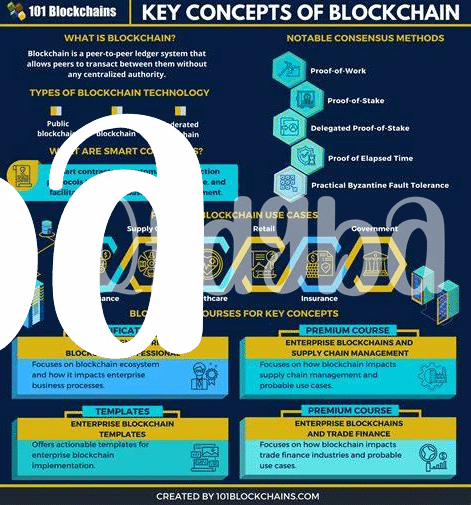

Introduction to Blockchain Technology 🔗

Blockchain technology is the innovative system that underpins cryptocurrencies like Bitcoin. It functions as a decentralized digital ledger that records transactions across a network of computers. This secure and transparent technology ensures that data cannot be altered, promoting trust and efficiency in financial transactions.

| Advantages of Blockchain Technology |

|

|---|

Current Applications of Blockchain in Finance 💸

Blockchain technology has been making waves in the finance sector with its innovative applications. One prominent use is in streamlining cross-border payments, reducing transaction times, costs, and increasing transparency. Smart contracts, a feature of blockchain, automate contract execution, ensuring trust between parties without the need for intermediaries. This not only expedites processes but also minimizes the risk of fraud. Additionally, blockchain is enhancing the efficiency of trade finance by digitizing and securely storing trade documents. These advancements are revolutionizing traditional financial systems, paving the way for more secure and streamlined transactions.

Furthermore, blockchain is facilitating faster and more secure identity verification processes in the financial industry. By storing personal data securely on the blockchain, individuals can easily verify their identities without compromising their sensitive information. This not only enhances user privacy and security but also reduces the time and resources required for identity verification procedures. The integration of blockchain in finance is not just a technological advancement but a fundamental shift towards a more efficient and trust-based financial ecosystem.

Benefits of Implementing Blockchain in Costa Rica 🇨🇷

Blockchain technology has the potential to bring a multitude of benefits to Costa Rica’s financial sector. By implementing blockchain, the country can streamline its payment systems, reducing transaction times and costs. This efficiency can foster greater financial inclusion, opening up access to banking services for more individuals and businesses across the nation. Furthermore, the transparent and immutable nature of blockchain can enhance the security and integrity of financial transactions, reducing the risk of fraud and enhancing trust in the financial system. These benefits align with Costa Rica’s commitment to innovation and sustainable economic development, positioning blockchain as a key driver for financial progress in the country.

Challenges and Risks Associated with Blockchain Adoption ⚠️

Blockchain adoption in Costa Rica faces several challenges and risks that need to be carefully addressed. One major concern is the potential for security breaches and hacks, as the decentralized nature of blockchain makes it a target for cyber threats. Additionally, there may be resistance from traditional financial institutions and regulatory bodies due to the disruptive nature of blockchain technology. Ensuring compliance with existing laws and regulations, as well as establishing clear governance frameworks, will be crucial in mitigating these risks and fostering widespread adoption.

For more insights on how blockchain technology is enhancing transparency in elections and driving innovation in policies, check out this article on blockchain technology innovation policies in Croatia.

Future Trends and Innovations in Finance with Blockchain 🚀

In the rapidly evolving landscape of finance, emerging trends and innovations driven by blockchain technology are reshaping the way transactions are conducted and financial services are delivered. One of the key future trends is the widespread adoption of decentralized finance (DeFi) platforms, which aim to provide traditional financial services without the need for intermediaries. This opens up opportunities for individuals to access a wide range of financial services, such as lending, borrowing, and trading, in a more transparent and efficient manner. Additionally, advancements in blockchain technology are paving the way for tokenization of assets, allowing for fractional ownership of real-world assets like real estate and art. These innovations have the potential to democratize access to investment opportunities and fundamentally transform the way we interact with financial systems.

| Benefits of Implementing Blockchain in Costa Rica 🇨🇷 | Challenges and Risks Associated with Blockchain Adoption ⚠️ |

|---|---|

| Increased transparency and security in financial transactions | Concerns over regulatory compliance and legal frameworks |

| Efficient cross-border payments and reduced transaction costs | Potential for cyber threats and hacking vulnerabilities |

The Potential Impact of Blockchain on Costa Rican Economy 💼

Blockchain technology has the potential to revolutionize the Costa Rican economy by streamlining processes, increasing transparency, and reducing costs across various sectors. With its secure and decentralized nature, blockchain can enhance trust in financial transactions and facilitate faster cross-border payments. By embracing this innovative technology, Costa Rica could attract more foreign investment, boost economic growth, and create new job opportunities for its citizens.

Furthermore, the adoption of blockchain in Costa Rica could lead to increased efficiency in government operations, improved data security, and enhanced regulatory compliance. This transition towards a blockchain-powered economy has the potential to transform traditional financial services, drive digital transformation, and position Costa Rica as a leader in technological innovation within the region.

Insert a link to blockchain technology innovation policies in Congo-Brazzaville with anchor text “blockchain technology innovation policies in Colombia” using the markup.