Overview of Aml Laws in Maldives 🌊

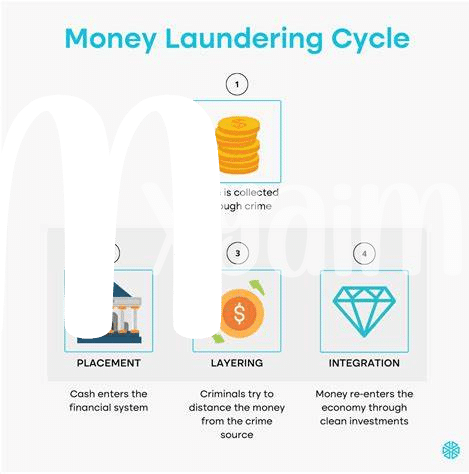

Maldives has put in place Anti-Money Laundering (AML) laws to combat financial crimes within its jurisdiction. These regulations aim to ensure transparency in financial transactions and prevent the illegal flow of funds. As a key player in the global financial landscape, Maldives recognizes the importance of adhering to international standards to maintain the integrity of its financial system. 🏝️

To achieve this goal, Maldives has implemented a comprehensive framework that outlines the obligations and responsibilities of financial institutions and entities operating within its borders. By strengthening AML laws, Maldives seeks to enhance its ability to detect and deter money laundering activities, ultimately contributing to a more secure and stable financial environment for its residents and businesses. 🌴

Impact of Aml Regulations on Bitcoin 💰

In the world of digital currencies, the impact of Anti-Money Laundering (AML) regulations on Bitcoin transactions cannot be underestimated. These regulations play a crucial role in safeguarding the integrity of the financial system and preventing illicit activities. For Bitcoin users, compliance with AML laws is essential to ensure transparency and trust in their transactions. However, navigating these regulations can pose challenges, requiring a careful balance between privacy and regulatory requirements. As the regulatory landscape continues to evolve, understanding and adapting to AML laws are key to the future of Bitcoin transactions.

Challenges Faced by Bitcoin Users 🤔

Bitcoin users often encounter challenges when navigating the cryptocurrency landscape. From regulatory uncertainties to security concerns, the hurdles can be daunting. Ensuring compliance with anti-money laundering laws adds another layer of complexity, requiring users to carefully assess their transactions. Additionally, the volatile nature of cryptocurrency markets poses risks of its own, impacting the value of holdings. Despite these obstacles, many users remain optimistic about the potential of Bitcoin while advocating for clearer guidelines and user-friendly frameworks to enhance the overall experience.

Compliance Requirements for Cryptocurrency Transactions 📝

Cryptocurrency transactions bring about a unique set of compliance requirements due to their decentralized nature and the evolving regulatory landscape. Understanding and adhering to these requirements is crucial for individuals and businesses engaging in Bitcoin transactions. Compliance measures often involve implementing robust know-your-customer (KYC) procedures, monitoring transactions for suspicious activities, and ensuring compliance with anti-money laundering (AML) regulations. Furthermore, staying informed about regulatory updates and seeking legal guidance can help navigate the complex compliance landscape surrounding cryptocurrency transactions. As the regulatory environment continues to evolve, proactive compliance measures will be essential for ensuring the legitimacy and sustainability of Bitcoin transactions.

To learn more about how technology is shaping AML regulations for Bitcoin globally, including insights into Liechtenstein’s regulatory framework, check out this article on bitcoin anti-money laundering (AML) regulations in Liechtenstein. [Bitcoin anti-money laundering (AML) regulations in Liechtenstein](https://wikicrypto.news/exploring-the-role-of-technology-in-aml-for-bitcoin)

Future Implications of Aml Laws on Bitcoin 🚀

As the landscape of financial regulations continues to evolve, the future implications of AML laws on Bitcoin transactions are poised to shape the cryptocurrency space significantly. With authorities tightening their grip on anti-money laundering measures, the ways in which Bitcoin is used and exchanged may undergo substantial alterations. Balancing the inherent decentralization of Bitcoin with the need for compliance with AML regulations presents a unique challenge for stakeholders in the crypto industry. As countries like Maldives refine their approach to regulating virtual currencies, the future of Bitcoin transactions in relation to AML laws holds both opportunities for innovation and potential obstacles for widespread adoption. Adapting to these shifting regulatory paradigms will be crucial for the long-term sustainability and mainstream integration of Bitcoin in the global financial ecosystem.

Recommendations for Navigating Aml Regulations 🗺️

Navigating Anti-Money Laundering (AML) regulations in the context of Bitcoin transactions can be complex and challenging. To successfully navigate these regulations, it is essential to stay informed about the latest AML laws specific to cryptocurrencies in Maldives. Implementing robust identity verification processes and transaction monitoring systems can help ensure compliance with AML regulations. Additionally, engaging with reputable exchanges and platforms that prioritize AML compliance is crucial for conducting secure Bitcoin transactions. Educating oneself on best practices for AML compliance and staying updated on regulatory changes can help individuals and businesses navigate the evolving landscape of AML laws effectively. Investing in training and resources to enhance AML compliance efforts is also recommended to mitigate risks associated with cryptocurrency transactions. By proactively addressing AML requirements and staying vigilant, stakeholders can navigate the regulatory environment with greater confidence and security.

Make sure to regularly check for updates on the official website for Bitcoin Anti-Money Laundering (AML) Regulations in Maldives [here](Bitcoin Anti-Money Laundering (AML) Regulations in Maldives).