Current Landscape of Digital Currency 💡

The digital currency landscape in the Bahamas is evolving rapidly, with an increasing number of individuals and businesses embracing the convenience and efficiency of digital payments. This shift towards digital currencies is driven by the desire for faster transactions, reduced fees, and improved financial inclusion. Companies are also recognizing the benefits of digital currencies, leading to a growing acceptance of these innovative payment methods in various sectors. The emergence of digital wallets and mobile payment solutions has further facilitated the integration of digital currencies into everyday transactions, making financial interactions more seamless and accessible for all.

As the use of digital currencies continues to gain momentum, stakeholders in the Bahamas are closely monitoring these developments to adapt policies and regulations accordingly. This dynamic landscape positions the country at the forefront of digital currency adoption, setting the stage for a future where traditional payment methods are complemented by innovative digital solutions.

Government Initiatives and Regulations 🏛️

The government in the Bahamas has been actively involving itself in setting regulations and guidelines for the adoption of digital currency. As part of their initiatives, they have been working towards creating a framework that ensures the stability and security of digital transactions. By establishing clear regulations, the government aims to protect consumers while also fostering an environment that is conducive to the growth of digital currency use within the country. This proactive approach is seen as a positive step towards embracing the future of finance in the Bahamas.

Please insert the link into the text where it fits smoothly.

Role of Businesses in Adoption 📈

Businesses play a crucial role in driving the adoption of digital currency within the Bahamas ecosystem. As early adopters, they pave the way for a seamless transition towards digital transactions, encouraging consumer trust and acceptance. By integrating digital currency payment options, businesses not only cater to tech-savvy customers but also contribute to the overall growth and modernization of the local economy. Through strategic partnerships and a commitment to innovation, businesses can showcase the convenience and efficiency of digital currency, ultimately shaping consumer behavior towards embracing this transformative financial technology.

With an increasing number of businesses embracing digital currency, the landscape of financial transactions is rapidly evolving. From small enterprises to large corporations, the widespread acceptance of digital currency signals a shift towards a more efficient and secure payment system. This adoption not only streamlines transactions but also opens up new opportunities for global business expansion and seamless cross-border trade. By championing the integration of digital currency into daily operations, businesses in the Bahamas are poised to adapt to the changing financial landscape and position themselves as leaders in the digital economy.

Benefits and Challenges of Digital Currency 💰

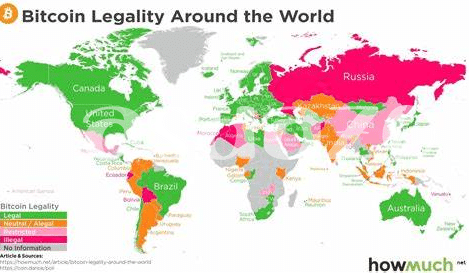

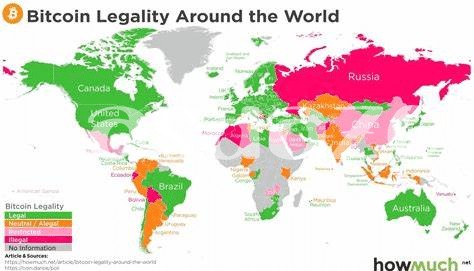

Digital currencies offer a host of advantages, such as increased financial inclusion and reduced transaction costs. With digital currencies, individuals can access financial services more easily, especially in areas with limited banking infrastructure. Moreover, the transparency provided by blockchain technology can help combat fraud and enhance security in transactions. However, challenges persist, including concerns about regulatory frameworks and the potential for cyber attacks. It is crucial for stakeholders to address these issues collaboratively to foster a conducive environment for digital currency adoption in the Bahamas.

To further explore the legal aspects of digital currencies, you can read about Belgium’s stance on accepting Bitcoin as payment in the article “is bitcoin recognized as legal tender in Barbados?” available at is bitcoin recognized as legal tender in Barbados?.

Public Education and Awareness Efforts 📚

Efforts are underway to increase public education and awareness around digital currencies in the Bahamas. Various initiatives focus on providing accessible information through workshops, educational campaigns, and online resources. The aim is to empower individuals with the knowledge needed to make informed decisions about digital currency usage. By fostering a better understanding of the benefits and risks associated with these currencies, the public can navigate this evolving landscape more confidently. Collaboration among government agencies, businesses, and community groups plays a vital role in amplifying the reach of education efforts and ensuring that the whole population can engage effectively with digital currencies.

Future Outlook and Potential Impact 🔮

In the ever-evolving landscape of digital currencies, the Bahamas stands at a pivotal juncture poised for significant growth and innovation. Emerging technologies, coupled with shifting global financial trends, are reshaping the future outlook of digital currency adoption in the region. The potential impact of embracing digital currencies transcends transactional convenience; it extends to financial inclusion, transparency, and economic empowerment for individuals and businesses alike. As the digital currency ecosystem continues to mature, the Bahamas has the opportunity to position itself as a frontrunner in the adoption and integration of these transformative technologies, unlocking new avenues for economic prosperity and financial accessibility.

[a href=”https://example.com”]is bitcoin recognized as legal tender in belgium?[/a]