Growing Acceptance of Bitcoin in Canadian Businesses 🌐

The utilization of Bitcoin in Canadian businesses is on a sharp incline, signaling a notable shift towards digital currency adoption. More and more establishments across various sectors are recognizing the benefits of incorporating Bitcoin into their payment systems. This growing acceptance not only streamlines transactions but also adds a layer of flexibility and efficiency to cross-border payments. From small startups to established corporations, the trend towards embracing Bitcoin as a valid form of payment is reshaping the way Canadian businesses engage in financial transactions. As this momentum continues to build, the landscape of cross-border payments in Canada is poised for significant transformation, paving the way for a more seamless and interconnected global economy.

Regulatory Challenges and Opportunities for Bitcoin 💼

As the adoption of Bitcoin gains traction in Canada, the landscape of cross-border payments faces both regulatory challenges and opportunities. Regulatory frameworks play a crucial role in shaping the path for Bitcoin in the financial ecosystem. The dynamic nature of cryptocurrency regulation presents a unique balance between fostering innovation and ensuring consumer protection. Navigating through these regulatory waters can pave the way for a more streamlined and efficient cross-border payment system. By addressing regulatory challenges head-on, the potential for Bitcoin to revolutionize the traditional financial sector becomes more tangible. Embracing these opportunities can lead to a more inclusive and secure cross-border payment environment, driving the future of finance towards a more decentralized and accessible future.

Impact of Bitcoin on Traditional Banking Institutions 💰

Bitcoin’s rise in Canada has left traditional banking institutions grappling with the impact of this digital currency on their operations. Faced with the challenge of adapting to this new financial landscape, banks are exploring ways to integrate Bitcoin into their systems while also safeguarding against potential disruptions. As more Canadians embrace Bitcoin for cross-border payments, traditional banks are reassessing their role in the evolving financial ecosystem. While some view Bitcoin as a threat to their traditional business models, others see it as an opportunity to innovate and enhance their services. The competition between Bitcoin and traditional banking institutions is shaping the future of cross-border payments in Canada, setting the stage for a dynamic shift in how money moves across borders.

Potential for Increased Financial Inclusion through Bitcoin 🌍

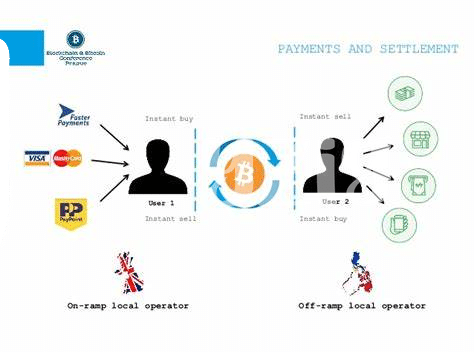

Using Bitcoin for cross-border payments has the potential to bring more people into the financial fold, especially in regions where traditional banking services are limited. The decentralized nature of Bitcoin allows for transactions to be conducted without the need for a bank account, making it an attractive option for those who are excluded from the traditional financial system. This increased financial inclusion through Bitcoin can empower individuals and businesses to participate in the global economy, facilitating trade and fostering economic growth in underserved communities.

To learn more about compliance with bitcoin cross-border money transfer laws in Cambodia, check out this insightful guide: bitcoin cross-border money transfer laws in Cambodia.

Security Concerns and Innovations in Cross-border Payments 🔒

In an increasingly digital world, the landscape of cross-border payments is constantly evolving. As technology advances, so too do security concerns surrounding the transmission of funds across international borders. Innovations such as blockchain technology promise to revolutionize the way payments are made, offering secure and transparent transactions that bypass traditional banking systems. These advancements not only enhance the security of cross-border payments but also increase efficiency and reduce costs for businesses and consumers alike. As the future unfolds, it is clear that staying abreast of these security concerns and embracing innovative solutions will be paramount in shaping the future of cross-border payments.

The Evolving Role of Bitcoin in Canada’s Economy 💡

As Bitcoin continues to gain traction in Canada, its role in the country’s economy is evolving rapidly. The increasing use of Bitcoin for cross-border transactions and remittances is reshaping the traditional financial landscape. This digital currency offers a decentralized and efficient alternative to conventional banking systems, providing users with greater control over their funds and faster transfer times. As more businesses and individuals in Canada embrace Bitcoin for financial transactions, it is poised to become a significant player in the country’s economic ecosystem.

For more information on the latest bitcoin cross-border money transfer laws in Cameroon, please visit bitcoin cross-border money transfer laws in Burundi to stay informed about the regulatory framework governing cryptocurrencies in the region.