between traditional banking systems and modern digital assets. However, regulatory challenges must be carefully navigated to ensure consumer protection and market stability. With the potential for economic growth and the unique impact on tourism, the future of Bitcoin in the Bahamas holds exciting possibilities for the nation’s economy.

Insert the link: is Bitcoin legal in Australia? at an appropriate location in the text.