Impact on Traditional Remittance Services 🌎

The rise of Bitcoin is reshaping the landscape of traditional remittance services, offering a fresh perspective on cross-border transactions. With its decentralized nature and lower fees, Bitcoin is gradually disrupting the established players in the remittance industry. As more people explore the benefits of using Bitcoin for transferring money worldwide, traditional remittance services are facing a new wave of competition in providing faster and more cost-effective solutions for global transactions. The impact of Bitcoin on traditional remittance services extends beyond mere technological advancements, highlighting a shift towards a more efficient and inclusive financial ecosystem.

Benefits of Using Bitcoin for Remittances 💸

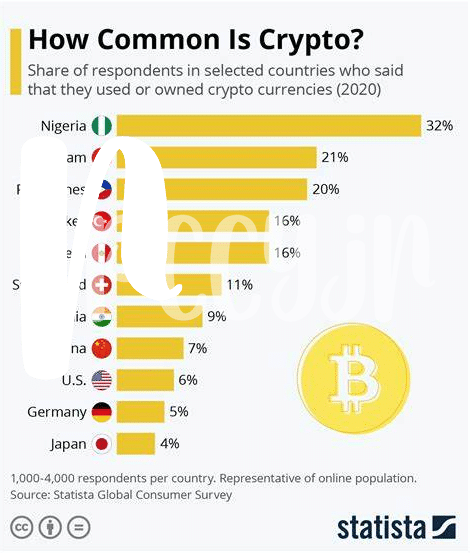

Using Bitcoin for remittances offers a fresh perspective on cross-border money transfers. With its decentralized nature and lower transaction fees, Bitcoin presents a promising alternative to traditional remittance services, enabling faster and more cost-effective transactions. The accessibility of Bitcoin transcends geographical boundaries, providing unbanked populations with a simple and efficient means to send and receive money securely. Additionally, the transparency and security features inherent in blockchain technology enhance the trust and reliability of remittance transactions for both senders and recipients. The flexibility and convenience of Bitcoin further streamline the remittance process, empowering individuals to take control of their financial interactions on a global scale.

Challenges and Risks in Adopting Bitcoin 🤔

Navigating the realm of adopting Bitcoin for remittances presents various complexities that warrant careful consideration. Security concerns, volatility in cryptocurrency prices, and technical barriers can pose challenges for users unfamiliar with digital currencies. Moreover, the regulatory landscape surrounding Bitcoin remains dynamic and heterogeneous across different regions, adding a layer of uncertainty for both senders and receivers. To mitigate risks, education on safe practices, robust security measures, and transparent communication channels are crucial. Overcoming these hurdles will require collaboration between industry stakeholders, policymakers, and consumers to foster a more secure and accessible ecosystem for cross-border transactions.

Regulations Shaping the Future of Remittances 📜

Regulations play a crucial role in shaping the future of remittances, especially with the rise of Bitcoin as a disruptive force in the financial landscape. As governments and regulatory bodies grapple with the implications of cryptocurrency on cross-border transactions, a delicate balance between innovation and oversight is being sought. This evolving regulatory framework will have a significant impact on how individuals and businesses conduct remittances using digital assets, ushering in a new era of transparency, security, and accessibility. To learn more about how Bitcoin is transforming international remittances, check out this insightful article on using bitcoin for international remittances in Togo.

Innovation in Remittance Technology and Services 🚀

In the fast-paced realm of remittance technology and services, innovation is key to enhancing the efficiency, affordability, and accessibility of cross-border money transfers. Fintech solutions leveraging blockchain and AI technologies are revolutionizing the way remittances are processed, reducing transaction times and costs while increasing transparency and security. Mobile apps and digital platforms are simplifying the remittance process for users worldwide, enabling seamless transfers at the tap of a screen. These advancements in technology are reshaping the remittance landscape, offering unparalleled convenience and empowerment to individuals relying on these vital financial lifelines for their loved ones back home.

The Evolving Landscape of Global Remittance Industry 🔄

The landscape of the global remittance industry is constantly evolving due to technological advancements and changing consumer preferences. With the increasing use of digital platforms and cryptocurrencies, the traditional methods of sending money across borders are being revolutionized. Mobile apps, online platforms, and blockchain technology are providing faster, more secure, and cost-effective options for remittance transactions. This shift towards digital solutions is reshaping the way money is transferred globally, making the process more efficient and accessible to a wider range of individuals.

One interesting example of this transformation can be seen in Thailand, where the use of Bitcoin for international remittances is gaining popularity. By utilizing the benefits of blockchain technology, individuals can now send money to loved ones in Trinidad and Tobago with greater ease and lower transaction fees. This innovative approach is not only simplifying the remittance process but also highlighting the potential for cryptocurrencies to revolutionize cross-border payments.